- Australia

- /

- Real Estate

- /

- ASX:SRV

Top ASX Dividend Stocks For Reliable Income

Reviewed by Simply Wall St

In the current Australian market, where fluctuations are evident with companies like Aristocrat Leisure impacting overall performance, investors are increasingly seeking stability amidst volatility. Dividend stocks often provide a reliable income stream, making them an attractive option for those looking to navigate uncertain economic conditions while benefiting from consistent returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Bisalloy Steel Group (ASX:BIS) | 9.82% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.16% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.05% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.63% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.87% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.45% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.76% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.19% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.00% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.40% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kina Securities Limited operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage services with a market cap of A$328.75 million.

Operations: Kina Securities Limited generates revenue primarily from its Banking & Finance segment, which accounts for PGK 421.46 million, and its Wealth Management segment, contributing PGK 47.36 million.

Dividend Yield: 8.7%

Kina Securities offers a high dividend yield of 8.69%, placing it in the top quartile of Australian dividend payers, though its dividends have been unstable over its nine-year history. The company's payout ratio is currently 74.8%, suggesting dividends are covered by earnings, with future coverage expected to improve slightly to 68.4%. However, concerns include a high level of bad loans at 11.1% and low allowance for these loans at just 21%.

- Click here and access our complete dividend analysis report to understand the dynamics of Kina Securities.

- Upon reviewing our latest valuation report, Kina Securities' share price might be too pessimistic.

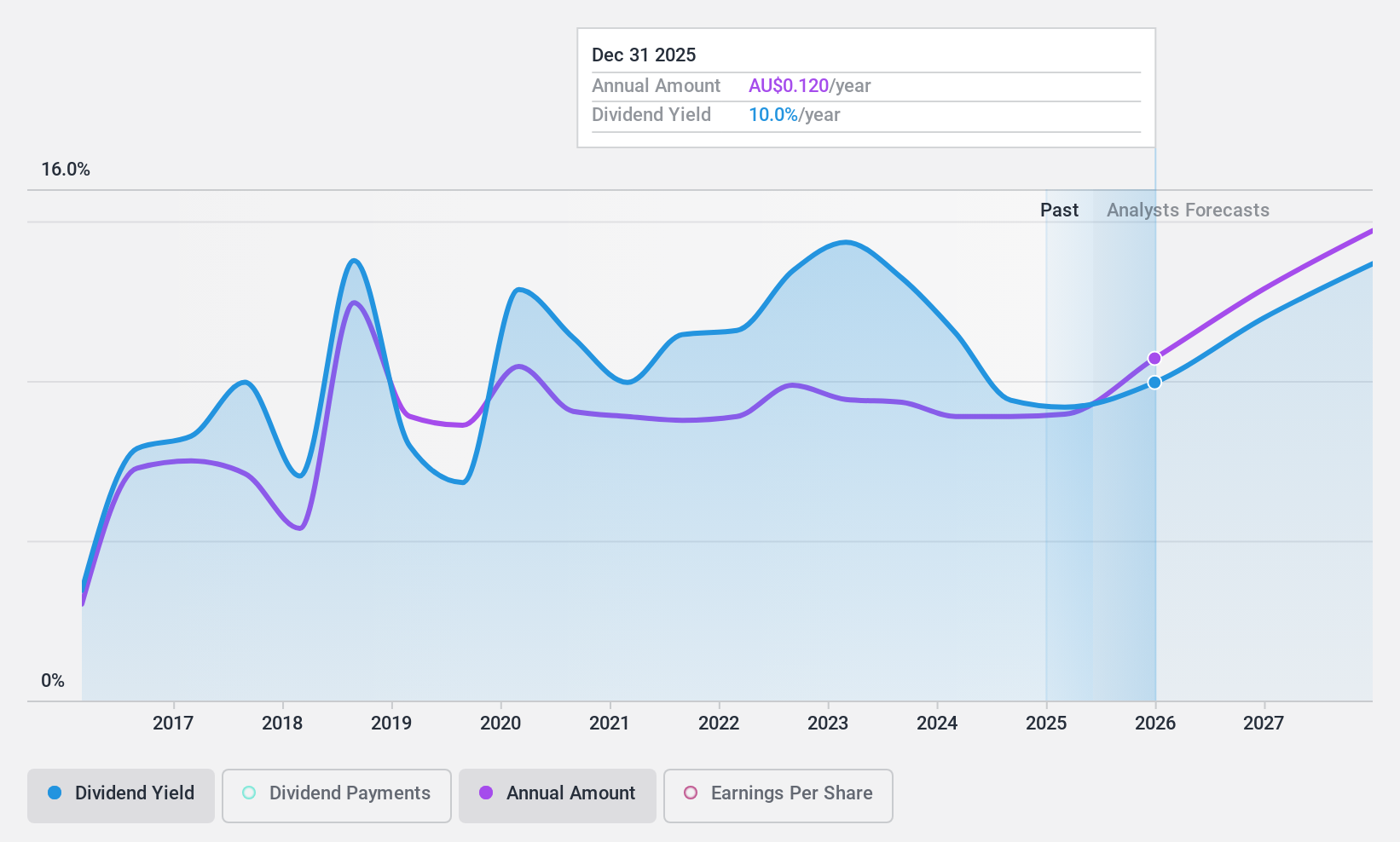

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$519.10 million.

Operations: Servcorp Limited generates revenue primarily from its real estate rental segment, amounting to A$326.36 million.

Dividend Yield: 4.5%

Servcorp's dividend prospects are mixed, with a volatile history over the past decade. Despite this, dividends are well-covered by earnings (47.1% payout ratio) and cash flows (13.3% cash payout ratio). Recent earnings growth and a low trading valuation suggest potential value for investors. The company announced an A$0.14 per share dividend for H1 2025, reflecting its commitment to shareholder returns, though its yield of 4.49% is below top-tier Australian payers.

- Take a closer look at Servcorp's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Servcorp shares in the market.

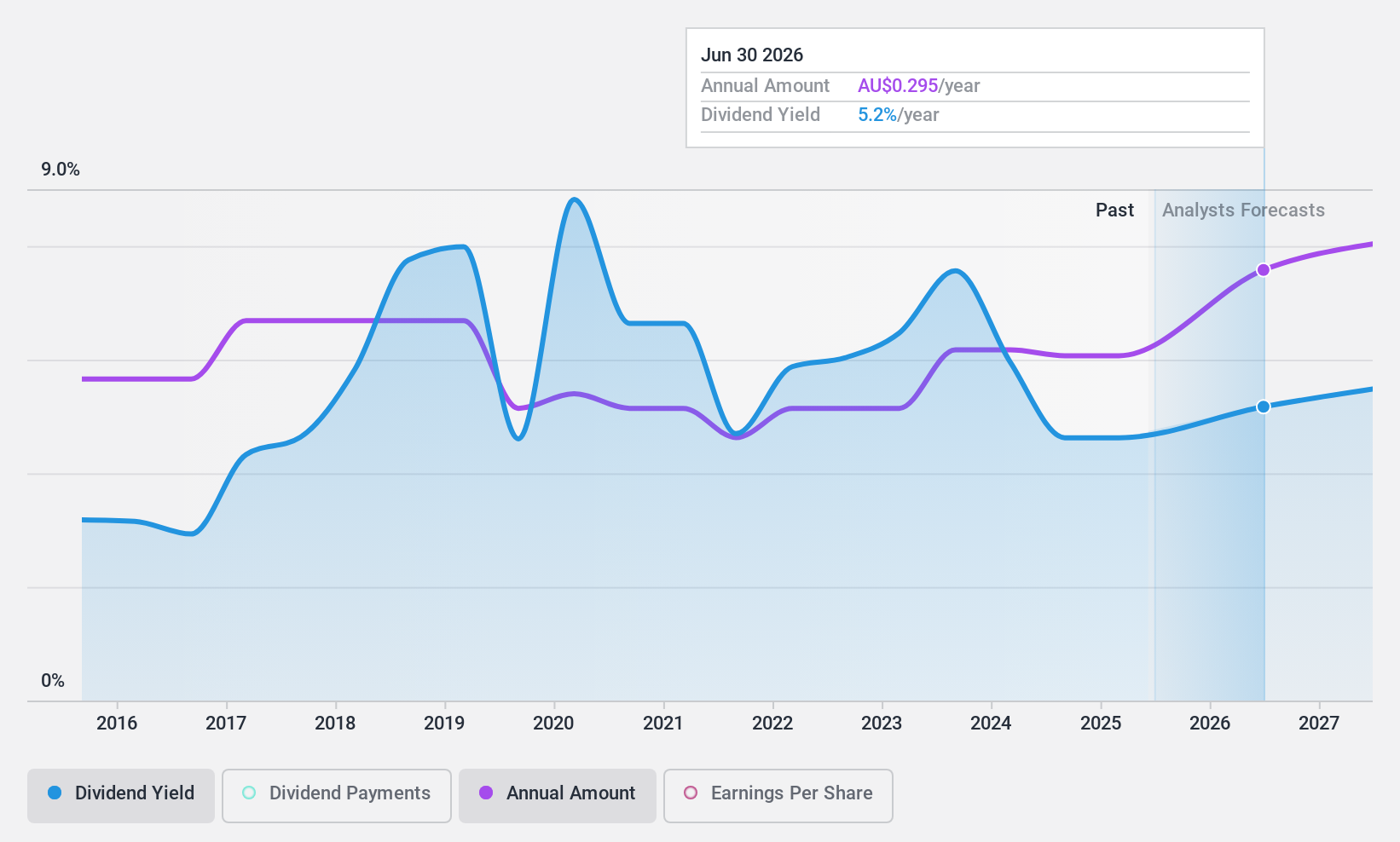

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Super Retail Group Limited operates as a retailer of auto, sports, and outdoor leisure products in Australia and New Zealand, with a market cap of A$3.17 billion.

Operations: Super Retail Group Limited's revenue segments include Rebel at A$1.32 billion, Macpac at A$215.80 million, Super Cheap Auto (SCA) at A$1.51 billion, and Boating, Camping and Fishing (BCF) at A$912.60 million.

Dividend Yield: 8.5%

Super Retail Group's dividend profile is characterized by volatility over the past decade, yet it maintains coverage with a payout ratio of 68.8% and cash payout ratio of 68%. The company's recent sales growth of 4.5% supports its dividend sustainability. Trading slightly below fair value and offering a top-tier yield of 8.48%, Super Retail announced an A$0.32 fully franked dividend for H1 2025, reinforcing its commitment to shareholder returns despite fluctuating earnings performance.

- Dive into the specifics of Super Retail Group here with our thorough dividend report.

- The analysis detailed in our Super Retail Group valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Delve into our full catalog of 32 Top ASX Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives