Charter Hall Long WALE REIT (ASX:CLW) adds AU$91m to market cap in the past 7 days, though investors from five years ago are still down 2.3%

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Charter Hall Long WALE REIT (ASX:CLW) shareholders for doubting their decision to hold, with the stock down 30% over a half decade.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Charter Hall Long WALE REIT

Charter Hall Long WALE REIT isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

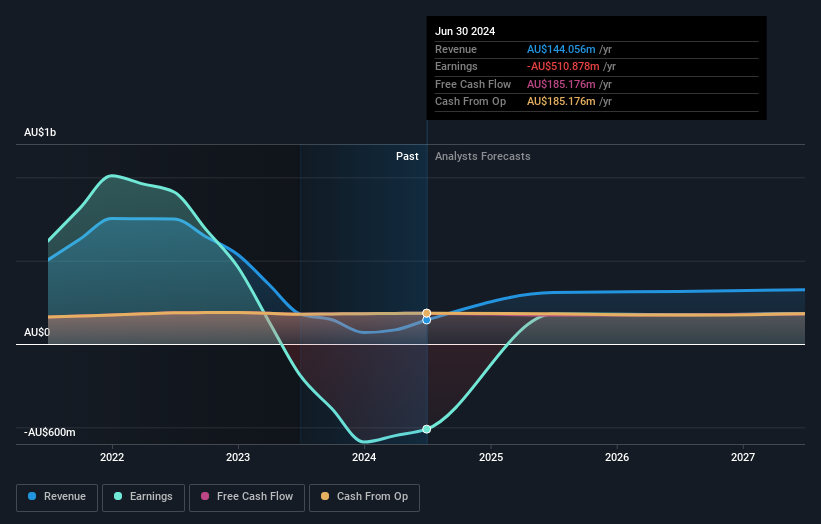

Over five years, Charter Hall Long WALE REIT grew its revenue at 0.6% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 5% isn't particularly surprising. The key question is whether the company can make it to profitability, and beyond, without trouble. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Charter Hall Long WALE REIT stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Charter Hall Long WALE REIT's TSR for the last 5 years was -2.3%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Charter Hall Long WALE REIT shareholders have received a total shareholder return of 32% over one year. Of course, that includes the dividend. Notably the five-year annualised TSR loss of 0.5% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Charter Hall Long WALE REIT better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Charter Hall Long WALE REIT .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CLW

Charter Hall Long WALE REIT

An Australian Real Estate Investment Trust (REIT) listed on the ASX and investing in high quality Australasian real estate assets that are predominantly leased to corporate and government tenants on long term leases.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives