Duratec And 2 Other Stocks On The ASX That May Be Priced Below Fair Value

Reviewed by Simply Wall St

As the ASX200 closed up 0.45% at 8,347 points, investors are keenly observing how international political shifts might influence market dynamics, with sectors like IT and Real Estate leading gains. In this environment of cautious optimism, identifying stocks that may be priced below their fair value becomes crucial for investors seeking opportunities amidst changing global influences.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.63 | A$12.36 | 46.3% |

| Mader Group (ASX:MAD) | A$6.14 | A$11.91 | 48.5% |

| Ingenia Communities Group (ASX:INA) | A$5.35 | A$9.36 | 42.8% |

| Atlas Arteria (ASX:ALX) | A$4.98 | A$9.67 | 48.5% |

| MLG Oz (ASX:MLG) | A$0.62 | A$1.17 | 47.2% |

| Charter Hall Group (ASX:CHC) | A$15.04 | A$28.70 | 47.6% |

| Telix Pharmaceuticals (ASX:TLX) | A$26.10 | A$46.81 | 44.2% |

| ReadyTech Holdings (ASX:RDY) | A$3.14 | A$6.19 | 49.3% |

| Vault Minerals (ASX:VAU) | A$0.355 | A$0.67 | 47.4% |

| Syrah Resources (ASX:SYR) | A$0.255 | A$0.48 | 47.4% |

We're going to check out a few of the best picks from our screener tool.

Duratec (ASX:DUR)

Overview: Duratec Limited, with a market cap of A$404.53 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure in Australia.

Operations: The company's revenue segments are comprised of A$46.64 million from Energy, A$220.16 million from Defence, A$111.33 million from Buildings & Facades, and A$155.64 million from Mining & Industrial services in Australia.

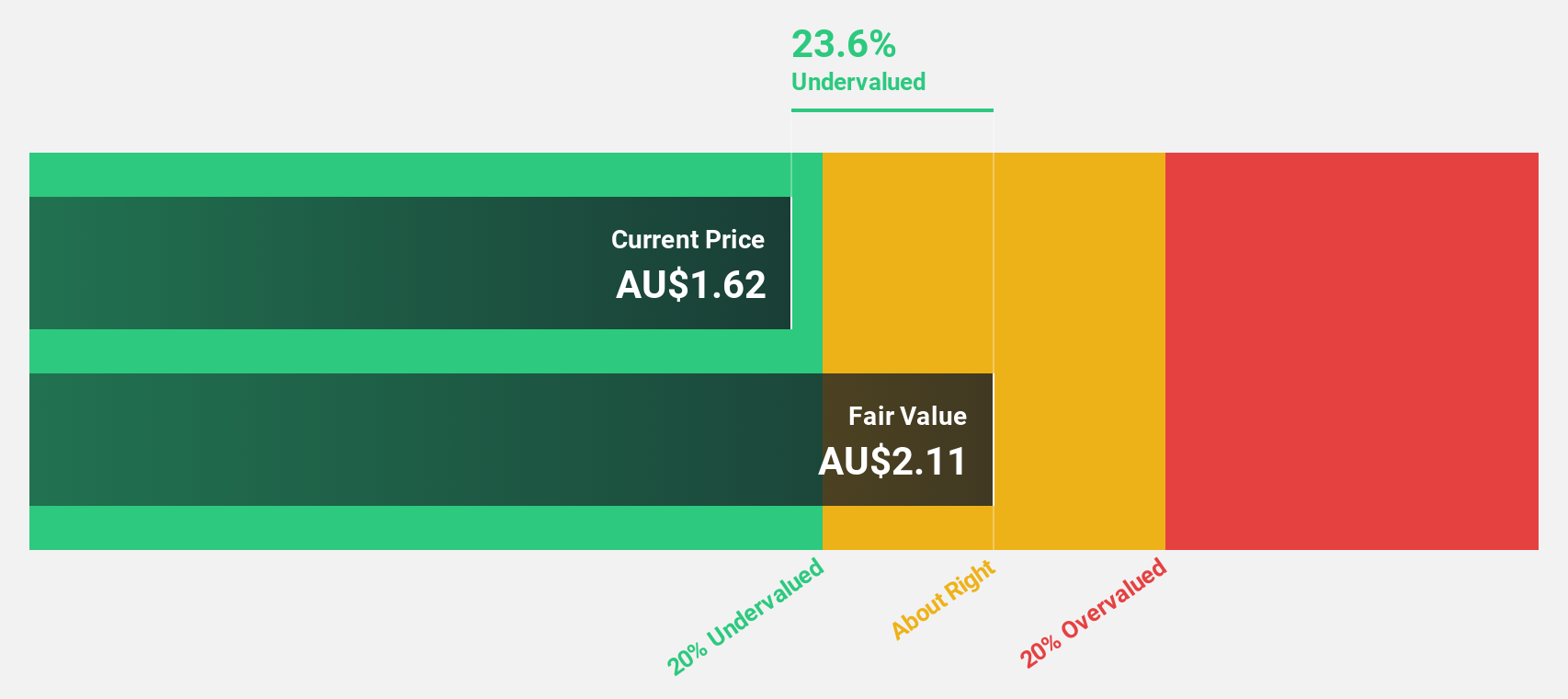

Estimated Discount To Fair Value: 29.9%

Duratec is trading at A$1.58, significantly below its estimated fair value of A$2.25, indicating it may be undervalued based on cash flows. The company expects revenue between A$600 million and A$640 million for the fiscal year ending June 2025. Its earnings are forecast to grow at 14.4% annually, outpacing the Australian market's growth rate of 12.6%, with a high projected return on equity of 32.9% in three years.

- Insights from our recent growth report point to a promising forecast for Duratec's business outlook.

- Navigate through the intricacies of Duratec with our comprehensive financial health report here.

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited, with a market cap of A$2.08 billion, provides a range of banking products and services specifically tailored for small and medium businesses in Australia through its subsidiaries.

Operations: The company's revenue is primarily derived from its banking segment, which generated A$326.60 million.

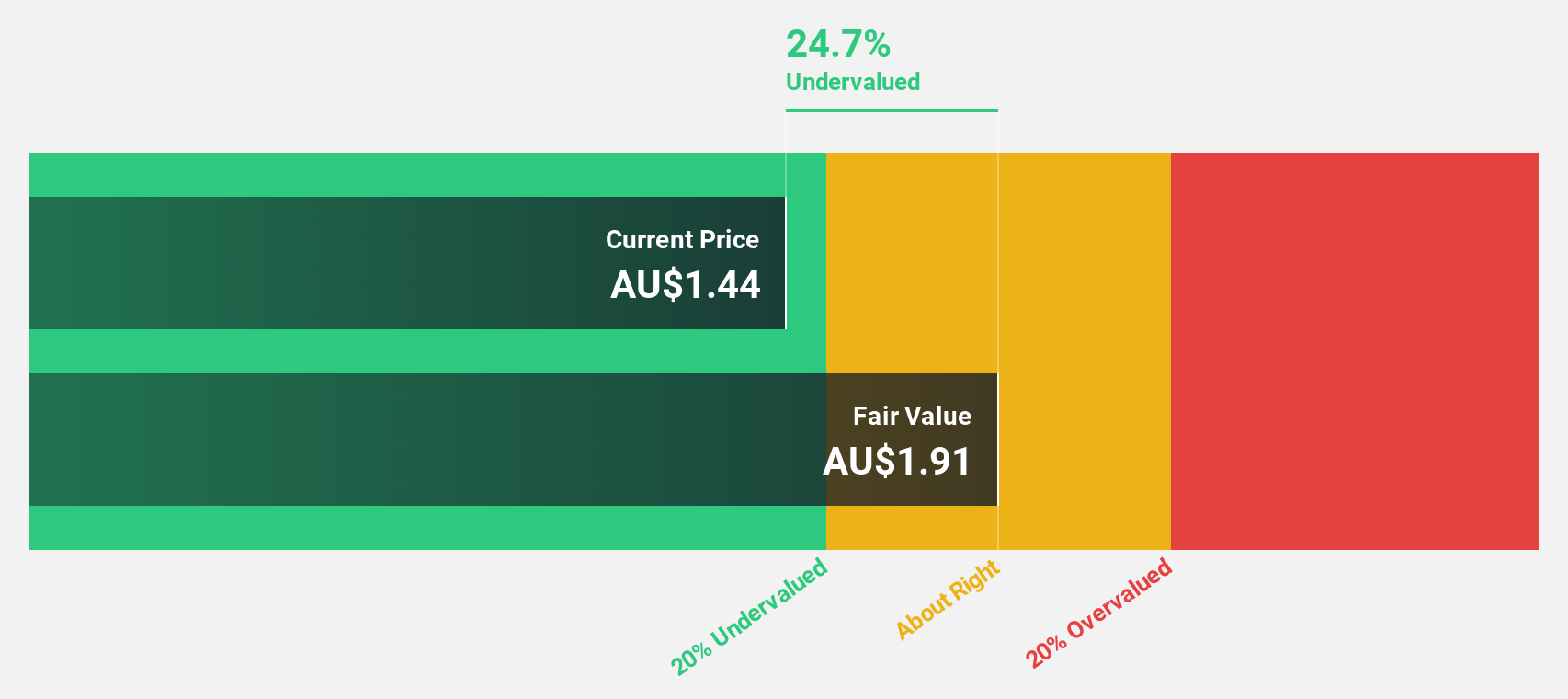

Estimated Discount To Fair Value: 11.3%

Judo Capital Holdings is trading at A$1.86, slightly below its estimated fair value of A$2.10, suggesting some undervaluation based on cash flows. Earnings are projected to grow significantly at 26.25% annually, surpassing the Australian market's growth rate of 12.6%. However, Judo has a high level of bad loans (2.8%) and a low allowance for these loans (50%). Recent board changes include appointing Brad Cooper as an Independent Non-Executive Director to enhance strategic leadership and governance.

- Our expertly prepared growth report on Judo Capital Holdings implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Judo Capital Holdings' balance sheet health report.

Mader Group (ASX:MAD)

Overview: Mader Group Limited is a contracting company offering specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of A$1.27 billion.

Operations: The company's revenue primarily comes from Staffing & Outsourcing Services, amounting to A$774.47 million.

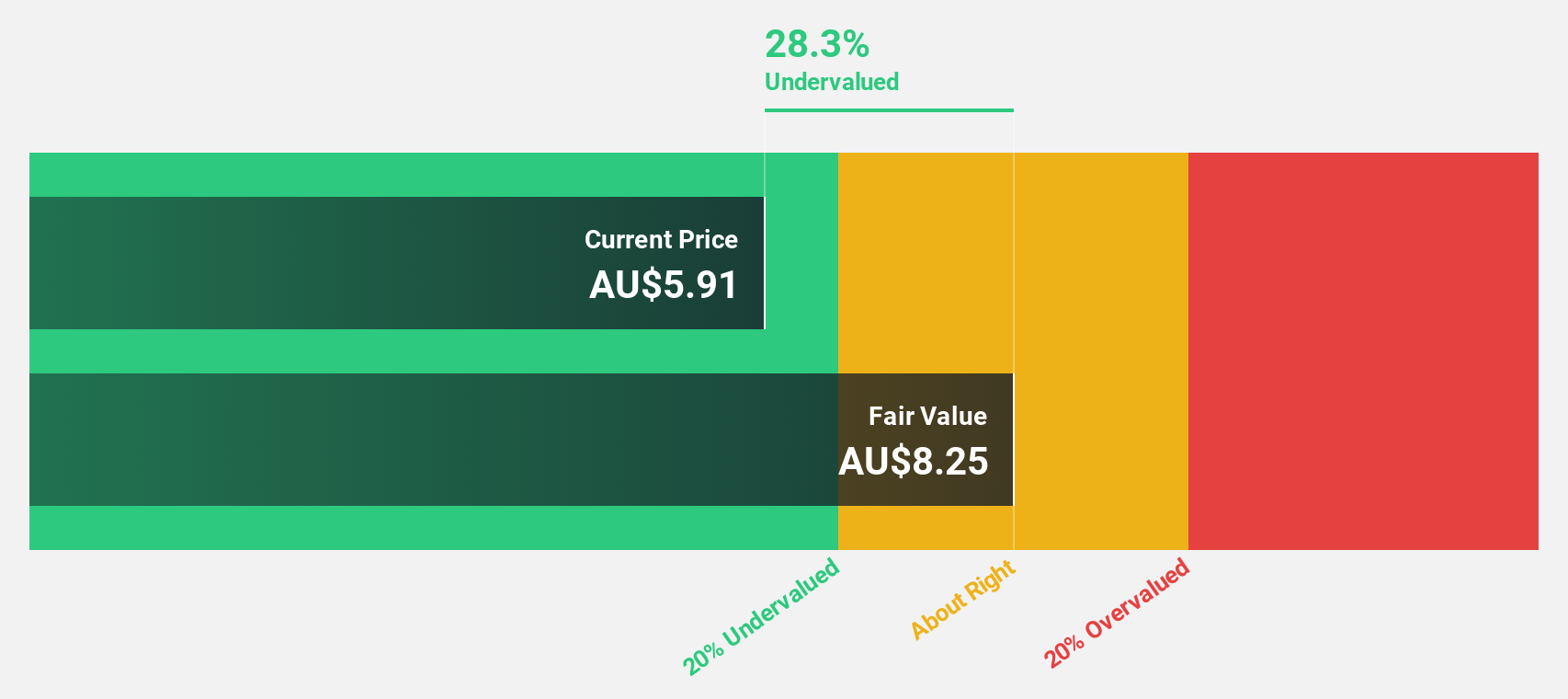

Estimated Discount To Fair Value: 48.5%

Mader Group is trading at A$6.14, significantly below its estimated fair value of A$11.91, indicating undervaluation based on cash flows. The company's earnings are projected to grow 15.1% annually, outpacing the Australian market's growth rate of 12.6%. Despite strong past earnings growth (30.9%), recent insider selling could be a concern for potential investors considering this stock's valuation and future prospects in the industry landscape.

- In light of our recent growth report, it seems possible that Mader Group's financial performance will exceed current levels.

- Dive into the specifics of Mader Group here with our thorough financial health report.

Where To Now?

- Dive into all 42 of the Undervalued ASX Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JDO

Judo Capital Holdings

Through its subsidiaries, engages in the provision of various banking products and services for small and medium businesses in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives