- Australia

- /

- Commercial Services

- /

- ASX:AMA

AMA Group And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

As the ASX 200 hovers just above 9,000 points, traders are cautiously navigating the market amid global economic events and local earnings reports. Despite some hesitancy, certain smaller stocks continue to capture investor attention due to their potential for growth and value. Penny stocks, though an old term, still represent opportunities in lesser-known companies with strong fundamentals that can offer both stability and upside potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.59 | A$122.18M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.40 | A$76.27M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.04 | A$468.71M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.31 | A$354.91M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$2.79 | A$3.18B | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.02 | A$1.02B | ✅ 4 ⚠️ 2 View Analysis > |

| Bravura Solutions (ASX:BVS) | A$2.28 | A$1.02B | ✅ 3 ⚠️ 3 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.37 | A$135.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Austin Engineering (ASX:ANG) | A$0.315 | A$195.47M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.855 | A$149.41M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 455 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

AMA Group (ASX:AMA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AMA Group Limited operates a collision repair business across Australia and New Zealand, with a market cap of A$449.56 million.

Operations: No specific revenue segments are reported for the company.

Market Cap: A$449.56M

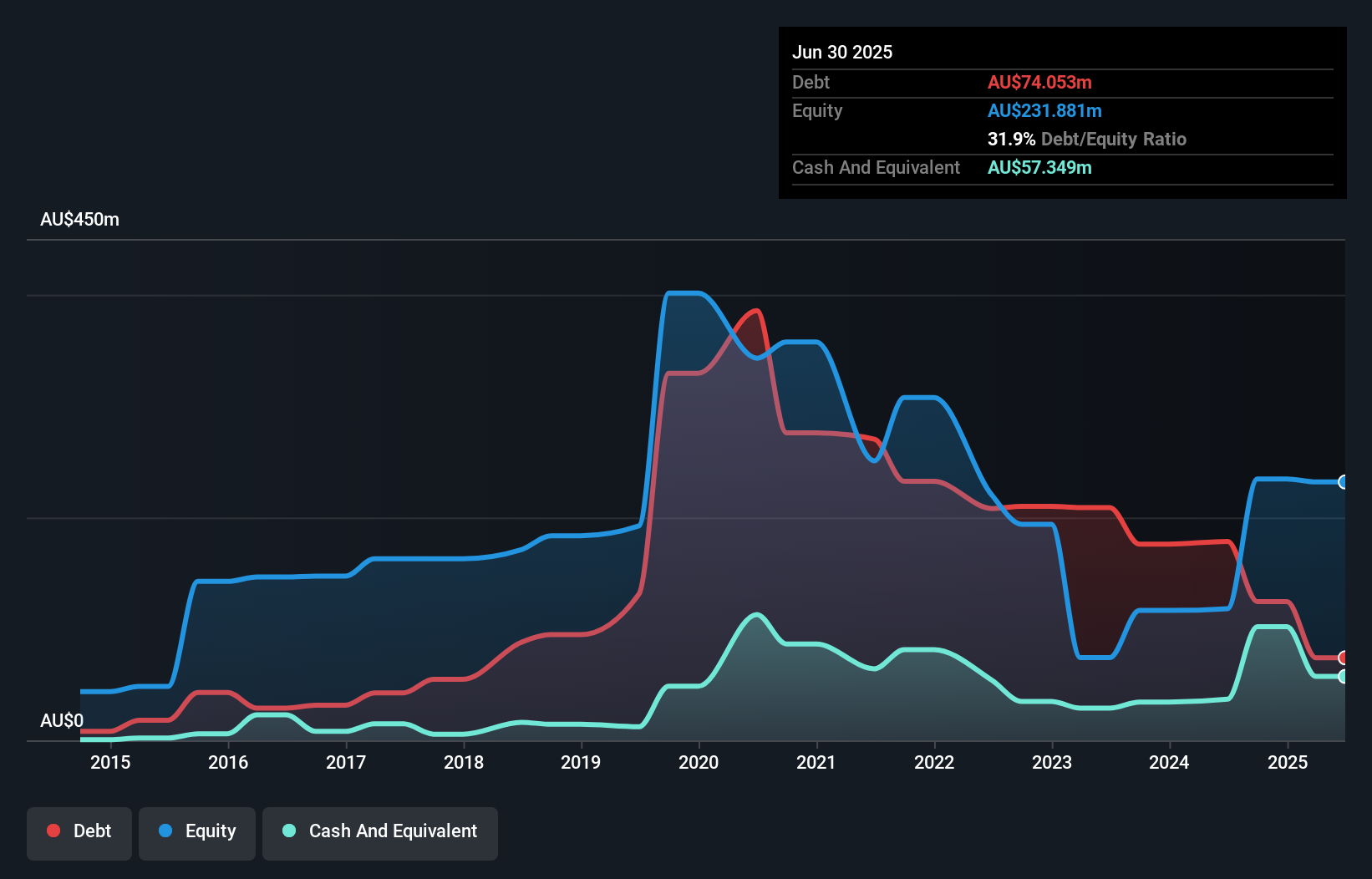

AMA Group, with a market cap of A$449.56 million, operates in the collision repair sector across Australia and New Zealand. Despite being unprofitable, it has reduced losses by 21% annually over the past five years and maintains a satisfactory net debt to equity ratio of 7.2%. The company trades at a significant discount to its estimated fair value and analysts anticipate a potential price increase of 22.3%. Recent earnings show sales growth to A$1.01 billion for the year ended June 2025, while net loss slightly improved from A$7.63 million to A$7.47 million year-on-year.

- Dive into the specifics of AMA Group here with our thorough balance sheet health report.

- Gain insights into AMA Group's future direction by reviewing our growth report.

Peet (ASX:PPC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Peet Limited acquires, develops, and markets residential land in Australia with a market cap of A$800.55 million.

Operations: Peet's revenue is primarily derived from Company Owned Projects (A$313.24 million), complemented by Funds Management (A$56.39 million) and Joint Arrangements (A$51.88 million).

Market Cap: A$800.55M

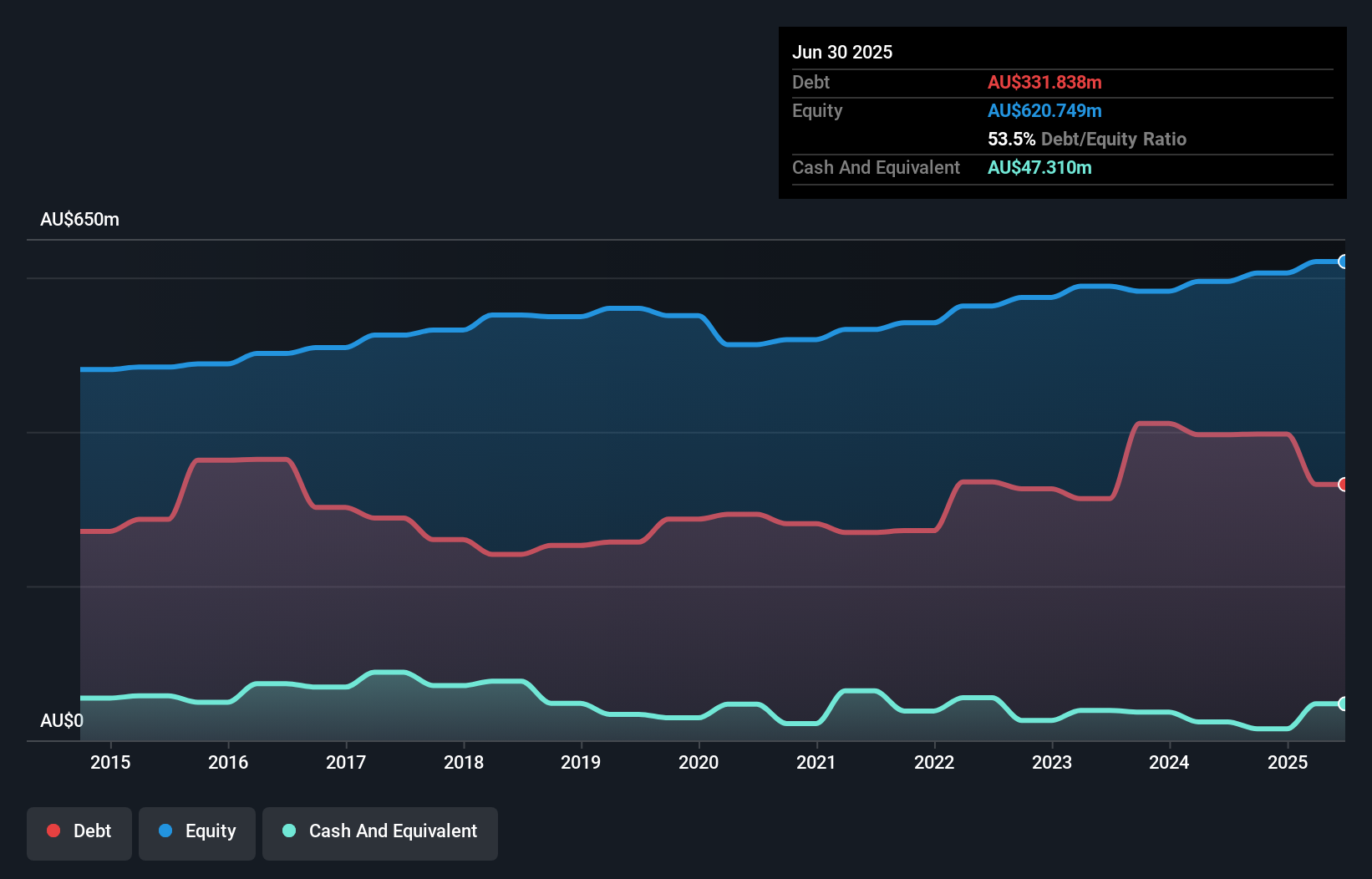

Peet Limited, with a market cap of A$800.55 million, is navigating a strategic review led by Goldman Sachs to optimize its asset base amidst favorable market conditions. The company reported robust earnings growth for FY25, with sales reaching A$414.79 million and net income at A$58.47 million, reflecting strong demand in the Australian residential property sector. Despite high debt levels (net debt to equity ratio of 45.8%), Peet's debt is well-covered by operating cash flow and interest payments are comfortably managed by EBIT coverage of 10.7x. However, the management team is relatively new with an average tenure of one year.

- Get an in-depth perspective on Peet's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Peet's track record.

XRF Scientific (ASX:XRF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XRF Scientific Limited manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries across Australia, Canada, and Europe with a market cap of A$313.40 million.

Operations: The company's revenue is derived from three main segments: Consumables (A$19.26 million), Precious Metals (A$21.51 million), and Capital Equipment (A$22.56 million).

Market Cap: A$313.4M

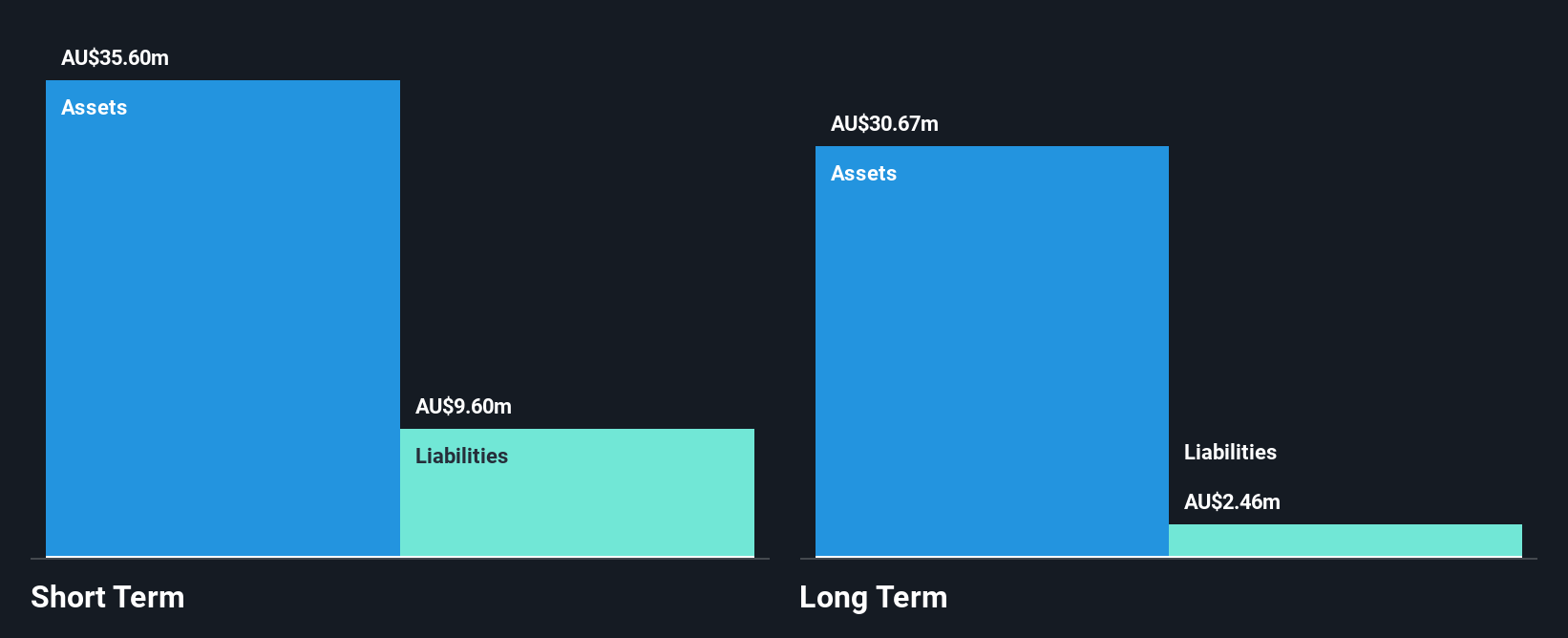

XRF Scientific, with a market cap of A$313.40 million, has demonstrated financial resilience despite modest sales growth. Its recent earnings report for FY25 shows net income rising to A$10.38 million from A$8.89 million the previous year, highlighting improved profit margins at 17.5%. The company's strong balance sheet is evidenced by short-term assets exceeding liabilities and a reduced debt-to-equity ratio from 14.5% to 4.4% over five years, complemented by well-covered interest payments and operating cash flow surpassing debt levels significantly. Furthermore, XRF's seasoned management and board enhance its operational stability amidst industry volatility.

- Jump into the full analysis health report here for a deeper understanding of XRF Scientific.

- Learn about XRF Scientific's future growth trajectory here.

Key Takeaways

- Jump into our full catalog of 455 ASX Penny Stocks here.

- Seeking Other Investments? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AMA

AMA Group

Engages in the development and operation of collision repair business in Australia and New Zealand.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives