- Australia

- /

- Hospitality

- /

- ASX:AGI

Discover 3 ASX Penny Stocks With Market Caps Under A$2B

Reviewed by Simply Wall St

Australian shares are showing resilience, with the ASX rallying despite recent volatility in global markets influenced by U.S. political and economic concerns. For investors looking beyond the major players, penny stocks—often representing smaller or emerging companies—can still offer intriguing potential for growth. While the term "penny stock" may seem outdated, these investments can uncover hidden value when backed by solid financial health, and we'll explore three such opportunities on the ASX today.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.455 | A$130.4M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.68 | A$126.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.925 | A$57.6M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$410.95M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.14 | A$231.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.042 | A$49.13M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$36.87M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.835 | A$398.89M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 424 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Ainsworth Game Technology (ASX:AGI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ainsworth Game Technology Limited is an international company that designs, manufactures, and services electronic gaming machines and related equipment, with a market cap of A$353.63 million.

Operations: Ainsworth Game Technology generates revenue of A$294.76 million from its segment focused on gaming machines and related equipment and services.

Market Cap: A$353.63M

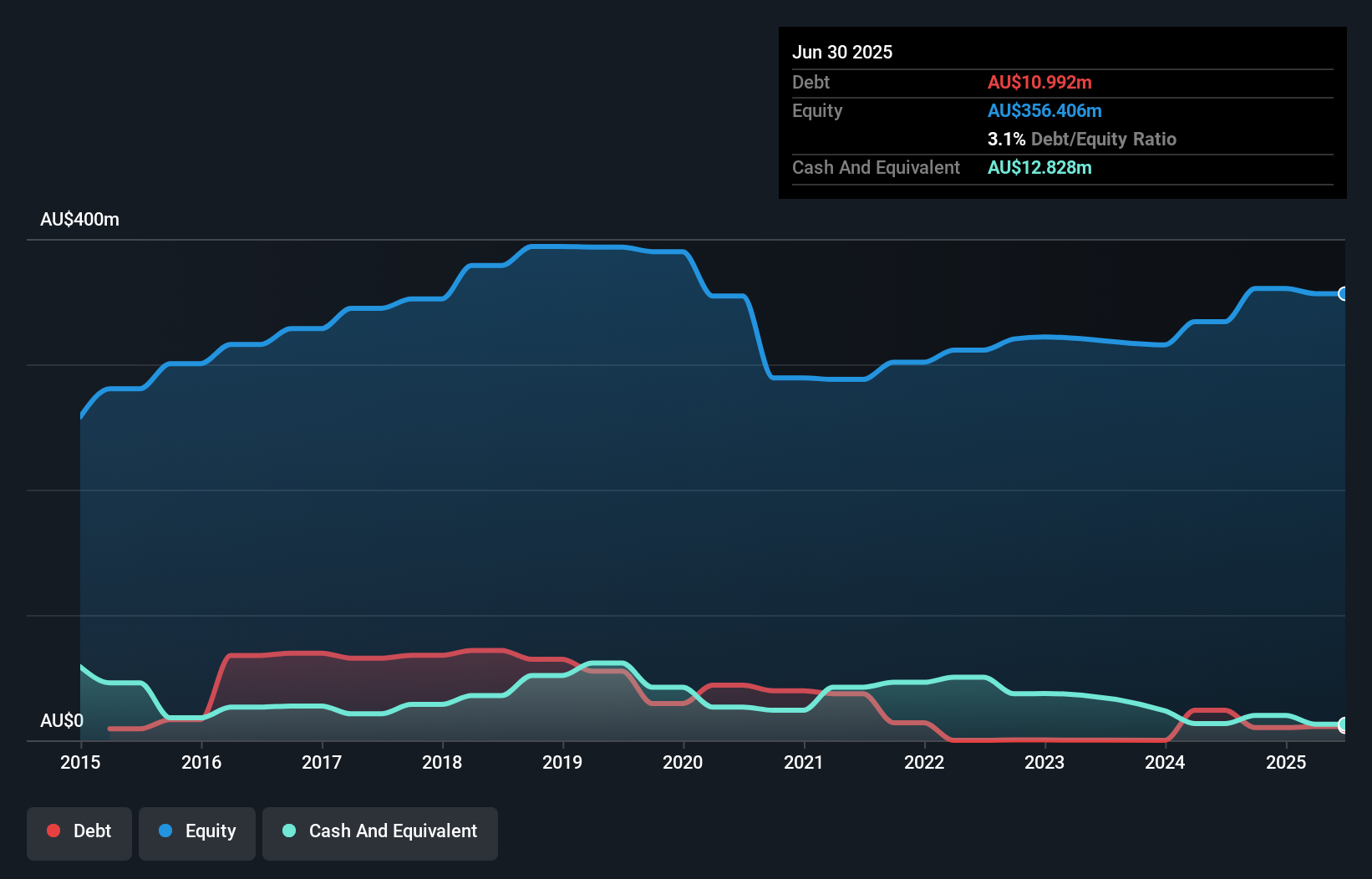

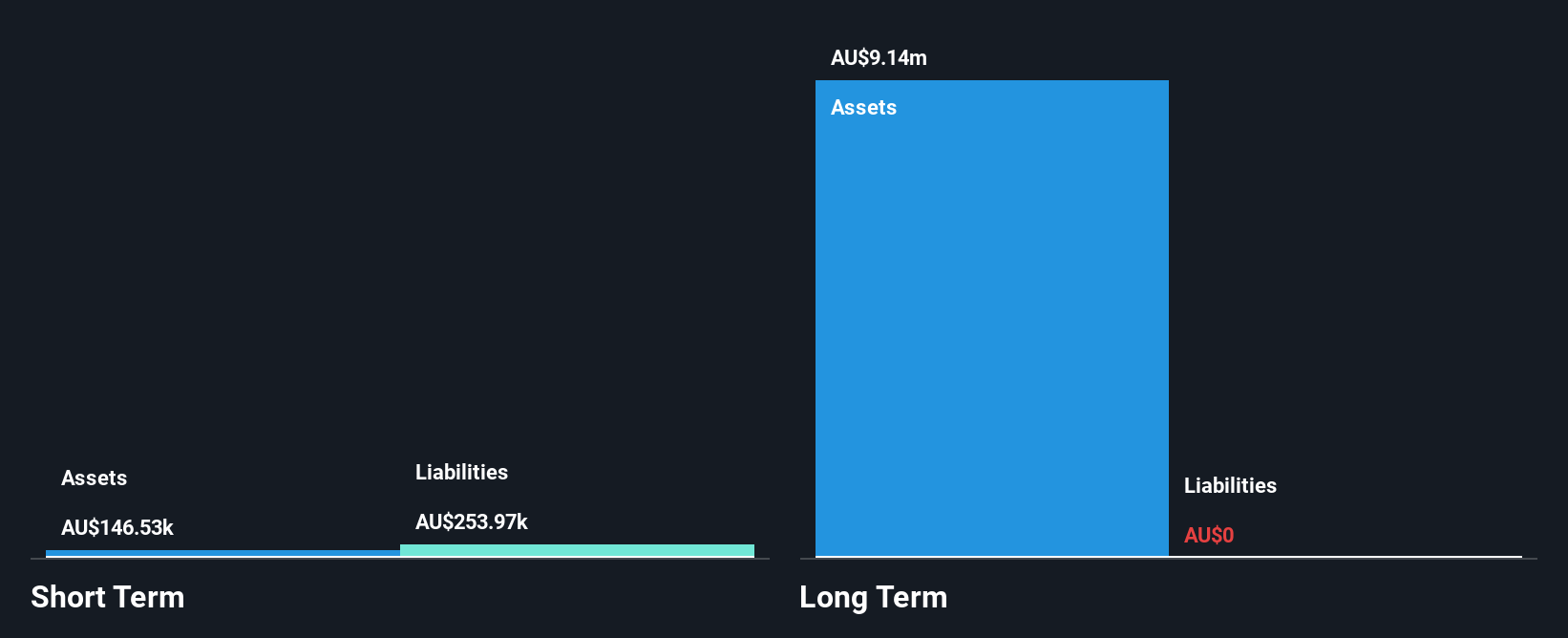

Ainsworth Game Technology, with a market cap of A$353.63 million, has demonstrated significant earnings growth of 289.2% over the past year, outpacing the hospitality industry. The company maintains strong financial health with short-term assets covering both short and long-term liabilities and more cash than total debt. Despite this growth, net profit margins remain modest at 7.2%, though improved from last year's 2.1%. Recent earnings results for H1 2025 showed increased sales but a decline in net income to A$4.94 million from A$13.98 million the previous year, highlighting some volatility in performance despite overall positive trends in debt reduction and asset management efficiency.

- Take a closer look at Ainsworth Game Technology's potential here in our financial health report.

- Review our growth performance report to gain insights into Ainsworth Game Technology's future.

Altair Minerals (ASX:ALR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Altair Minerals Limited is involved in the exploration of natural resources across Australia and Canada, with a market capitalization of A$90.93 million.

Operations: Currently, Altair Minerals Limited does not report any specific revenue segments.

Market Cap: A$90.93M

Altair Minerals Limited, with a market cap of A$90.93 million, is pre-revenue and faces significant challenges including high volatility and short-term liabilities exceeding assets. Despite being debt-free, the company has only a one-month cash runway but recently raised A$3.26 million through equity offerings to bolster its financial position. The management team is relatively new with limited experience, which may impact strategic execution. Recent exploration initiatives in Guyana's Greater Oko Project show promise due to experienced leadership in mineral discovery; however, auditors have expressed doubts about Altair's ability to continue as a going concern without further capital or revenue generation improvements.

- Click here to discover the nuances of Altair Minerals with our detailed analytical financial health report.

- Assess Altair Minerals' previous results with our detailed historical performance reports.

United Overseas Australia (ASX:UOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, along with its subsidiaries, is involved in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia, with a market capitalization of A$1.18 billion.

Operations: The company's revenue is primarily derived from land development and resale, generating A$438.18 million, alongside investment activities contributing A$257.51 million.

Market Cap: A$1.18B

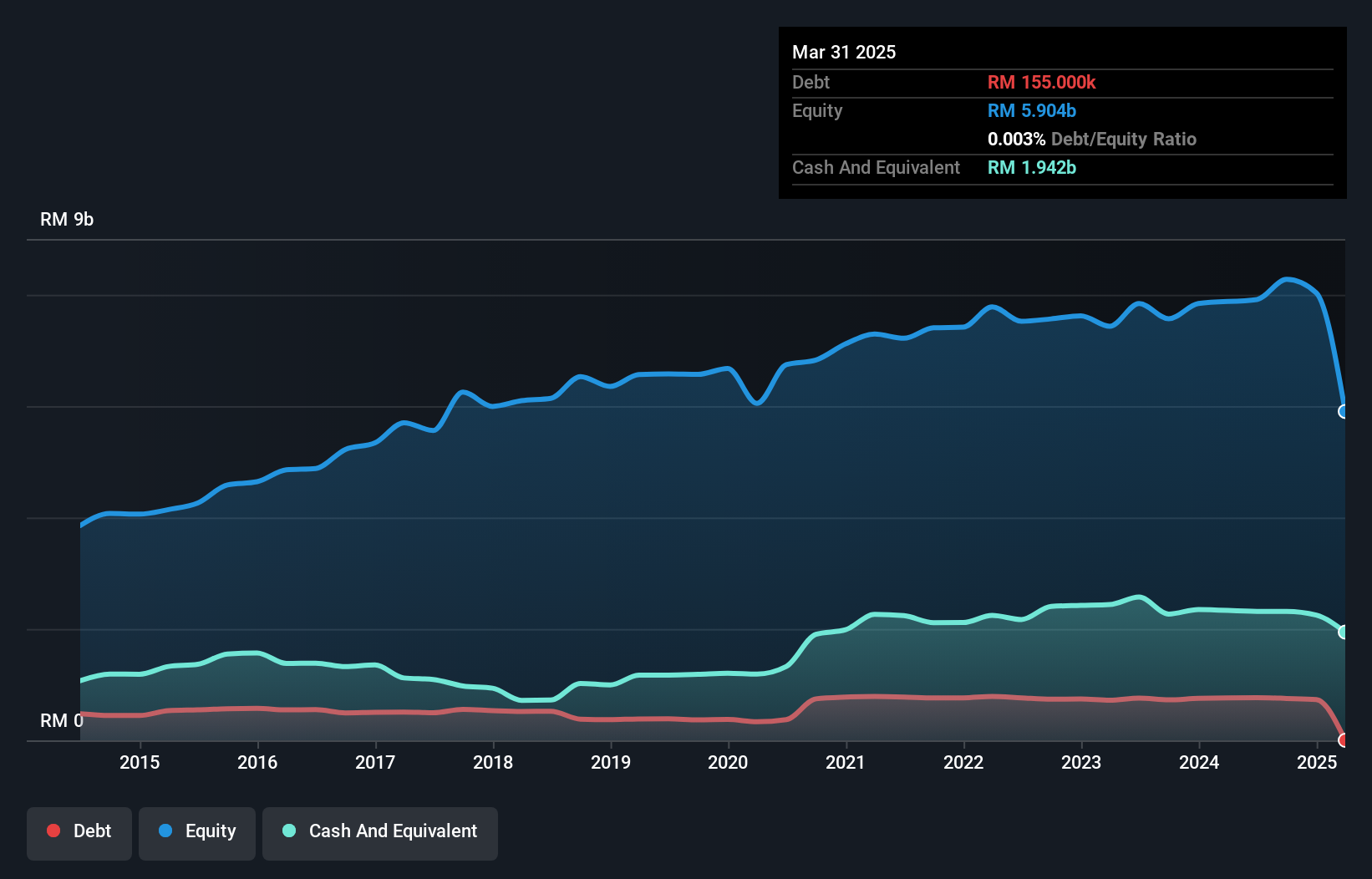

United Overseas Australia Ltd, with a market cap of A$1.18 billion, demonstrates financial stability through its substantial short-term assets (A$1.7 billion) covering both short and long-term liabilities. The company has grown earnings by 27.5% over the past year, though this is below the industry average growth rate. Its price-to-earnings ratio of 11.5x suggests it may be undervalued compared to the broader Australian market at 21x. Despite a low return on equity (5%) and an unstable dividend history, UOS maintains strong interest coverage and cash exceeds total debt, indicating prudent financial management amidst fluctuating profit margins.

- Unlock comprehensive insights into our analysis of United Overseas Australia stock in this financial health report.

- Evaluate United Overseas Australia's historical performance by accessing our past performance report.

Next Steps

- Embark on your investment journey to our 424 ASX Penny Stocks selection here.

- Curious About Other Options? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AGI

Ainsworth Game Technology

Designs, develops, manufactures, sells, distributes, and services electronic gaming machines, and other related equipment and services in Australia, North America, Latin America, Europe, New Zealand, South Africa, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives