Has Mesoblast’s Surging Share Price Left Its Future Growth Prospects Underappreciated?

Reviewed by Bailey Pemberton

- If you are wondering whether Mesoblast is a hidden bargain or a value trap at its current share price, you are not alone. This breakdown aims to unpack that question.

- The stock has been choppy in the short term, down 1.8% over the last week. That comes after a 24.8% jump over the past month and a 42.8% gain over the last year, all against a still negative year to date return of 17.3% and a 215.8% rise over three years.

- Recent moves have been driven less by day to day noise and more by shifting expectations around Mesoblast's pipeline progress and regulatory backdrop. Investors are reassessing the likelihood and timing of key approvals. At the same time, broader biotech sentiment and capital flows into higher risk growth names have added extra volatility to every piece of Mesoblast related news.

- Right now, Mesoblast scores a 4/6 valuation check rating. This suggests the market may not be fully pricing in its potential. However, headline metrics only tell part of the story. Next we will walk through the usual valuation approaches before circling back to a more complete way of thinking about what this stock may be worth.

Approach 1: Mesoblast Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company might be worth by projecting its future cash flows and discounting them back to today, to reflect risk and the time value of money.

For Mesoblast, the latest twelve month Free Cash Flow is roughly $50.7 million in the red, highlighting its current cash burn as it develops its pipeline. Analysts project this to turn positive and scale rapidly, with forecasts reaching about $1.21 billion in Free Cash Flow by 2035, based initially on analyst estimates through 2028 and then extended using Simply Wall St extrapolations for later years.

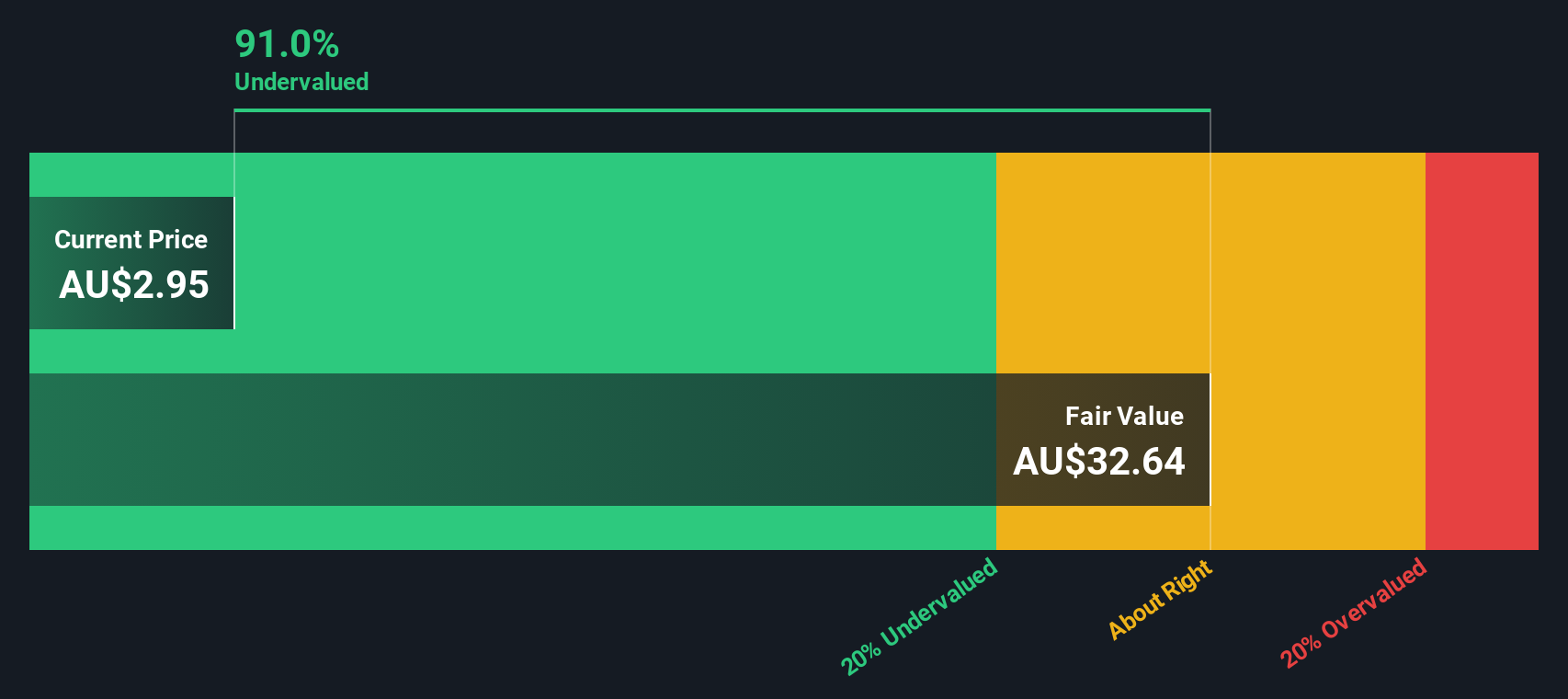

Feeding these cash flow projections into a 2 Stage Free Cash Flow to Equity model produces an estimated intrinsic value of about $26.18 per share. Compared with the current share price, this implies the stock is roughly 89.4% undervalued and suggests a substantial mismatch between projected cash generation and what the market is currently willing to pay.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mesoblast is undervalued by 89.4%. Track this in your watchlist or portfolio, or discover 910 more undervalued stocks based on cash flows.

Approach 2: Mesoblast Price vs Book

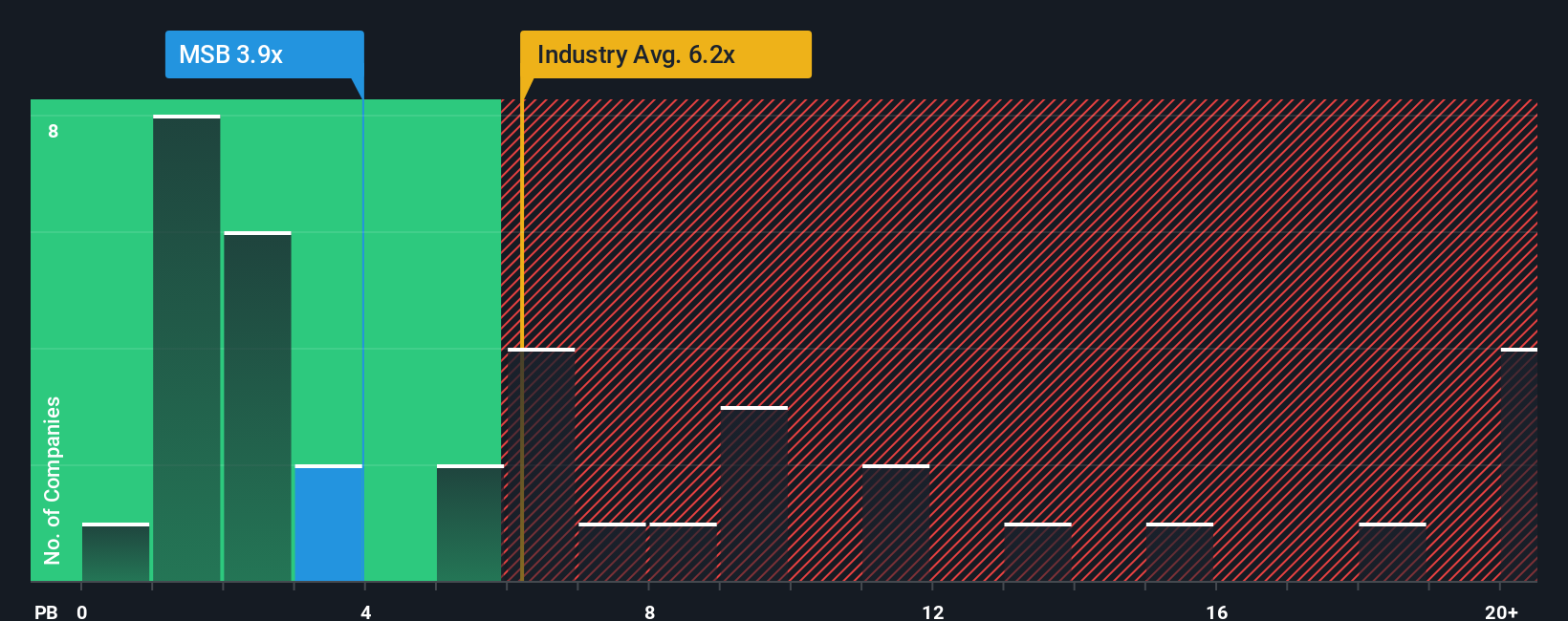

For asset heavy or still loss making biotechs, the price to book ratio is often a more meaningful starting point than earnings based multiples. This is because it anchors valuation to the net assets funding the pipeline rather than profits that are not yet in sight.

In general, faster growing and less risky companies tend to justify a higher normal price to book multiple. Slower growth or higher risk businesses are usually assigned a lower one, as investors demand a discount for the extra uncertainty.

Mesoblast currently trades on a price to book of about 3.95x, below the Biotechs industry average of roughly 6.23x and also under the peer group average of around 4.56x. Simply Wall St’s proprietary Fair Ratio framework goes a step further by estimating what a reasonable price to book should be once Mesoblast’s growth prospects, risk profile, margins, industry positioning and market cap are all taken into account, rather than relying on blunt peer comparisons.

On that basis, Mesoblast’s actual 3.95x multiple sits below the Fair Ratio estimate, indicating the shares are pricing in more caution than the model suggests is warranted.

Result: UNDERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mesoblast Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company with the numbers behind its potential. A Narrative is the story you believe about Mesoblast, translated into assumptions about future revenue growth, profit margins and risk, which then flows into a financial forecast and a fair value estimate. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to map their perspective to a clear Buy, Hold or Sell stance by comparing their Fair Value to the current share price. As new information such as trial results, regulatory decisions or earnings updates arrive, these Narratives and their valuations update dynamically, helping you decide whether your story still holds. For example, one Mesoblast Narrative might assume rapid approval and strong commercial uptake with a high fair value, while another might price in slower approval and tougher competition, leading to a much lower fair value and a more cautious stance.

Do you think there's more to the story for Mesoblast? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)