- Australia

- /

- Residential REITs

- /

- ASX:INA

This Insider Has Just Sold Shares In Ingenia Communities Group (ASX:INA)

We'd be surprised if Ingenia Communities Group (ASX:INA) shareholders haven't noticed that the CEO, MD & Director, Simon Owen, recently sold AU$201k worth of stock at AU$4.91 per share. However, the silver lining is that the sale only reduced their total holding by 2.8%, so we're hesitant to read anything much into it, on its own.

View our latest analysis for Ingenia Communities Group

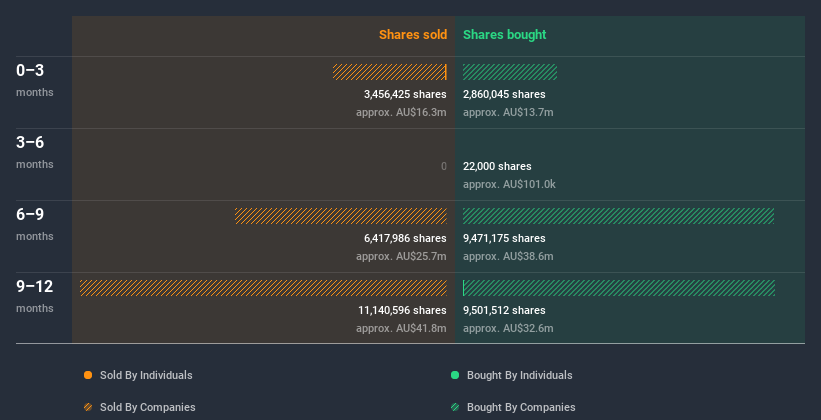

Ingenia Communities Group Insider Transactions Over The Last Year

In fact, the recent sale by Simon Owen was the biggest sale of Ingenia Communities Group shares made by an insider individual in the last twelve months, according to our records. So what is clear is that an insider saw fit to sell at around the current price of AU$4.97. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

In the last twelve months insiders purchased 53.50k shares for AU$203k. On the other hand they divested 41.00k shares, for AU$201k. In the last twelve months there was more buying than selling by Ingenia Communities Group insiders. Their average price was about AU$3.80. It is certainly positive to see that insiders have invested their own money in the company. But we must note that the investments were made at well below today's share price. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Does Ingenia Communities Group Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 0.8% of Ingenia Communities Group shares, worth about AU$13m, according to our data. Whilst better than nothing, we're not overly impressed by these holdings.

So What Does This Data Suggest About Ingenia Communities Group Insiders?

An insider hasn't bought Ingenia Communities Group stock in the last three months, but there was some selling. But we take heart from prior transactions. It's good to see insiders are shareholders. So we're not overly bothered by recent selling. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. In terms of investment risks, we've identified 3 warning signs with Ingenia Communities Group and understanding them should be part of your investment process.

Of course Ingenia Communities Group may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Ingenia Communities Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:INA

Ingenia Communities Group

Ingenia Communities Group (ASX: INA) is a leading operator, owner and developer of communities offering quality affordable rental and holiday accommodation focussed on the growing seniors’ market in Australia.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives