Amidst a volatile Australian market, with key sectors like energy and utilities facing significant downturns and health care showing modest gains, investors are navigating a complex landscape influenced by global trade tensions and fluctuating commodity prices. In this environment, identifying high growth tech stocks requires careful consideration of factors such as innovation potential, adaptability to market changes, and resilience against broader economic uncertainties.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Telix Pharmaceuticals | 20.02% | 33.35% | ★★★★★★ |

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| WiseTech Global | 20.53% | 25.64% | ★★★★★★ |

| Pro Medicus | 22.56% | 23.74% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Wrkr | 51.62% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| Mesoblast | 56.15% | 62.13% | ★★★★★★ |

| SiteMinder | 21.12% | 65.36% | ★★★★★★ |

| Opthea | 58.66% | 66.98% | ★★★★★★ |

Click here to see the full list of 54 stocks from our ASX High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PYC Therapeutics Limited is a drug-development company focused on discovering and developing novel RNA therapeutics to treat genetic diseases in Australia, with a market cap of A$559.93 million.

Operations: The company generates revenue primarily through the discovery and development of novel RNA therapeutics, amounting to A$24.99 million.

PYC Therapeutics, a contender in Australia's high-growth tech sector, is navigating through its early unprofitable phase with strategic moves aimed at future profitability. With an annual revenue growth forecast at 10.1%, PYC outpaces the broader Australian market's 5.4% growth rate, showcasing its potential amidst industry challenges. The company recently reported a half-year revenue jump to AUD 12.69 million from AUD 9.12 million year-over-year but also noted an increased net loss of AUD 25.57 million, reflecting significant reinvestment and R&D expenses crucial for long-term gains. Additionally, a recent follow-on equity offering of AUD 145.81 million underscores their aggressive capital raising efforts to fuel research and expansion strategies essential for transitioning into profitability projected within three years.

- Delve into the full analysis health report here for a deeper understanding of PYC Therapeutics.

Explore historical data to track PYC Therapeutics' performance over time in our Past section.

Qoria (ASX:QOR)

Simply Wall St Growth Rating: ★★★★☆☆

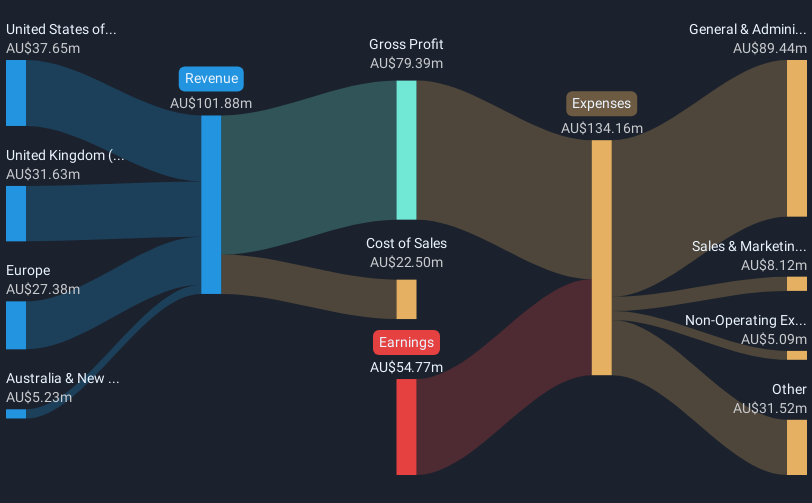

Overview: Qoria Limited is engaged in the marketing, distribution, and sale of cyber safety products and services across Australia, New Zealand, the United Kingdom, the United States, Europe, and other international markets with a market cap of A$577.60 million.

Operations: Qoria focuses on providing cyber safety solutions globally, with key markets in Australia, New Zealand, the UK, the US, and Europe. The company generates revenue through the sale and distribution of its products and services aimed at enhancing digital security for consumers.

Qoria, amidst a challenging landscape for unprofitable tech firms in Australia, shows promising signs with its strategic focus on becoming profitable within three years. The company's revenue is expected to grow at 15.7% annually, outpacing the Australian market's average of 5.4%. This growth is underpinned by a significant reduction in net losses — down from AUD 28.2 million to AUD 9.6 million year-over-year — and an aggressive R&D investment strategy that aligns with industry shifts towards software innovation and service delivery models. These efforts are crucial as Qoria navigates its path toward profitability, leveraging both product development and market expansion to solidify its standing in the high-tech sector.

- Unlock comprehensive insights into our analysis of Qoria stock in this health report.

Examine Qoria's past performance report to understand how it has performed in the past.

WiseTech Global (ASX:WTC)

Simply Wall St Growth Rating: ★★★★★★

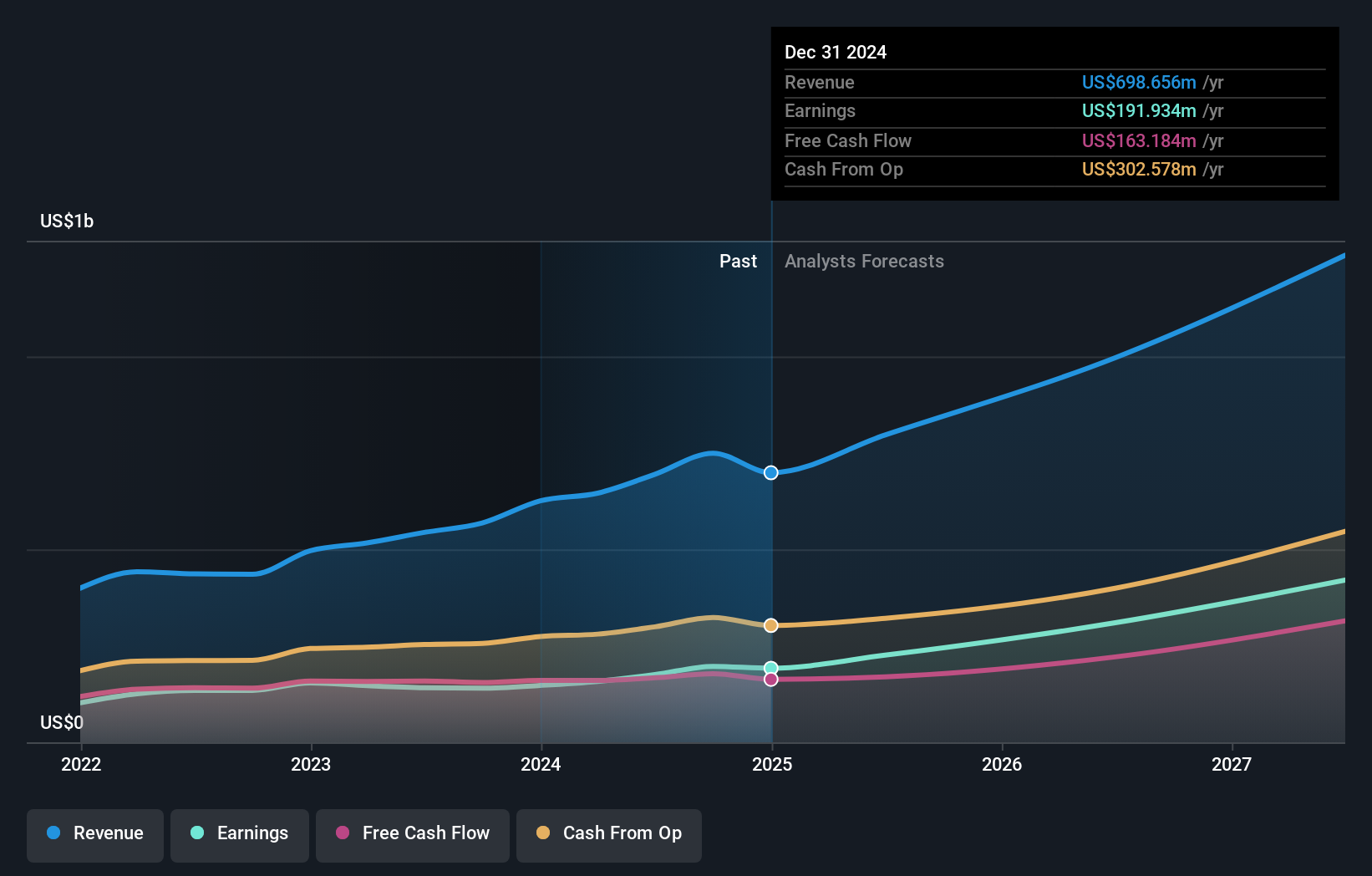

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions, with a market cap of A$29.85 billion.

Operations: The company focuses on delivering software solutions for the logistics execution industry, generating revenue of $698.66 million from its Internet Software & Services segment.

WiseTech Global, a standout in Australia's tech landscape, has demonstrated robust financial health with its recent half-year earnings report showing a jump in net income to USD 106.4 million from USD 77.1 million the previous year. This performance is underpinned by a significant annual revenue growth rate of 20.5%, outstripping the broader Australian market's growth of 5.4%. The company's commitment to innovation is evident from its substantial R&D expenditure, aligning with industry trends towards enhanced software solutions and services. Additionally, WiseTech’s strategic board reshuffles aim to bolster its governance and future growth strategy amidst high expectations for continued earnings expansion at an annual rate of 25.6%.

Make It Happen

- Delve into our full catalog of 54 ASX High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WiseTech Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WTC

WiseTech Global

Engages in the development and provision of software solutions to the logistics execution industry in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives