ASX Value Picks Genesis Minerals And 2 Stocks Possibly Trading Below Estimated Worth

Reviewed by Simply Wall St

As the Australian market continues to navigate a landscape marked by fluctuating interest rate expectations and sector-specific surges, investors are keenly assessing opportunities for value amidst the volatility. In this context, identifying stocks potentially trading below their estimated worth can be particularly rewarding, and Genesis Minerals along with two other promising picks may offer such prospects in today's dynamic environment.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trajan Group Holdings (ASX:TRJ) | A$0.84 | A$1.65 | 49% |

| Resimac Group (ASX:RMC) | A$1.135 | A$2.18 | 47.9% |

| Reckon (ASX:RKN) | A$0.63 | A$1.19 | 46.9% |

| NRW Holdings (ASX:NWH) | A$4.90 | A$9.21 | 46.8% |

| MAAS Group Holdings (ASX:MGH) | A$4.77 | A$9.21 | 48.2% |

| Liontown Resources (ASX:LTR) | A$1.135 | A$2.10 | 45.9% |

| James Hardie Industries (ASX:JHX) | A$34.66 | A$66.00 | 47.5% |

| Genesis Minerals (ASX:GMD) | A$7.02 | A$13.62 | 48.5% |

| Cynata Therapeutics (ASX:CYP) | A$0.235 | A$0.44 | 46.1% |

| Airtasker (ASX:ART) | A$0.36 | A$0.71 | 49.5% |

Let's uncover some gems from our specialized screener.

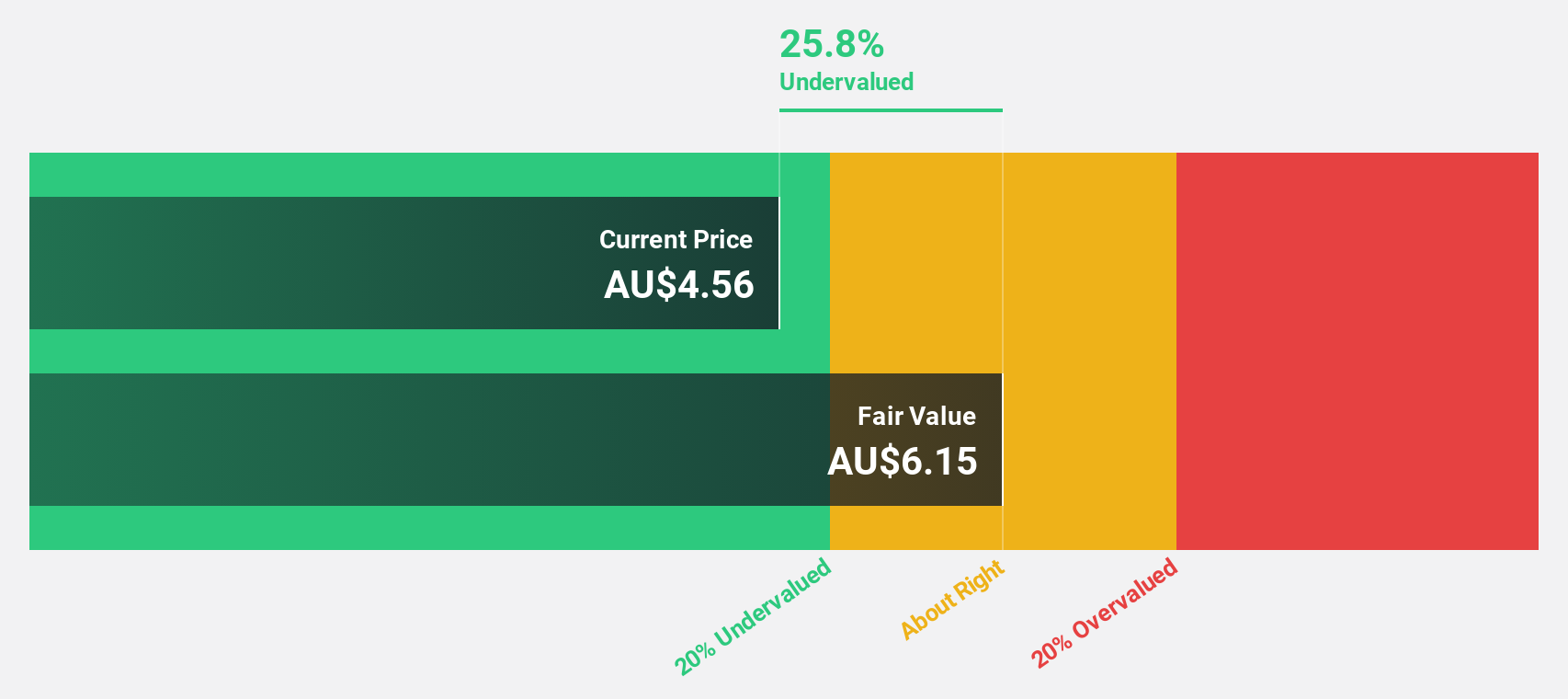

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited is involved in gold mining, project development, and exploration activities in Western Australia, with a market cap of A$8.02 billion.

Operations: The company generates revenue of A$920.14 million from its activities in mineral production, exploration, and development.

Estimated Discount To Fair Value: 48.5%

Genesis Minerals is trading at A$7.02, significantly below its estimated fair value of A$13.62, indicating it is highly undervalued based on discounted cash flow analysis. The company has shown robust financial performance with earnings growing by 124.1% over the past year and revenue reaching A$920.14 million, up from A$438.59 million a year ago. Recent inclusion in the S&P/ASX 100 Index underscores its market relevance and potential for future growth in profitability and revenue.

- Our earnings growth report unveils the potential for significant increases in Genesis Minerals' future results.

- Unlock comprehensive insights into our analysis of Genesis Minerals stock in this financial health report.

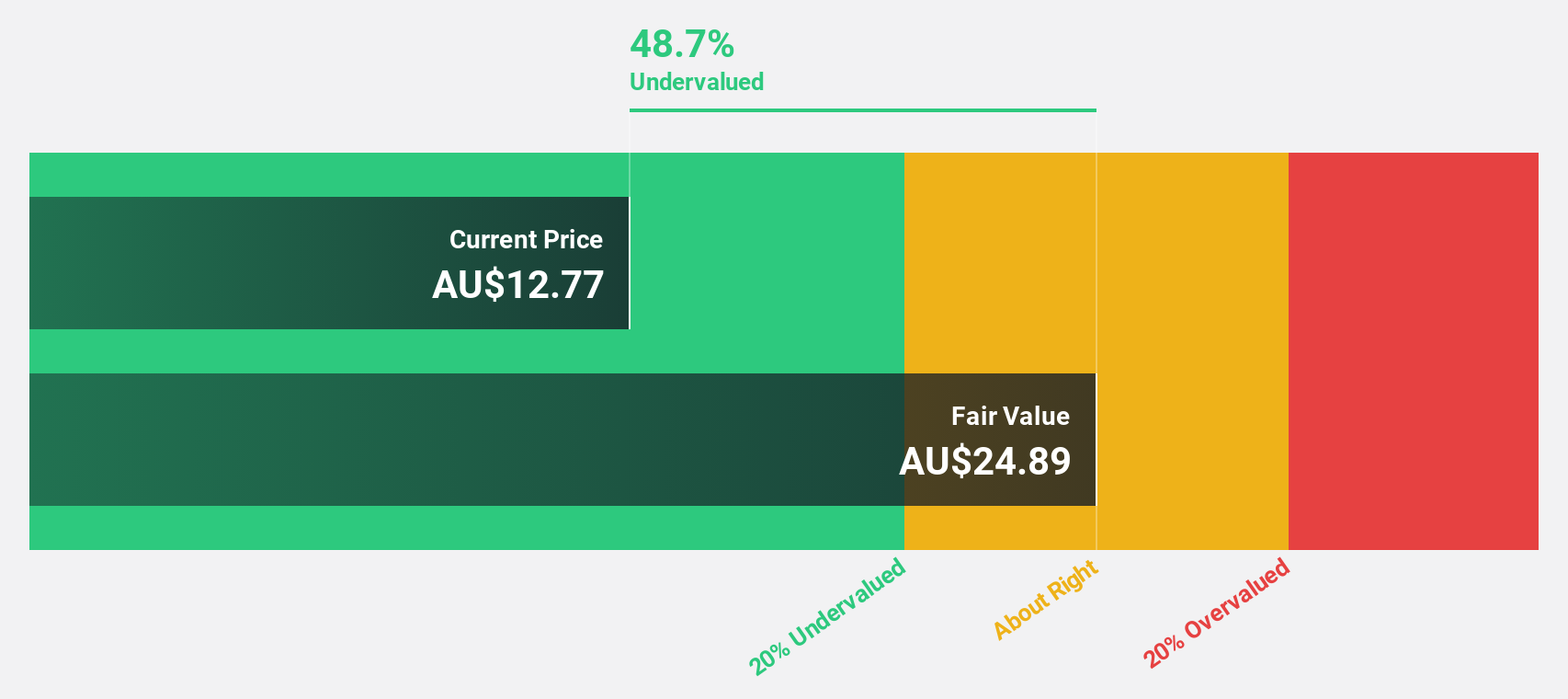

Jumbo Interactive (ASX:JIN)

Overview: Jumbo Interactive Limited operates as an online and mobile retailer of lottery tickets across Australia, the United Kingdom, Canada, Fiji, and other international markets, with a market cap of A$758.82 million.

Operations: The company's revenue is derived from three primary segments: Managed Services (A$26.72 million), Lottery Retailing (A$108.05 million), and Software-As-A-Service (SaaS) (A$44.25 million).

Estimated Discount To Fair Value: 45%

Jumbo Interactive, trading at A$12.17, is significantly undervalued with an estimated fair value of A$22.12 based on discounted cash flow analysis. The company has completed the acquisition of Dream Car Giveaways, potentially enhancing its revenue streams. Despite a slight decline in sales to A$145.29 million for the year ending June 2025, earnings are forecast to grow by 11.87% annually, outpacing the broader Australian market's growth rate of 5.9%.

- Upon reviewing our latest growth report, Jumbo Interactive's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Jumbo Interactive with our detailed financial health report.

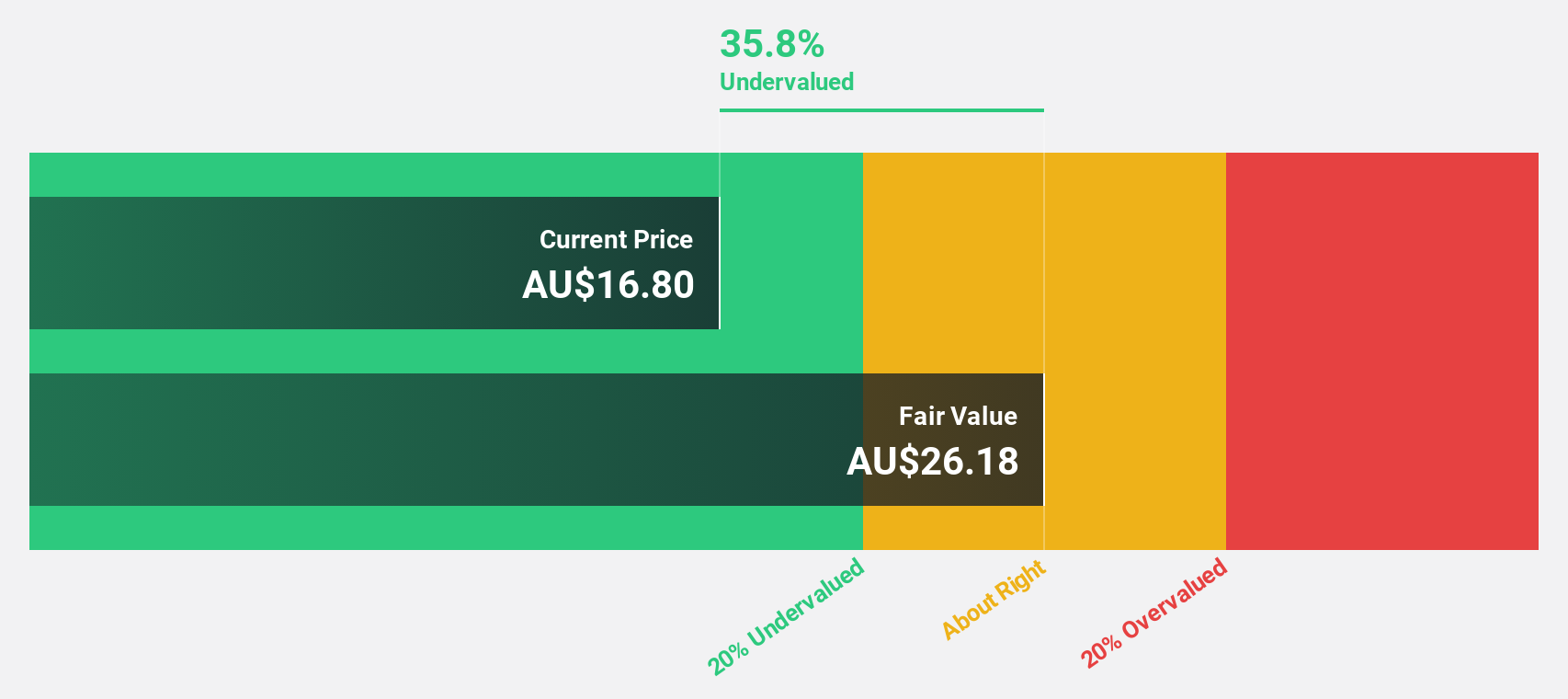

Telix Pharmaceuticals (ASX:TLX)

Overview: Telix Pharmaceuticals Limited is a commercial-stage biopharmaceutical company that develops and commercializes therapeutic and diagnostic radiopharmaceuticals, with a market cap of A$5.73 billion.

Operations: The company's revenue is derived from its Therapeutics segment, which generated $7.29 million, Precision Medicine contributing $575.13 million, and Manufacturing Solutions with $115.57 million.

Estimated Discount To Fair Value: 35.1%

Telix Pharmaceuticals is trading at A$16.94, significantly undervalued with a fair value estimate of A$26.09, based on discounted cash flow analysis. Recent revenue growth to A$206 million in Q3 2025 from A$135 million a year ago and upgraded annual revenue guidance to between A$800 million and A$820 million support its strong cash flow potential. However, debt coverage by operating cash flow remains a concern despite expected robust earnings growth of 47.62% annually over the next three years.

- Our comprehensive growth report raises the possibility that Telix Pharmaceuticals is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Telix Pharmaceuticals' balance sheet health report.

Where To Now?

- Navigate through the entire inventory of 36 Undervalued ASX Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives