- Australia

- /

- Metals and Mining

- /

- ASX:FMG

3 High Yielding ASX Dividend Stocks With Up To 7.5% Yield

Reviewed by Simply Wall St

Amidst a challenging day on the ASX where every sector closed in the red and the index itself dropped by nearly 85 points, investors may find solace in exploring high-yielding dividend stocks. In times of market volatility, such stocks can offer a semblance of stability and consistent returns, making them an appealing option for those looking to mitigate risk while maintaining income streams.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 6.45% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 5.15% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.01% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.69% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.59% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 6.97% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.68% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 7.51% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.17% | ★★★★★☆ |

| Australian United Investment (ASX:AUI) | 3.59% | ★★★★☆☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Beacon Lighting Group (ASX:BLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beacon Lighting Group Limited, operating both in Australia and internationally, specializes in the retail of lighting products with a market capitalization of A$548.94 million.

Operations: Beacon Lighting Group Limited generates A$312.87 million from the sale of light fittings, fans, and energy-efficient products.

Dividend Yield: 3.4%

Beacon Lighting Group maintains a balanced approach to dividends, with a payout ratio of 59.4% and cash payout ratio at 34.3%, suggesting earnings and cash flows adequately cover distributions. However, the dividend track record has been inconsistent over the past decade, showing volatility in payments despite an overall increase in dividends during this period. Additionally, its current yield of 3.43% is modest compared to leading Australian dividend stocks.

- Click here to discover the nuances of Beacon Lighting Group with our detailed analytical dividend report.

- The analysis detailed in our Beacon Lighting Group valuation report hints at an inflated share price compared to its estimated value.

Charter Hall Group (ASX:CHC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Charter Hall Group, operating under the ticker ASX:CHC, is a prominent Australian property investment and funds management company with a market capitalization of approximately A$5.83 billion.

Operations: Charter Hall Group generates revenue primarily through funds management, which contributes A$515.60 million, and property investments, adding A$142.20 million.

Dividend Yield: 3.6%

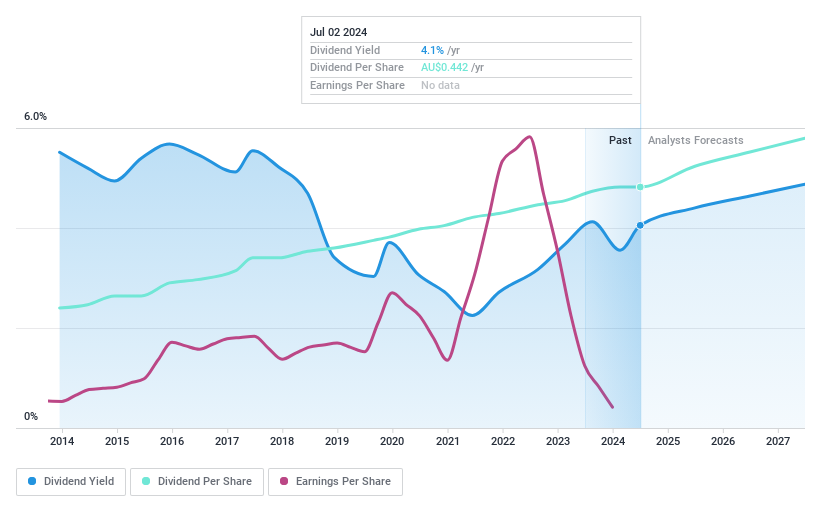

Charter Hall Group offers a stable dividend yield of 3.59%, consistently paid over the last decade, though it falls below the top quartile of Australian dividend payers at 6.39%. The dividends are well-supported by both earnings and cash flow, with payout ratios of 43.8% and 45.3% respectively, ensuring sustainability. Despite this reliability, its profit margins have decreased to 11.7% from last year's 42.9%, suggesting potential pressures on profitability even as earnings are expected to grow by 21.16% annually.

- Navigate through the intricacies of Charter Hall Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that Charter Hall Group's share price might be on the expensive side.

Fortescue (ASX:FMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd is an Australian company specializing in the exploration, development, production, processing, and sale of iron ore domestically and internationally, with a market capitalization of approximately A$82.34 billion.

Operations: Fortescue Ltd generates revenue primarily through its metals segment, which brought in A$18.47 billion, and its energy operations contributed A$0.08 billion.

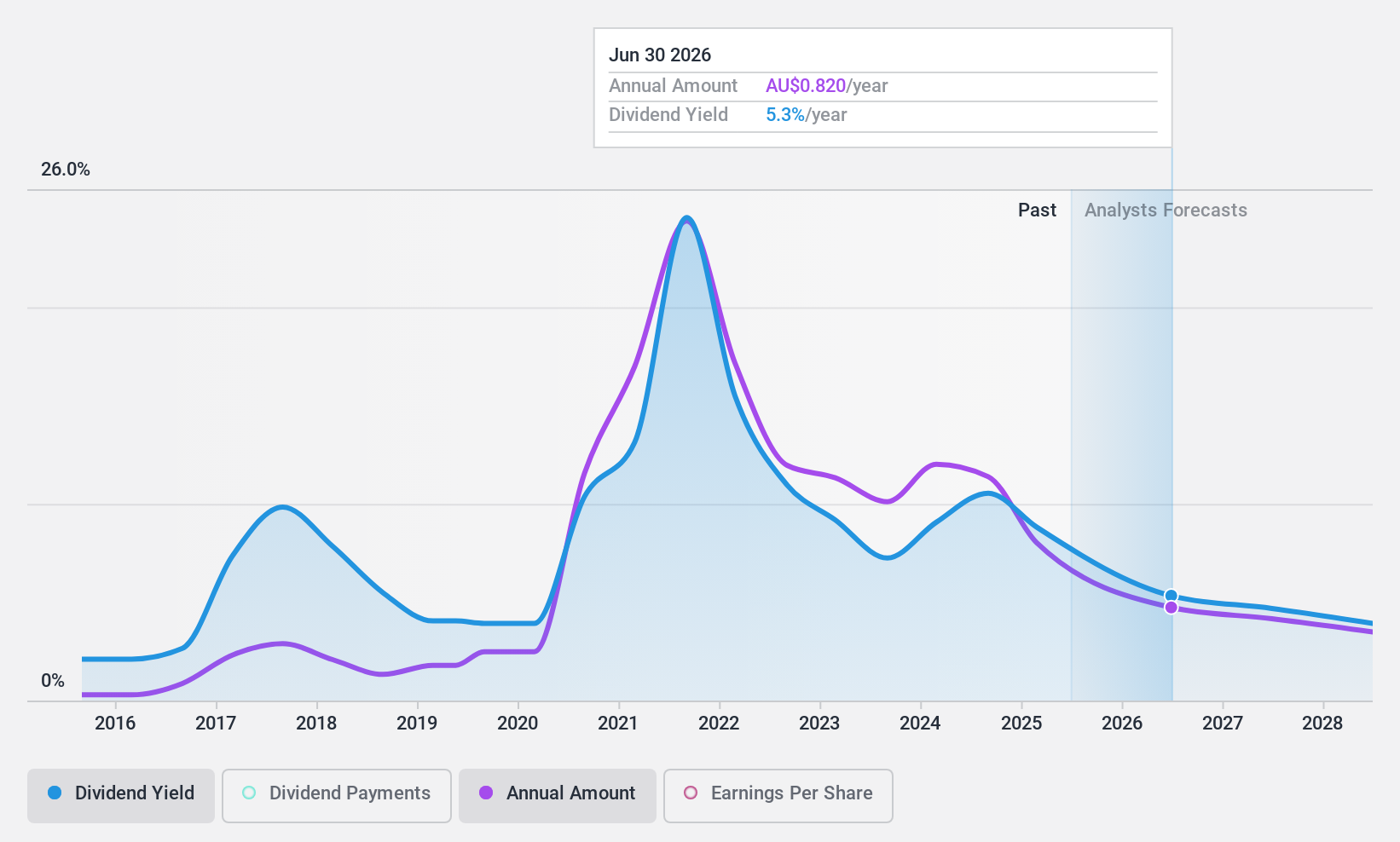

Dividend Yield: 7.5%

Fortescue's dividend history shows variability, with significant fluctuations over the past decade. Despite this, recent figures indicate a robust coverage with a payout ratio and cash payout ratio at 74.2% and 73.1%, respectively, suggesting current dividends are well-supported by earnings and cash flow. However, the company's earnings are projected to decline by an average of 18.6% annually over the next three years, which could challenge future dividend sustainability. Currently, Fortescue offers a high yield of 7.51%, placing it in the top tier of Australian dividend stocks.

- Click here and access our complete dividend analysis report to understand the dynamics of Fortescue.

- Our expertly prepared valuation report Fortescue implies its share price may be lower than expected.

Next Steps

- Dive into all 28 of the Top ASX Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FMG

Fortescue

Engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives