Not Many Are Piling Into Little Green Pharma Ltd (ASX:LGP) Just Yet

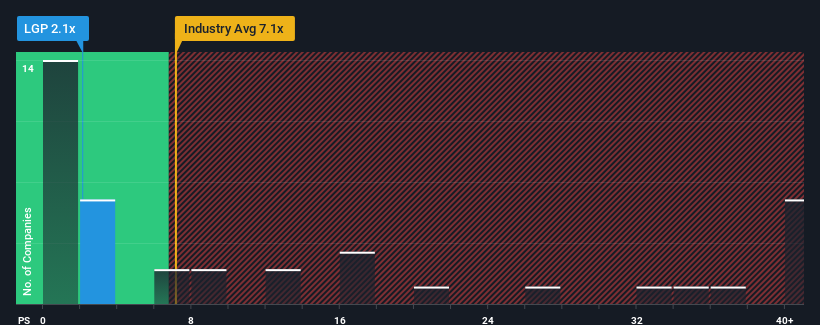

Little Green Pharma Ltd's (ASX:LGP) price-to-sales (or "P/S") ratio of 2.1x might make it look like a strong buy right now compared to the Pharmaceuticals industry in Australia, where around half of the companies have P/S ratios above 7.1x and even P/S above 26x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Little Green Pharma

How Little Green Pharma Has Been Performing

With revenue growth that's inferior to most other companies of late, Little Green Pharma has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Little Green Pharma.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Little Green Pharma's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 41% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 44% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 19% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that Little Green Pharma's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Little Green Pharma's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Little Green Pharma's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Little Green Pharma that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LGP

Little Green Pharma

Engages in the cultivation, production, and distribution of medicinal cannabis products in Australia and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives