- Australia

- /

- Capital Markets

- /

- ASX:NGI

Top 3 Undervalued Small Caps On ASX With Insider Action In November 2024

Reviewed by Simply Wall St

As the Australian market navigates a dynamic landscape, with the ASX200 closing up 0.33% and sectors like Energy and Industrials showing robust performance, investors are keenly observing economic shifts that could influence small-cap stocks. In this environment, identifying promising small-cap opportunities on the ASX involves looking at companies with strong fundamentals and insider action, which can signal confidence in their potential amidst broader market trends.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

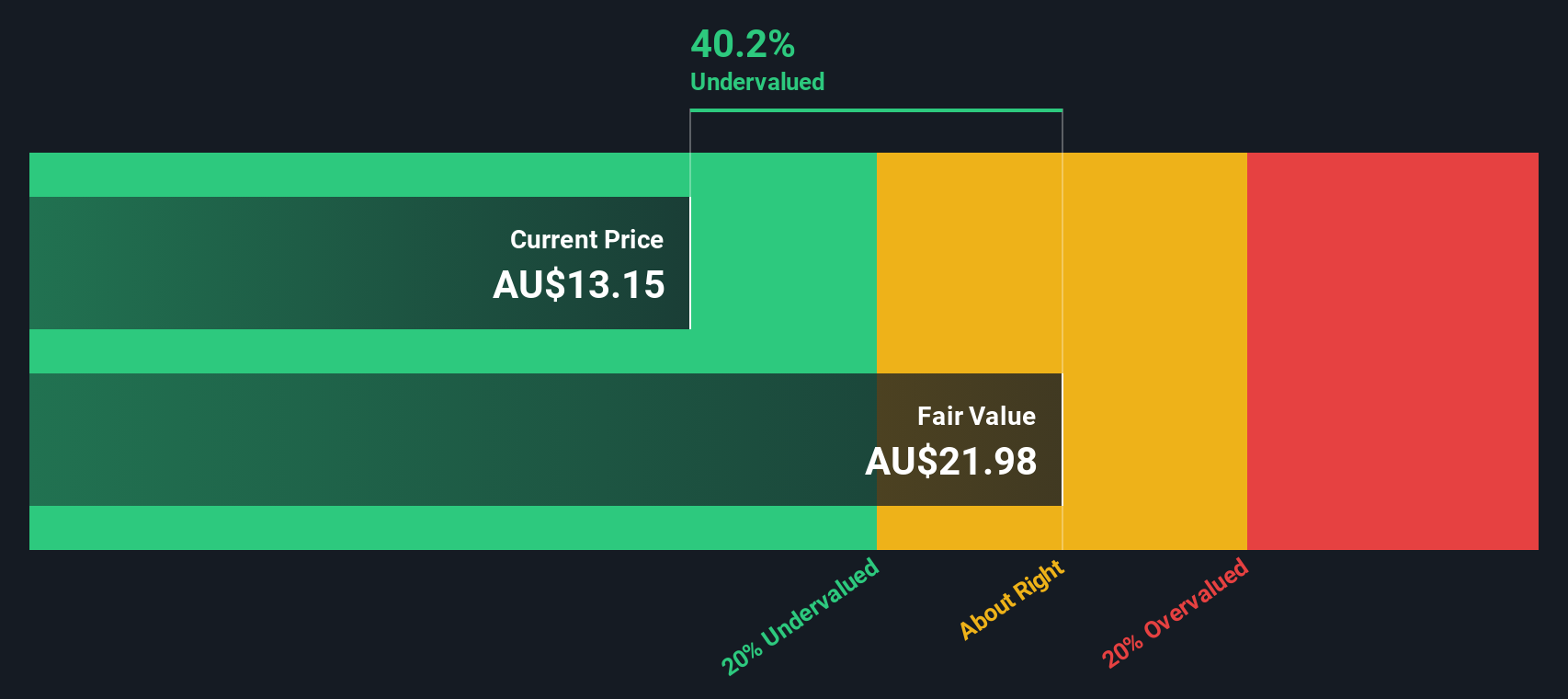

| GWA Group | 16.7x | 1.6x | 40.24% | ★★★★★☆ |

| SHAPE Australia | 14.4x | 0.3x | 32.20% | ★★★★☆☆ |

| Dicker Data | 19.7x | 0.7x | -10.12% | ★★★★☆☆ |

| Collins Foods | 18.0x | 0.7x | 5.20% | ★★★★☆☆ |

| Centuria Capital Group | 20.3x | 4.5x | 47.74% | ★★★★☆☆ |

| Corporate Travel Management | 20.6x | 2.5x | 49.95% | ★★★★☆☆ |

| Eagers Automotive | 11.5x | 0.3x | 35.31% | ★★★★☆☆ |

| Coventry Group | 236.2x | 0.4x | -22.12% | ★★★☆☆☆ |

| Cromwell Property Group | NA | 4.6x | -16.63% | ★★★☆☆☆ |

| Credit Corp Group | 24.4x | 3.3x | 28.20% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Credit Corp Group (ASX:CCP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Credit Corp Group operates as a debt purchasing company with additional consumer lending services across Australia, New Zealand, and the United States, and has a market capitalization of A$1.67 billion.

Operations: The company generates revenue primarily from debt ledger purchasing in the United States and Australia/New Zealand, as well as consumer lending across these regions. Operating expenses are a significant component of its cost structure, with general and administrative expenses consistently being the largest category. The net income margin has shown variability, reaching 26.23% at one point but recently declining to 13.42%.

PE: 24.4x

Credit Corp Group, a small cap player in Australia, has been navigating financial challenges with its profit margins dropping from 23.1% to 13.4% over the past year. Despite this, earnings are projected to grow by 14% annually, indicating potential for recovery and growth. The company relies entirely on external borrowing for funding, which adds risk but also reflects strategic financial management in a competitive sector. Recent insider confidence is evident as they made share purchases between June and September 2024, signaling trust in future prospects amidst ongoing board renewals and executive changes like Sarah Brennan's appointment as Non-Executive Director.

- Click here and access our complete valuation analysis report to understand the dynamics of Credit Corp Group.

Gain insights into Credit Corp Group's past trends and performance with our Past report.

Centuria Capital Group (ASX:CNI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Centuria Capital Group is a diversified investment manager specializing in property funds management, co-investments, and development finance with a market capitalization of A$1.71 billion.

Operations: Centuria Capital Group's primary revenue streams include property funds management and co-investments, with significant contributions from property and development finance. The gross profit margin has shown fluctuations, reaching 89.33% in March 2020 before declining to 48.97% by December 2023. Operating expenses are a notable component of the cost structure, while non-operating items also impact financial outcomes significantly.

PE: 20.3x

Centuria Capital Group, a smaller player in the Australian market, showcases potential as an undervalued opportunity. Despite a drop in sales to A$327 million for the year ending June 2024 from A$370 million previously, net income more than doubled to A$73.21 million. This earnings growth indicates resilience and efficiency improvements. Insider confidence is evident with recent share purchases, suggesting optimism about future performance amid forecasts of 10% annual earnings growth.

- Take a closer look at Centuria Capital Group's potential here in our valuation report.

Assess Centuria Capital Group's past performance with our detailed historical performance reports.

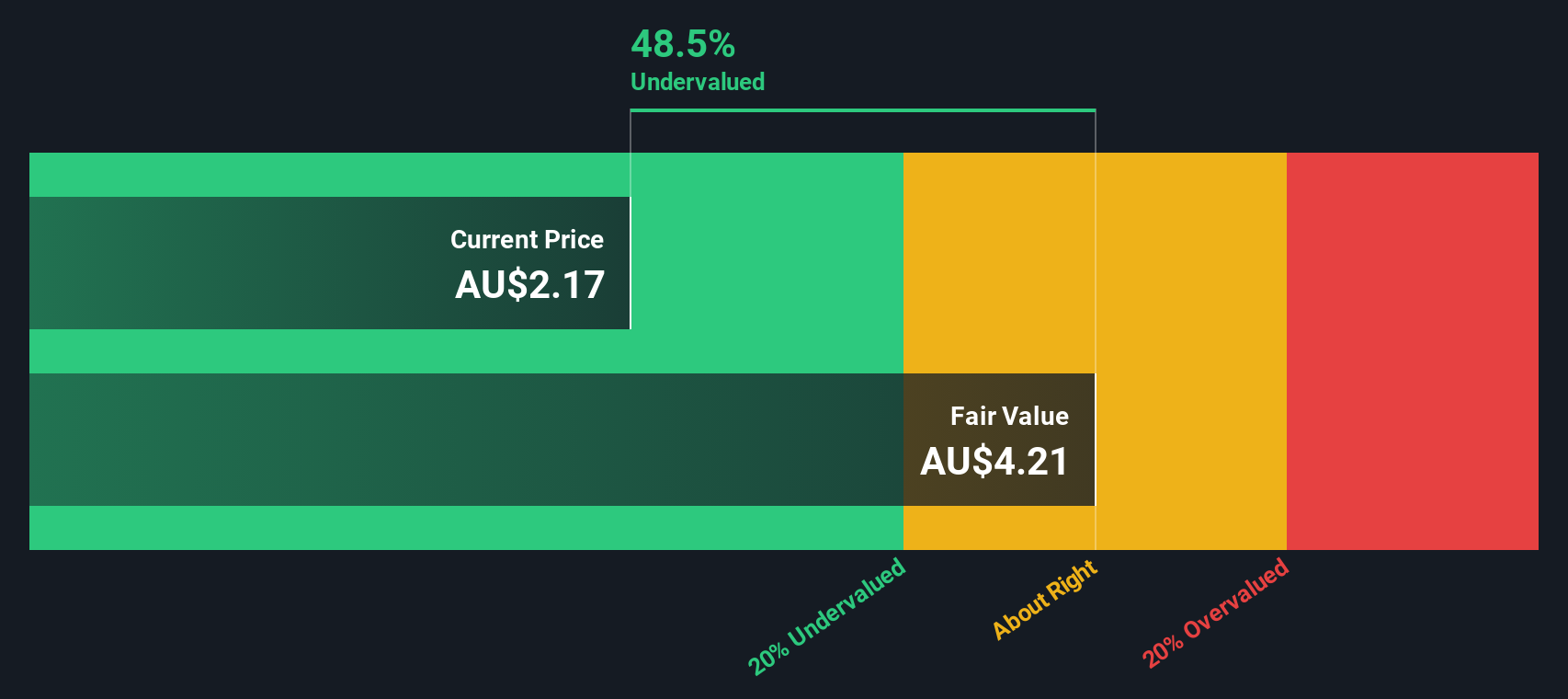

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★★

Overview: Navigator Global Investments is an asset management company primarily operating through its Lighthouse investment segment, with a market cap of approximately A$0.24 billion.

Operations: Navigator Global Investments generates revenue primarily from its Lighthouse segment, with a recent gross profit margin of 32.43%. The company incurs costs mainly through COGS and operating expenses, including general and administrative expenses.

PE: 8.1x

Navigator Global Investments, a player in the asset management industry, has seen its revenue jump to US$276.28 million for the year ending June 2024, up from US$184.9 million previously. Despite this growth, earnings quality is impacted by significant one-off items and reliance on external borrowing raises risk concerns due to lack of customer deposits. Insider confidence is evident with recent share purchases by insiders between August and September 2024. Added to the S&P Global BMI Index in September 2024, Navigator's inclusion may enhance visibility among investors seeking opportunities within Australia's smaller companies segment.

- Dive into the specifics of Navigator Global Investments here with our thorough valuation report.

Learn about Navigator Global Investments' historical performance.

Seize The Opportunity

- Gain an insight into the universe of 22 Undervalued ASX Small Caps With Insider Buying by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Global Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NGI

Navigator Global Investments

HFA Holdings Limited operates as a fund management company in Australia.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives