- Australia

- /

- Retail REITs

- /

- ASX:HDN

Does the Recent 18.5% Rally Signal More Gains Ahead for HomeCo Daily Needs REIT?

Reviewed by Simply Wall St

Thinking about what to do with HomeCo Daily Needs REIT stock? You are not alone. Whether you are deciding whether to buy, hold, or trim your position, a closer look at the numbers can make a big difference. The stock has caught some attention lately with a solid 18.5% return year-to-date and nearly 17% gains over the past year. Even over the last three years, HomeCo Daily Needs REIT is up almost 50%, which is notable for a REIT in a market where retail property sentiment has been up and down.

Of course, it is not all smooth sailing. The past week saw a modest dip of 0.4%, a reminder that investor sentiment can be sensitive, often shifting with broader market expectations around interest rates and consumer spending. However, the stock's 2.6% bump over the past month suggests that investors are still optimistic about its stability and long-term strategy. With retail property continuing to adapt in the current environment, HomeCo seems to be maintaining its appeal.

If you are weighing if now is the right time to buy, consider this: based on standard valuation checks, the company scores a 2 out of 6 for being undervalued. This means it is not the deepest value available, but there may still be upside. Next, we will look at how different valuation methods stack up and what they reveal about where this stock stands right now. Stick around, because there is also a better way to get a true sense of what HomeCo might be worth later in the article.

HomeCo Daily Needs REIT scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: HomeCo Daily Needs REIT Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future adjusted funds from operations and discounting those cash flows back to the present. This approach helps investors look past market noise and focus on a company's potential to generate cash in the years ahead.

For HomeCo Daily Needs REIT, analysts estimate that the company generated A$182.5 million in free cash flow (FCF) over the last twelve months and expect it to reach A$168.1 million in 2026. Although analyst forecasts only extend out five years, projections are extrapolated further, with a forecast of A$132 million in FCF for 2030. The valuation is performed using a two-stage Free Cash Flow to Equity model, applying these expected cash flows and discounting them back to their present value using industry standards.

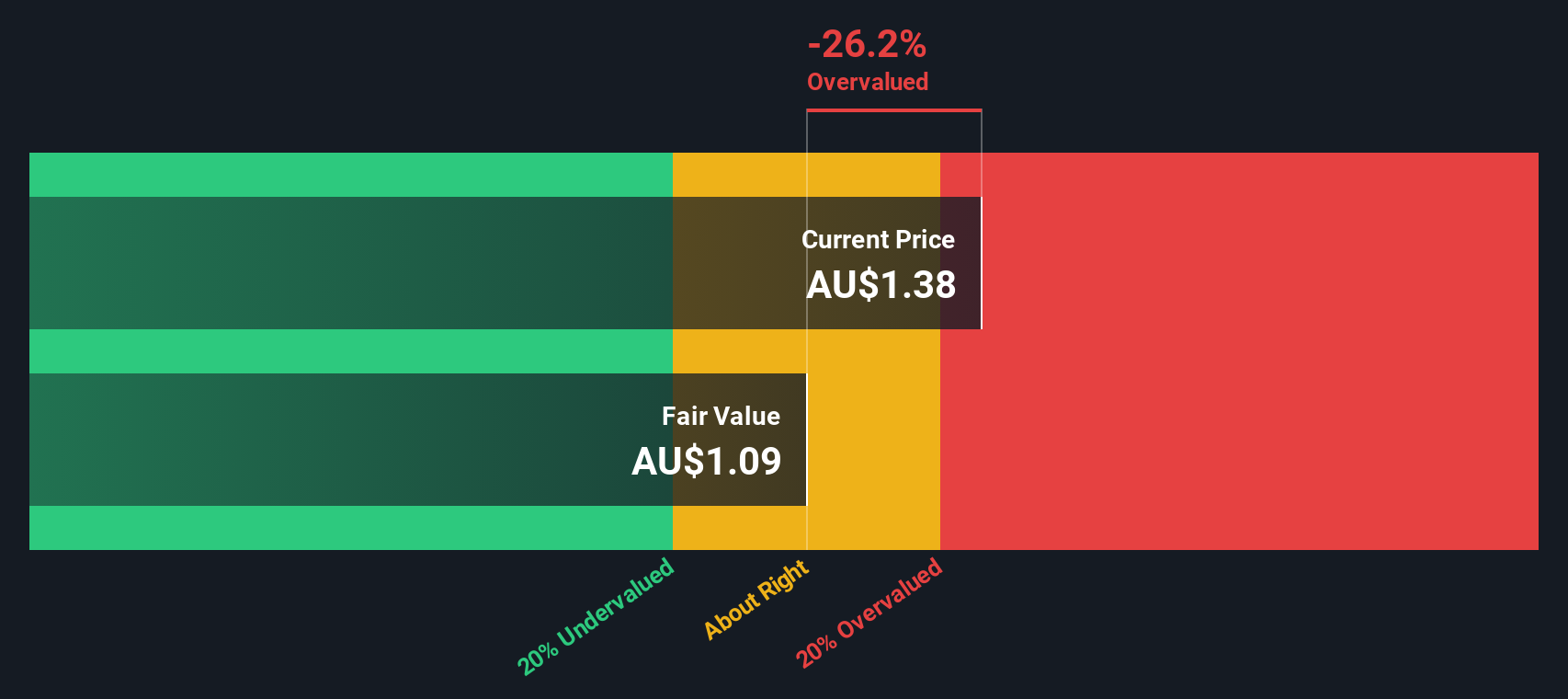

After crunching these numbers, the DCF intrinsic value comes in at A$1.09 per share. However, the current share price implies that HomeCo Daily Needs REIT is about 26.5% more expensive than this estimated fair value, indicating it is overvalued in the market right now.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for HomeCo Daily Needs REIT.

Approach 2: HomeCo Daily Needs REIT Price vs Earnings

For profitable companies like HomeCo Daily Needs REIT, the price-to-earnings (PE) ratio is a popular way to assess if a stock is trading at a sensible valuation. The PE ratio helps investors understand what they are paying for each dollar of current earnings, making it especially useful when a company is consistently generating profits.

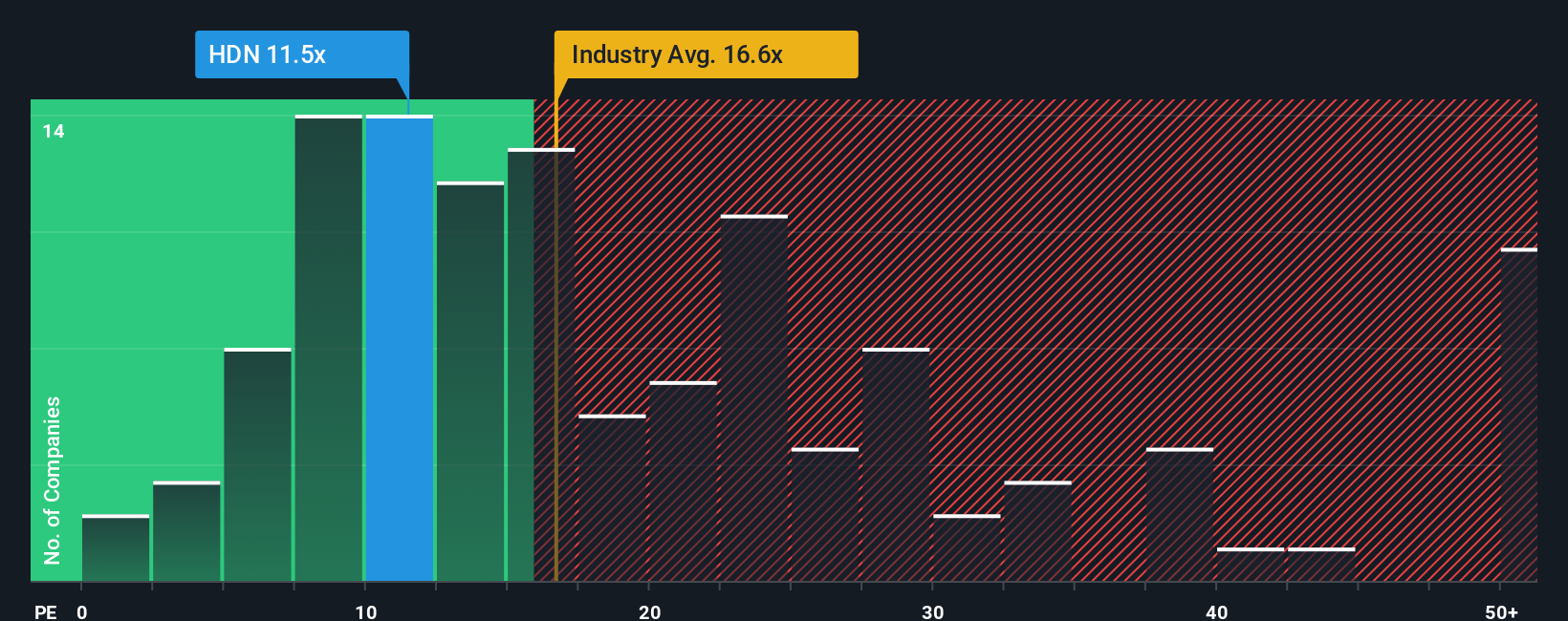

When looking at what counts as a "normal" PE ratio, it is important to keep in mind that higher ratios can reflect expectations for faster future growth, strong profitability, or lower perceived risks. Conversely, a lower PE may signal slower growth, thinner margins, or higher risk. With HomeCo Daily Needs REIT currently trading at 11.46x earnings, it is roughly in line with its peer average of 11.23x and below the broader Retail REITs industry average of 16.54x.

Simply Wall St's proprietary "Fair Ratio" moves beyond basic benchmarks by estimating a fair PE based on the company’s earnings growth, profit margins, size, industry, and risk profile. This tailored approach provides a more accurate picture than merely comparing with peers or sector averages, which might not reflect HomeCo’s unique strengths and challenges. For HomeCo, the Fair Ratio is calculated at 16.74x, suggesting that, based on company-specific fundamentals and risks, shares could justify a higher PE multiple than they currently command.

Comparing the actual PE to the Fair Ratio, HomeCo’s stock appears to be undervalued using this approach.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your HomeCo Daily Needs REIT Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful concept that tells the story behind a company's numbers. It expresses your view on what the business will achieve, your fair value estimate, and how future revenue, earnings, and margins might unfold. Narratives connect a company's real-world story to a financial forecast and, ultimately, to an actionable fair value. This helps you move beyond generic ratios or analyst targets.

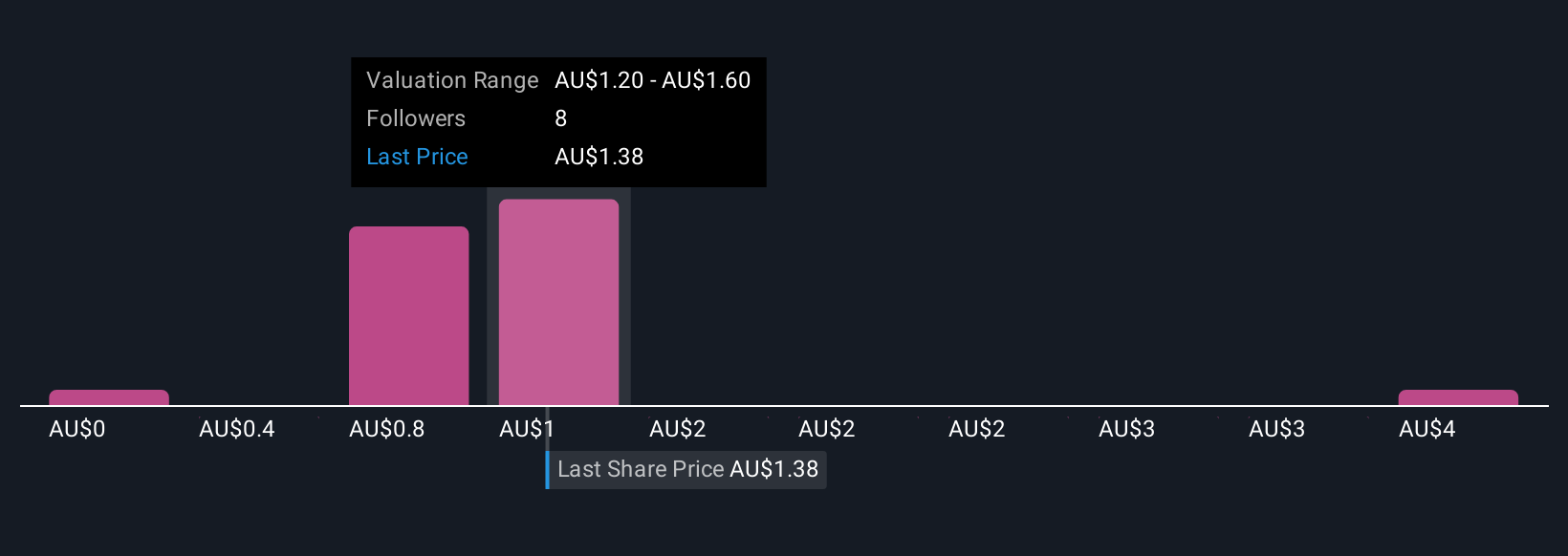

Narratives are designed to be accessible. You can create and explore them on Simply Wall St’s Community page, where millions of investors share perspectives. This tool enables you to see, at a glance, whether your outlook suggests the company is undervalued or overvalued by comparing your fair value with the current price. Whenever news or earnings results are released, Narratives update dynamically, so your estimates and stories always keep pace with reality.

For HomeCo Daily Needs REIT, for instance, one investor may believe that Australian urbanization and e-commerce growth will lift retail asset values, supporting a higher fair value of A$1.55 per share. Another might focus on margin pressures and slower retail, seeing a fair value as low as A$1.24. Your Narrative guides your decisions.

Do you think there's more to the story for HomeCo Daily Needs REIT? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HomeCo Daily Needs REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HDN

HomeCo Daily Needs REIT

An Australian Real Estate Investment Trust listed on the ASX with a mandate to invest in convenience-based assets across the target sub-sectors of Neighbourhood Retail, Large Format Retail and Health & Services.

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives