Exploring 3 Undervalued Small Caps On ASX With Insider Buying

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.51% at 8,416 points, driven by gains in the materials and IT sectors following China's measured response to international trade tensions. As investors navigate this dynamic landscape, identifying small-cap stocks that are potentially undervalued can be appealing, especially when there is insider buying which may indicate confidence in their future prospects amidst current economic conditions.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infomedia | 40.5x | 3.6x | 37.11% | ★★★★★★ |

| Rural Funds Group | 7.5x | 5.6x | 38.71% | ★★★★★★ |

| Collins Foods | 17.5x | 0.6x | 9.66% | ★★★★★☆ |

| Dicker Data | 19.2x | 0.7x | -60.40% | ★★★★☆☆ |

| Cromwell Property Group | NA | 4.8x | 25.05% | ★★★★☆☆ |

| Healius | NA | 0.6x | 8.73% | ★★★★☆☆ |

| Corporate Travel Management | 24.8x | 3.0x | 37.17% | ★★★☆☆☆ |

| Abacus Storage King | 10.8x | 6.8x | -19.02% | ★★★☆☆☆ |

| Eureka Group Holdings | 19.4x | 6.2x | 26.02% | ★★★☆☆☆ |

| Tabcorp Holdings | NA | 0.6x | -8.72% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

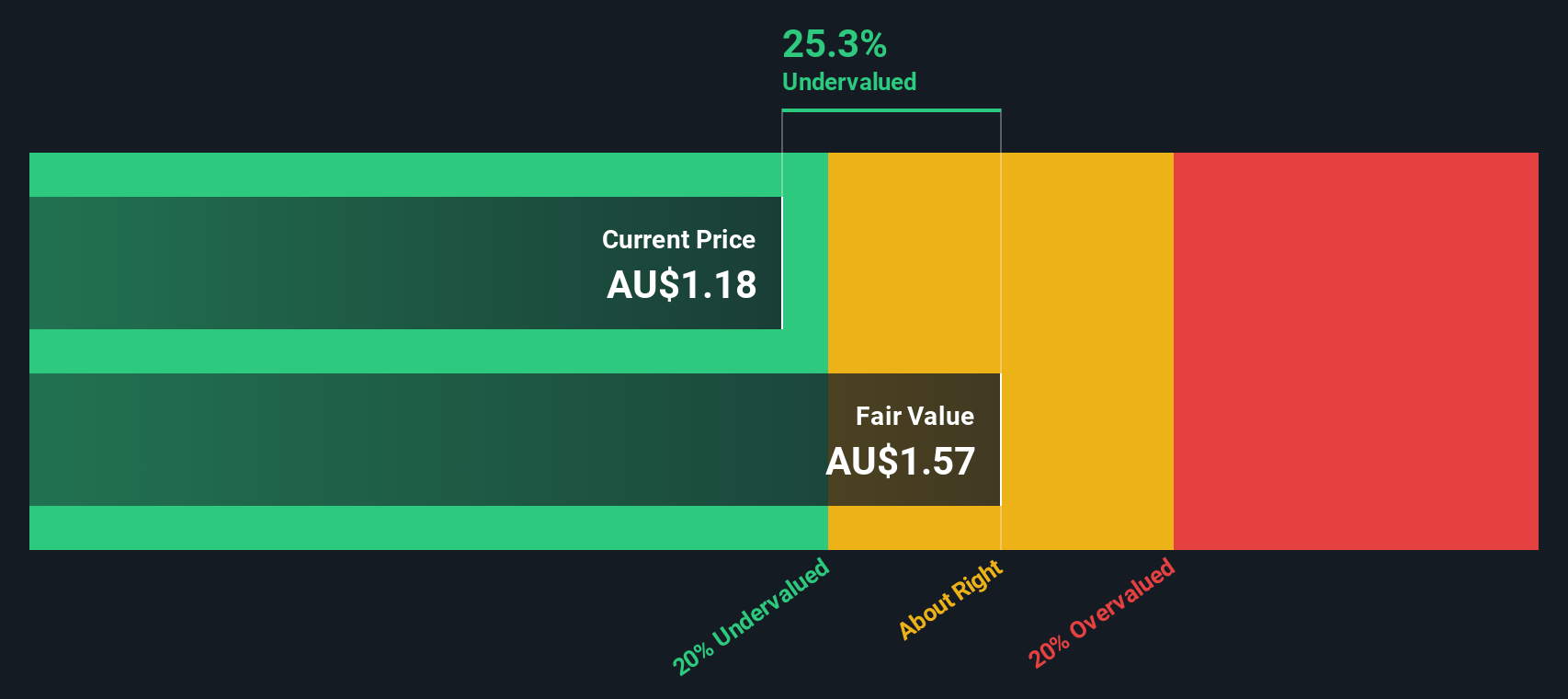

Abacus Group (ASX:ABG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Abacus Group is a diversified property investment company focusing on commercial real estate, with a market capitalization of A$2.15 billion.

Operations: Abacus Group's revenue primarily stems from its commercial segment, with recent figures showing A$192.35 million. The company has experienced fluctuations in net income margin, which reached as high as 1.38% but recently reported -1.26%. The gross profit margin has shown an upward trend, peaking at 77.34%. Operating expenses and non-operating expenses significantly impact the company's financial performance, with recent non-operating expenses recorded at A$351.99 million.

PE: -4.3x

Abacus Group, a small player in the Australian market, recently announced a dividend of A$0.0425 per share for the six months ending December 2024. Despite relying solely on external borrowing for funding, which poses higher risk, insider confidence is evident with recent share purchases. Earnings are projected to grow by 59% annually, suggesting potential future value. The appointment of Lucy Rowe as company secretary marks a shift in leadership dynamics at Abacus.

- Take a closer look at Abacus Group's potential here in our valuation report.

Evaluate Abacus Group's historical performance by accessing our past performance report.

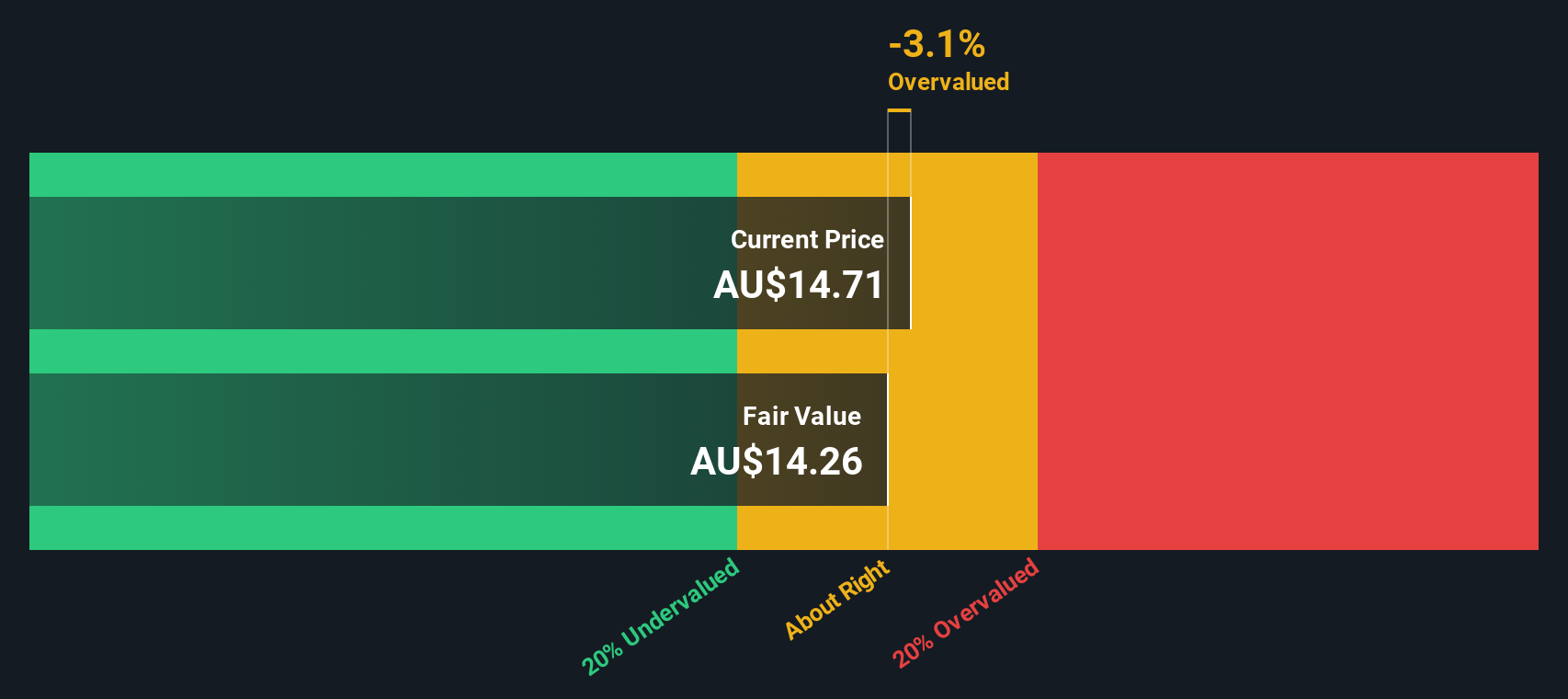

Corporate Travel Management (ASX:CTD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Corporate Travel Management is a company that provides travel services across Asia, Europe, North America, and Australia/New Zealand, with a market capitalization of A$3.18 billion.

Operations: The company generates revenue primarily from its travel services across Asia, Europe, North America, and Australia/New Zealand. Over recent periods, the gross profit margin has shown a notable upward trend, reaching 41.60% by December 2023. Operating expenses are significant and include general and administrative costs as a major component.

PE: 24.8x

Corporate Travel Management, a small company in Australia, is drawing attention for its potential value. Insiders have shown confidence by purchasing shares consistently over the past year. Despite relying solely on external borrowing for funding, which poses higher risks, the company's earnings are expected to grow at 12% annually. This growth outlook suggests a promising trajectory that could appeal to investors seeking opportunities in smaller companies with room for expansion.

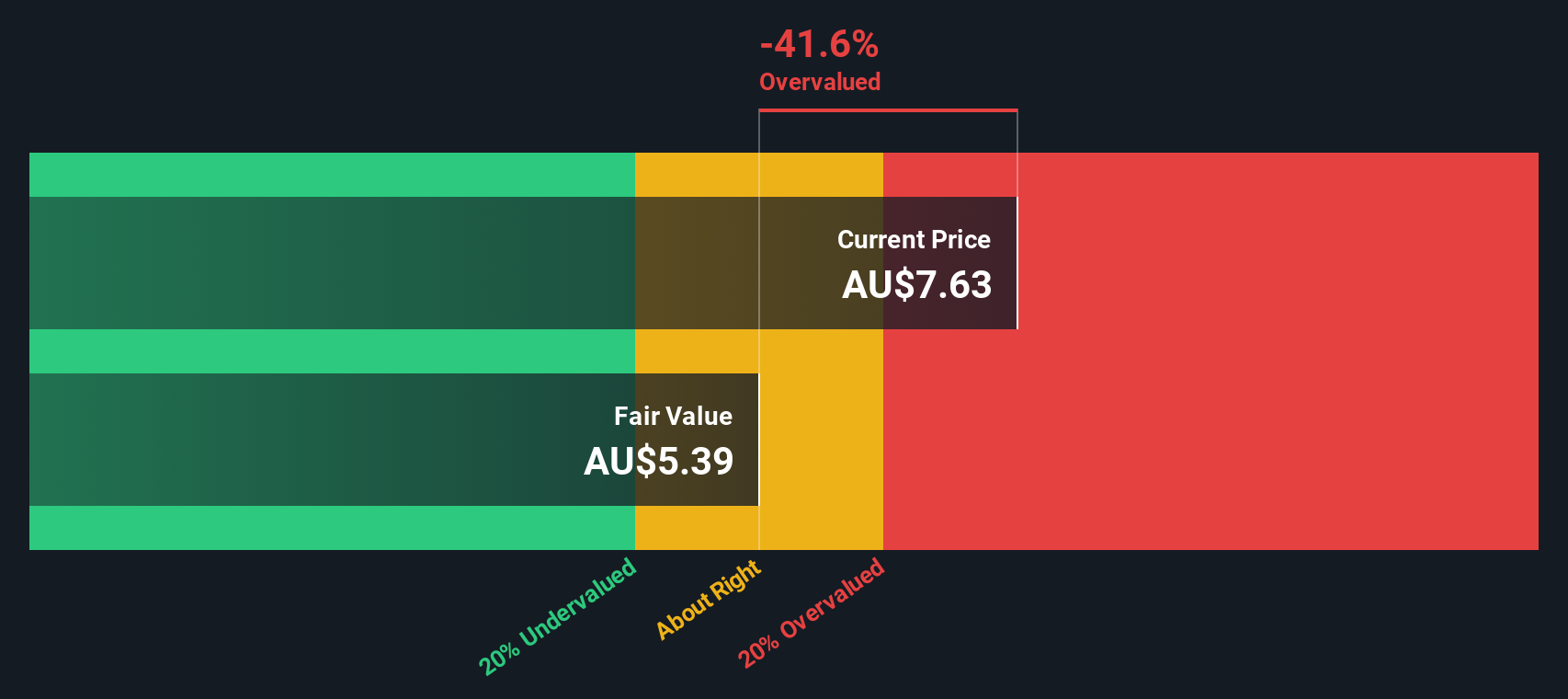

Data#3 (ASX:DTL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Data#3 is a value-added IT reseller and IT solutions provider with a market cap of approximately A$1.23 billion.

Operations: The company's revenue primarily stems from its operations as a value-added IT reseller and IT solutions provider. Over the observed periods, the net income margin has shown an upward trend, reaching 5.38% by June 2024. Cost of goods sold (COGS) represents a significant portion of expenses, impacting gross profit margins which have varied over time but reached 9.87% in the latest period recorded.

PE: 25.2x

Data#3, a smaller player in the Australian market, has recently seen insider confidence with share purchases by key figures over the past year. The company anticipates earnings growth of 9.61% annually, suggesting potential for value appreciation. However, its reliance on external borrowing introduces higher risk compared to customer deposits. The appointment of Bronwyn Morris as Chair of the Audit and Risk Committee from December 2024 adds strategic depth and governance expertise to its board.

- Get an in-depth perspective on Data#3's performance by reading our valuation report here.

Gain insights into Data#3's historical performance by reviewing our past performance report.

Summing It All Up

- Dive into all 20 of the Undervalued ASX Small Caps With Insider Buying we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DTL

Data#3

Provides information technology (IT) solutions and services in Australia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.