Medical Developments International (ASX:MVP) shareholders are up 10% this past week, but still in the red over the last three years

While not a mind-blowing move, it is good to see that the Medical Developments International Limited (ASX:MVP) share price has gained 28% in the last three months. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 83% in that time. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the last three years has been tough for Medical Developments International shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Medical Developments International

Because Medical Developments International made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Medical Developments International saw its revenue grow by 19% per year, compound. That's a pretty good rate of top-line growth. So it seems unlikely the 22% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

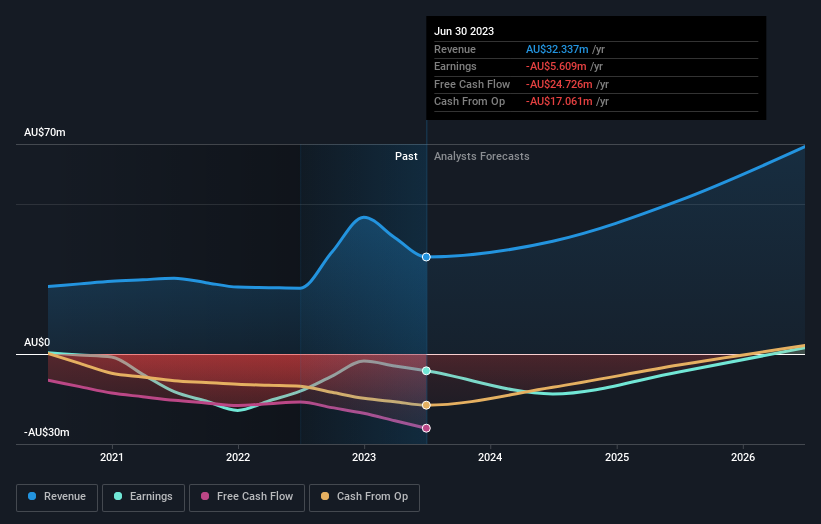

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Medical Developments International stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Medical Developments International had a tough year, with a total loss of 27%, against a market gain of about 9.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Medical Developments International has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MVP

Medical Developments International

Manufactures and distributes emergency medical solutions in Australia, Europe, the United States, and internationally.

Undervalued with excellent balance sheet.