- Philippines

- /

- Banks

- /

- PSE:SECB

Global Undervalued Small Caps With Insider Activity For April 2025

Reviewed by Simply Wall St

Amidst a backdrop of economic uncertainty and inflation fears, global markets have experienced notable fluctuations, with U.S. stock indexes declining due to trade policy concerns and persistent inflation pressures. As value stocks continue to outperform growth shares, investors may find opportunities in small-cap stocks that exhibit strong fundamentals and insider activity, which can be indicative of potential resilience in challenging market conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tristel | 22.0x | 3.1x | 41.84% | ★★★★★★ |

| Nexus Industrial REIT | 5.4x | 2.8x | 22.10% | ★★★★★★ |

| Bytes Technology Group | 22.5x | 5.7x | 8.50% | ★★★★★☆ |

| Robert Walters | NA | 0.2x | 48.33% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 28.93% | ★★★★★☆ |

| Savills | 24.3x | 0.5x | 41.04% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.8x | 34.94% | ★★★★☆☆ |

| Seeing Machines | NA | 1.9x | 45.19% | ★★★★☆☆ |

| Arendals Fossekompani | 21.4x | 1.6x | 46.48% | ★★★☆☆☆ |

| Saturn Oil & Gas | 6.4x | 0.4x | -20.88% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

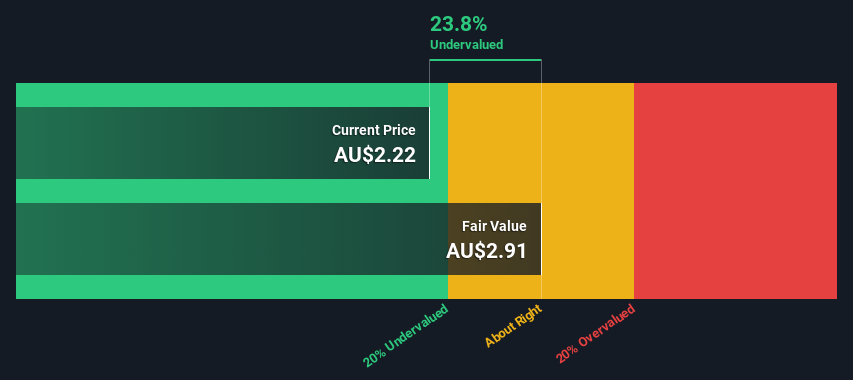

Region Group (ASX:RGN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Region Group operates as a real estate investment trust focusing on commercial properties, with a market capitalization of A$4.25 billion.

Operations: Region Group generates revenue primarily through its commercial real estate investments, with a recent focus on improving net income margins, which have varied significantly over time. The company has experienced fluctuations in its net income margin, reaching as high as 2.39% and dropping to negative values during certain periods. Operating expenses have remained relatively stable compared to the changes in non-operating expenses, which have had a notable impact on net income outcomes.

PE: 19.0x

Region Group, a smaller company in the investment landscape, shows potential for growth with earnings forecasted to rise by 12.42% annually. Despite its reliance on higher-risk external borrowing, insider confidence is evident as Steven Crane acquired 100,000 shares worth A$208,150 in recent months. The company recently announced a A$100 million share repurchase plan to enhance shareholder returns using proceeds from asset sales and available cash resources. With net income swinging to A$81.8 million for H1 2025 from a prior loss, Region Group's financial trajectory appears promising amidst proactive capital management strategies.

- Delve into the full analysis valuation report here for a deeper understanding of Region Group.

Gain insights into Region Group's historical performance by reviewing our past performance report.

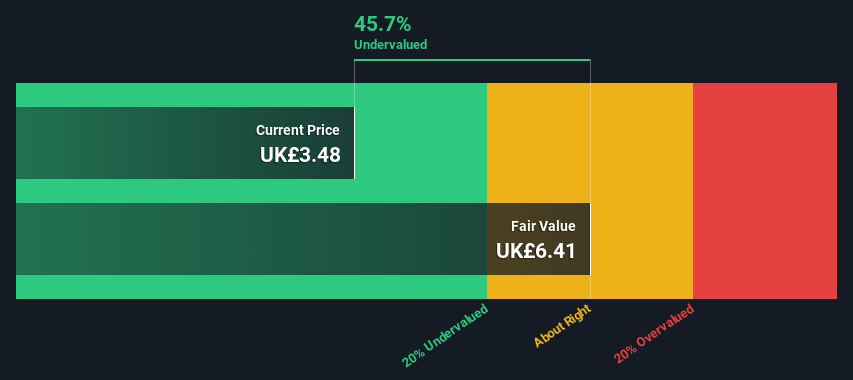

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wilmington is a company that provides information, education, and networking services across various sectors including legal, finance, and health, safety and environment (HSE), with a market capitalization of £0.23 billion.

Operations: The company generates revenue primarily from its Finance and Legal segments, with Finance contributing significantly more. The net profit margin has shown fluctuations, with a notable increase to 27.12% in June 2022 before moderating in subsequent periods. Operating expenses have generally remained low compared to gross profit, contributing to the net income margins observed across various periods.

PE: 23.8x

Wilmington, a smaller company, is navigating a challenging landscape with its earnings for the half-year ending December 31, 2024 showing sales of £46.57 million but net income dropping to £2.59 million from £7.12 million the previous year. Despite these figures, insider confidence remains strong as they continue share repurchases authorized in February 2025. Although reliant on external borrowing for funding, Wilmington's forecasted annual earnings growth of 17% suggests potential for future value realization.

- Get an in-depth perspective on Wilmington's performance by reading our valuation report here.

Understand Wilmington's track record by examining our Past report.

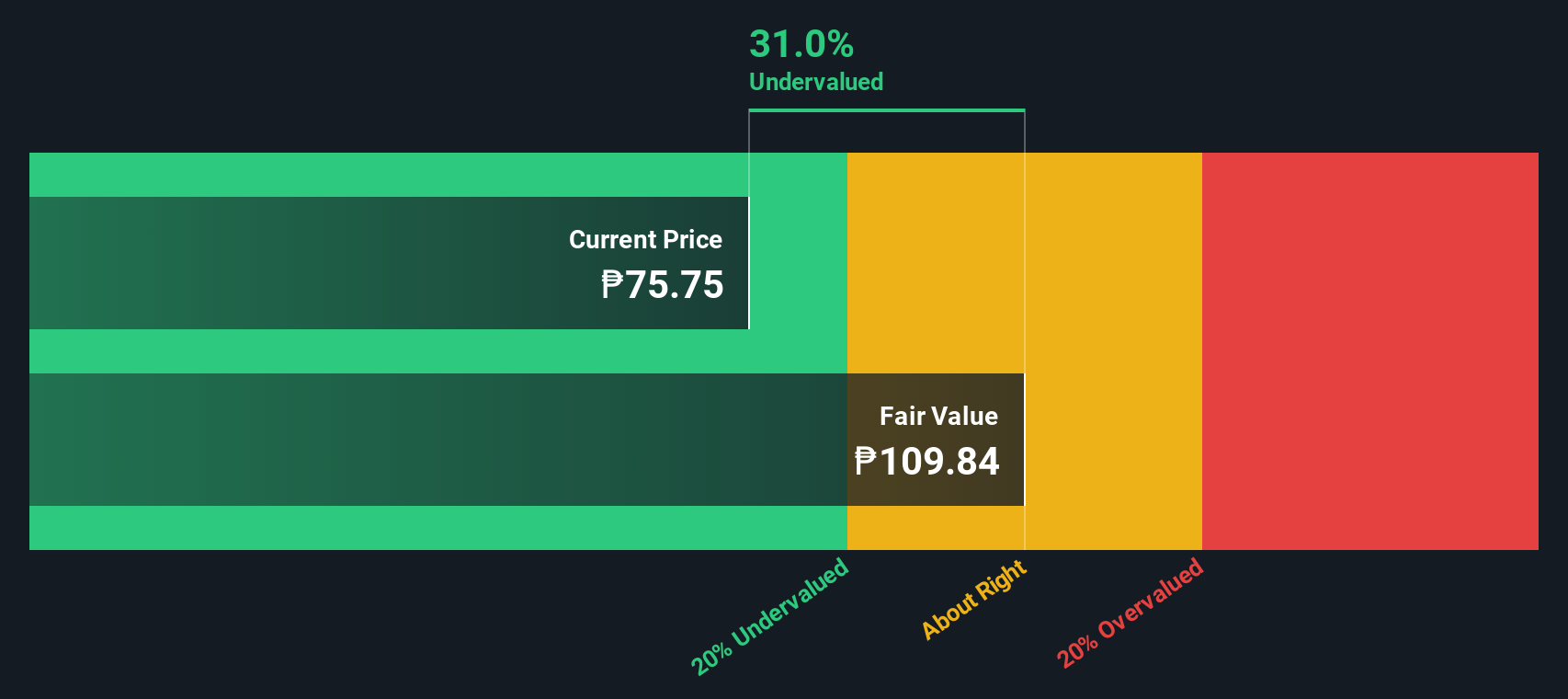

Security Bank (PSE:SECB)

Simply Wall St Value Rating: ★★★★★★

Overview: Security Bank is a financial institution offering services in retail banking, business banking, financial markets, and wholesale banking with a market capitalization of ₱101.5 billion.

Operations: The company's revenue streams are primarily derived from Retail Banking, Wholesale Banking, Business Banking, and Financial Markets. Operating expenses have shown a consistent upward trend over the years, with a significant portion attributed to General & Administrative Expenses. The net income margin has demonstrated variability over time but has generally remained below 50%. Gross profit margins were consistently at 100% until recent periods when they slightly decreased to levels around 95%.

PE: 4.8x

Security Bank, a small company in the financial sector, recently announced a cash dividend of PHP 1.50 per share, payable on April 28, 2025. Insider confidence is evident as John David G. Yap purchased 55,040 shares valued at approximately PHP 4.07 million in recent months. The bank reported net income growth to PHP 11.24 billion for the year ending December 31, 2024, up from PHP 9.11 billion previously and earnings per share increased to PHP 14.91 from PHP 12.08 last year despite a high bad loans ratio of 2.9%.

- Unlock comprehensive insights into our analysis of Security Bank stock in this valuation report.

Assess Security Bank's past performance with our detailed historical performance reports.

Summing It All Up

- Dive into all 135 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Security Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SECB

Security Bank

Provides banking and financial products and services to wholesale and retail clients in the Philippines.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives