Mesoblast (ASX:MSB) J-Code for Ryoncil Secures Reimbursement Access Is the Commercial Strategy Evolving?

Reviewed by Sasha Jovanovic

- On October 1, 2025, Mesoblast Limited announced that a permanent Medicare HCPCS J-Code (J3402) for Ryoncil® (remestemcel-L-rknd) became active, providing a standardized billing pathway for this FDA-approved therapy in pediatric steroid-refractory acute graft-versus-host disease.

- This CMS formal recognition is expected to simplify reimbursement and potentially broaden both public and private payer access to the only mesenchymal stromal cell product approved for children under age 12 with this condition.

- We'll explore how this new, streamlined reimbursement process could shift Mesoblast's investment narrative and commercial visibility for Ryoncil®.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Mesoblast's Investment Narrative?

For shareholders in Mesoblast, the investment thesis has always hinged on whether the company can turn regulatory approval and clinical promise into meaningful commercial returns. The recent activation of a permanent Medicare J-Code for Ryoncil® is a practical breakthrough that could materially affect short-term catalysts: it simplifies reimbursement and may significantly speed up patient access, especially among public payers. While the company is still unprofitable and relies on raising fresh capital, this formalized reimbursement could accelerate revenue recognition and build confidence in expanding Ryoncil®'s reach. It may also impact risk: dependence on a single approved product becomes less daunting as access barriers are lowered. However, ongoing legal challenges and the need for label expansions for adult indications remain key uncertainties. These changes are critical to how investors will weigh Mesoblast’s risk-reward equation going forward.

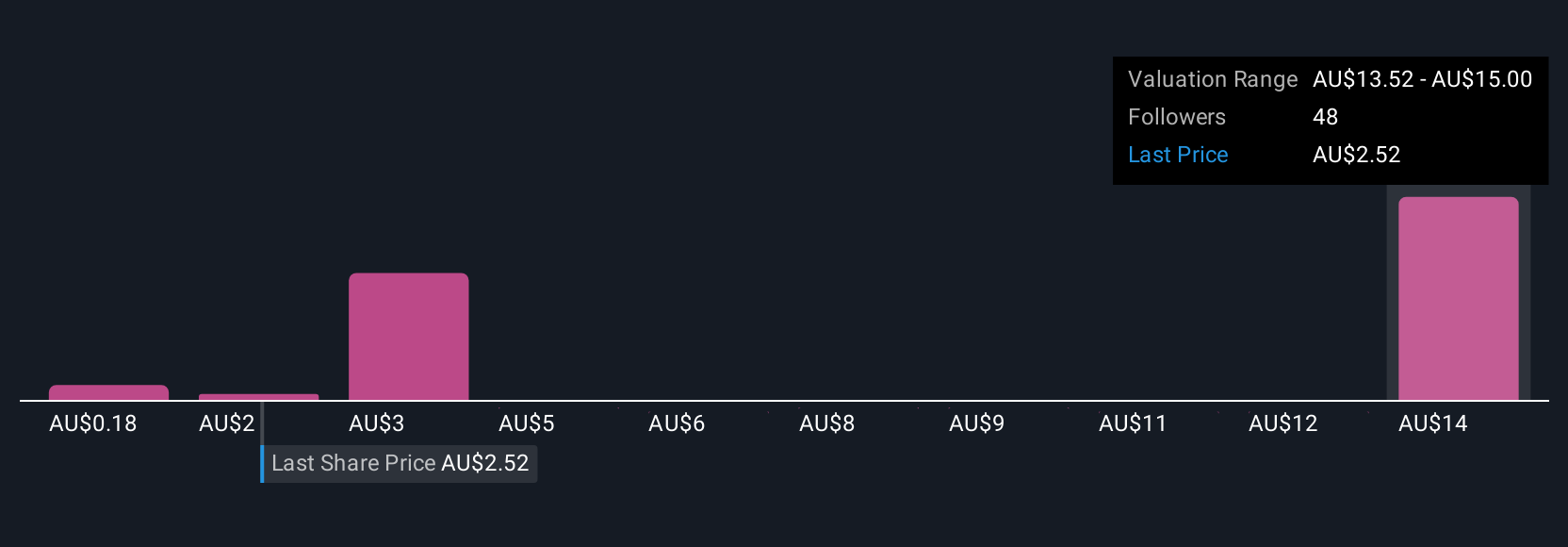

But on the other hand, unresolved legal cases may pose fresh challenges if not carefully managed. Despite retreating, Mesoblast's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 23 other fair value estimates on Mesoblast - why the stock might be a potential multi-bagger!

Build Your Own Mesoblast Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mesoblast research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mesoblast research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mesoblast's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)