Mesoblast (ASX:MSB) Is Up 44.1% After Strong Initial Sales of FDA-Approved Ryoncil

Reviewed by Simply Wall St

- Earlier this year, Mesoblast reported robust initial sales for Ryoncil, its first commercial cell therapy product approved by the US FDA last December to treat complications in children following bone marrow transplants.

- This marks the company's transition from a lengthy development phase to generating its first significant product-based revenue stream in over two decades.

- We’ll explore how the launch of Ryoncil as a new revenue driver may shape Mesoblast’s broader investment story.

What Is Mesoblast's Investment Narrative?

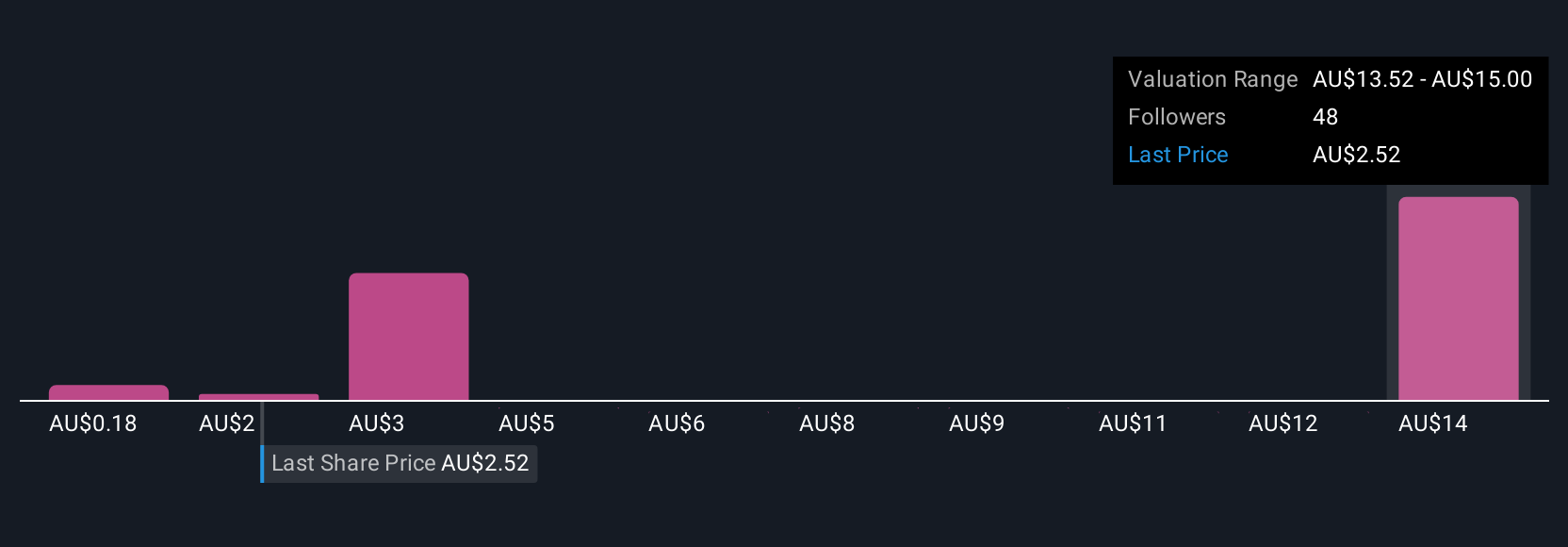

The story with Mesoblast is changing fast, and this recent Ryoncil sales update really highlights it. What stands out now is that the company, after years of R&D, has finally moved into genuine revenue generation, something that many cautious onlookers once doubted would materialize. This shift could significantly reframe the outlook for Mesoblast’s most important short-term catalysts: regulatory milestones around Revascor and a potential label extension for Ryoncil. Previously, the main risk was whether Mesoblast could commercialize any product at all, particularly with net losses and past concerns raised by auditors about going concern. Now, while risks like ongoing losses and the timing of expanded market access remain, the Ryoncil launch might ease near-term funding uncertainty and raise the stakes for coming FDA decisions. The ensuing surge in share price shows just how much the company’s catalysts may now matter more to investors than they did just weeks ago.

However, even with a new product on the market, the risk around funding needs remains a central consideration for investors.

Exploring Other Perspectives

Build Your Own Mesoblast Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mesoblast research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mesoblast research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mesoblast's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives