- Canada

- /

- Oil and Gas

- /

- TSX:NVA

Undervalued Small Caps In Global With Insider Buying

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a downturn, with key indices like the S&P 500 and Russell 2000 posting consecutive losses amid trade policy uncertainties and recession concerns. Despite easing inflation in the U.S., investor sentiment remains cautious due to ongoing geopolitical tensions and economic challenges across various regions. In this environment, identifying small-cap stocks that demonstrate resilience can be crucial; such stocks often possess strong fundamentals or strategic insider buying, which may signal confidence in their potential despite broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Macfarlane Group | 10.4x | 0.6x | 41.02% | ★★★★★★ |

| Nexus Industrial REIT | 5.5x | 2.8x | 25.27% | ★★★★★★ |

| Bytes Technology Group | 22.8x | 5.8x | 11.64% | ★★★★★☆ |

| Robert Walters | NA | 0.2x | 46.46% | ★★★★★☆ |

| Minto Apartment Real Estate Investment Trust | 8.4x | 3.4x | 21.85% | ★★★★★☆ |

| Hong Leong Asia | 8.8x | 0.2x | 46.66% | ★★★★☆☆ |

| Gamma Communications | 21.4x | 2.2x | 38.87% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 36.27% | ★★★★☆☆ |

| Optima Health | NA | 1.6x | 42.19% | ★★★★☆☆ |

| Franchise Brands | 38.4x | 2.0x | 26.73% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

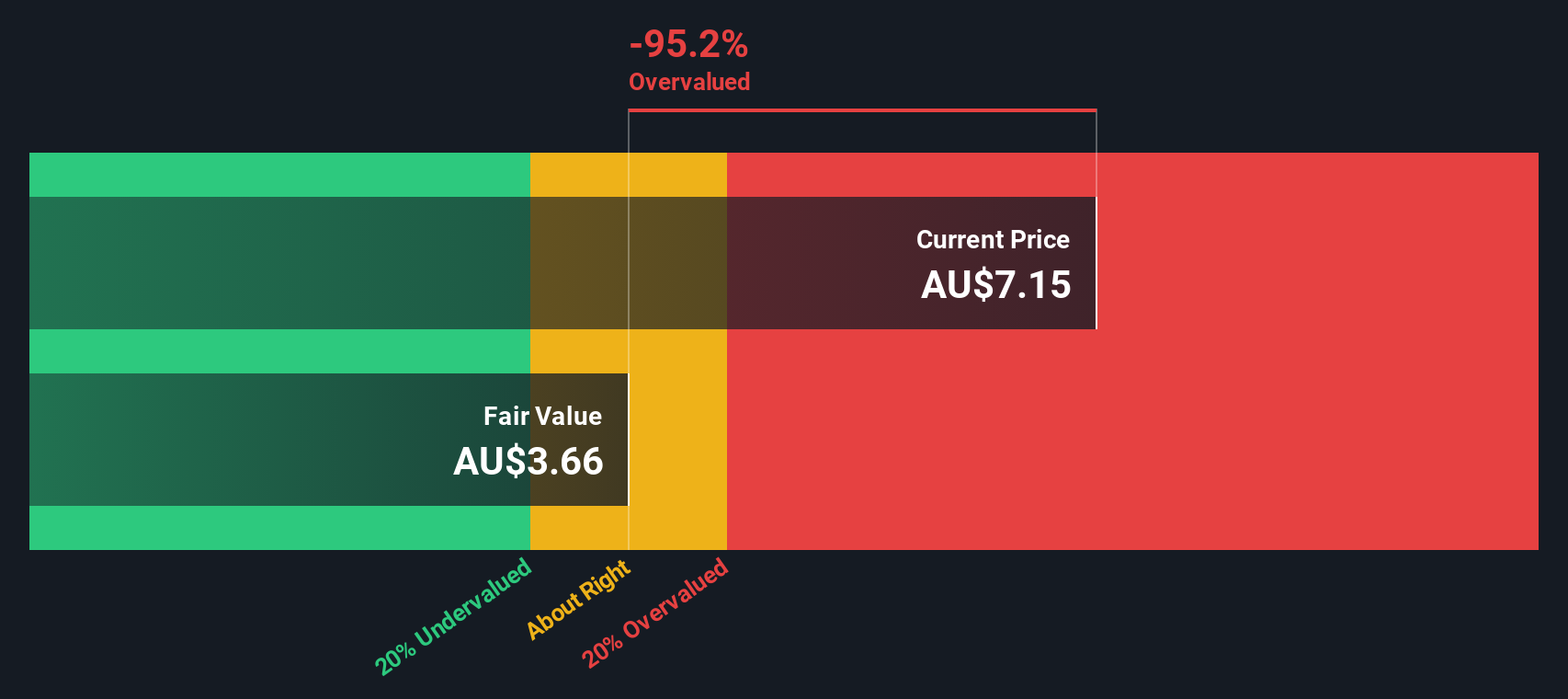

Cedar Woods Properties (ASX:CWP)

Simply Wall St Value Rating: ★★★★★★

Overview: Cedar Woods Properties is a property development and investment company with operations focused on residential communities, apartments, and commercial properties, boasting a market cap of A$0.35 billion.

Operations: Cedar Woods Properties generates revenue primarily through property development and investment, with a recent revenue figure of A$459.01 million. The company's cost of goods sold (COGS) is A$362.57 million, resulting in a gross profit of A$96.45 million and a gross profit margin of 21.01%. Operating expenses amount to A$28.78 million, impacting the net income which stands at A$52.86 million with a net income margin of 11.52%.

PE: 8.2x

Cedar Woods Properties, a smaller player in the property sector, recently reported a significant increase in earnings for the half-year ending December 2024, with net income jumping to A$15.01 million from A$2.64 million previously. Insider confidence is evident with recent share purchases by key figures within the company. Despite high debt levels and reliance on external borrowing, they project at least 10% NPAT growth for 2025 due to strong presale contracts worth over A$642 million and favorable economic conditions.

- Click to explore a detailed breakdown of our findings in Cedar Woods Properties' valuation report.

Gain insights into Cedar Woods Properties' past trends and performance with our Past report.

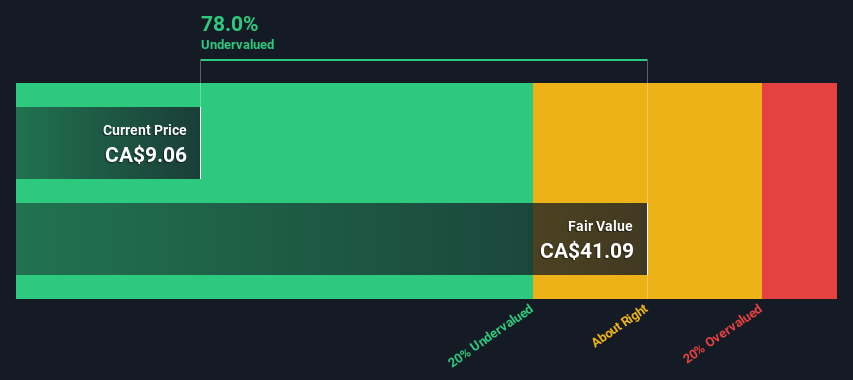

Enerflex (TSX:EFX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Enerflex is a global company specializing in the design, engineering, and manufacturing of natural gas compression, oil and gas processing, refrigeration systems, and electric power equipment with operations across Latin America, North America, and the Eastern Hemisphere.

Operations: Enerflex generates revenue primarily from North America, accounting for $1.63 billion, followed by the Eastern Hemisphere and Latin America. The company's cost of goods sold (COGS) significantly impacts its financial performance, with a gross profit margin fluctuating between 17.34% and 24.76% over recent periods. Operating expenses are substantial, including general and administrative costs which have ranged from approximately $105 million to $310 million in recent quarters. Net income margins have varied widely, reflecting both profits and losses across different time frames.

PE: 29.2x

Enerflex, a smaller company in the energy sector, recently reported improved financials with a net income of US$32 million for 2024 compared to a loss in the previous year. Despite sales dipping slightly to US$561 million in Q4, earnings per share turned positive. Insider confidence is evident as they initiate a share buyback plan approved by their board. Leadership changes see Preet Dhindsa stepping up as interim CEO, potentially steering Enerflex towards more stable growth amidst ongoing strategic initiatives.

- Take a closer look at Enerflex's potential here in our valuation report.

Review our historical performance report to gain insights into Enerflex's's past performance.

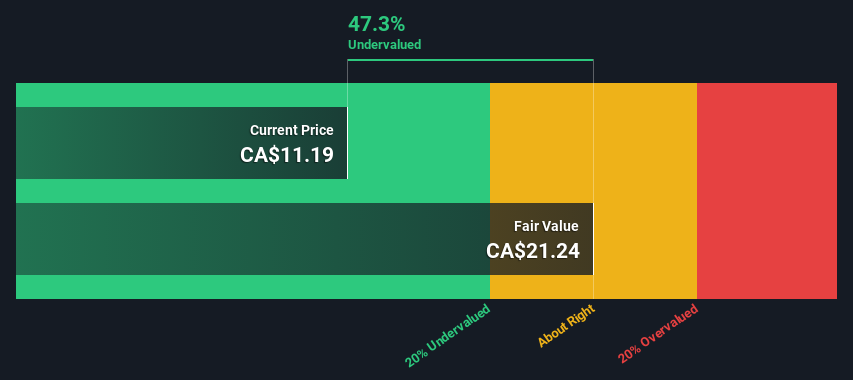

NuVista Energy (TSX:NVA)

Simply Wall St Value Rating: ★★★★★★

Overview: NuVista Energy is engaged in the exploration and production of oil and gas, with a market capitalization of approximately CA$2.25 billion.

Operations: NuVista Energy's revenue primarily comes from its oil and gas exploration and production activities, with a recent revenue figure of CA$1.08 billion. The company has experienced fluctuations in its gross profit margin, which was 53.93% as of the most recent period. Operating expenses have varied significantly over time, impacting overall profitability alongside notable changes in non-operating expenses and depreciation & amortization costs.

PE: 8.4x

NuVista Energy, a small energy player, showcases potential with its recent financials and strategic moves. Despite a dip in net income to C$305.72 million for 2024 from C$367.68 million the previous year, revenue slightly rose to C$1.27 billion. Their production is on an upward trend, expecting daily output to reach around 90,000 Boe/d in 2025. The company repurchased nearly one million shares for C$12.1 million recently, indicating confidence in its future prospects amidst external borrowing risks and projected earnings growth of 12%.

- Navigate through the intricacies of NuVista Energy with our comprehensive valuation report here.

Evaluate NuVista Energy's historical performance by accessing our past performance report.

Summing It All Up

- Click here to access our complete index of 143 Undervalued Global Small Caps With Insider Buying.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NuVista Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NVA

NuVista Energy

Engages in the exploration, development, and production of oil and natural gas reserves in the Western Canadian Sedimentary Basin.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)