- Australia

- /

- Metals and Mining

- /

- ASX:LRS

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As 2024 closed, the Australian market experienced a downturn, with the ASX finishing on a two-day decline, highlighting profit-taking across most sectors. Despite this broader market pullback, investors continue to seek opportunities in undervalued areas such as penny stocks. Though often considered niche or outdated, these smaller or newer companies can offer significant growth potential when supported by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$205.65M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$112.19M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Imugene (ASX:IMU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Imugene Limited is a clinical-stage immuno-oncology company in Australia focused on developing immunotherapies to activate the immune system of cancer patients, with a market cap of A$275.18 million.

Operations: The company's revenue is derived entirely from the research, development, and commercialisation of health technologies, amounting to A$4.97 million.

Market Cap: A$275.18M

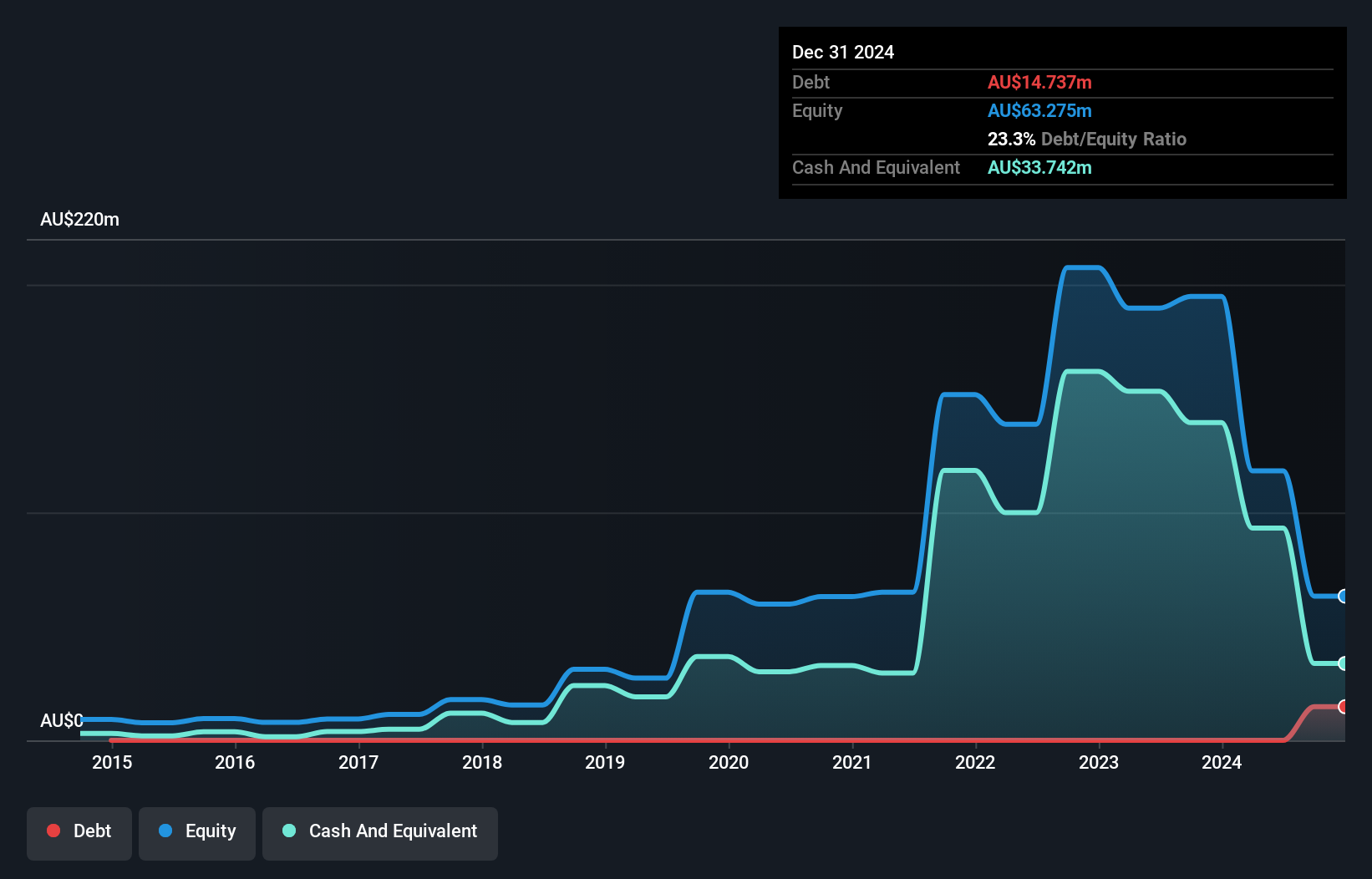

Imugene Limited, with a market cap of A$275.18 million, is a clinical-stage company focused on immunotherapies but remains pre-revenue with A$5 million in revenue. The company is unprofitable and has experienced increasing losses over the past five years. Despite having no debt and short-term assets of A$113 million covering both short-term (A$29.3M) and long-term liabilities (A$3.8M), Imugene faces challenges with less than one year of cash runway. Recent board changes include the resignation of Jens Eckstein as a non-executive director, highlighting potential shifts in strategic direction amidst financial constraints.

- Take a closer look at Imugene's potential here in our financial health report.

- Learn about Imugene's future growth trajectory here.

Latin Resources (ASX:LRS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Latin Resources Limited is engaged in the exploration and development of mining projects across Australia, Peru, Argentina, and Brazil with a market capitalization of A$448.23 million.

Operations: The company's revenue is primarily derived from its exploration and evaluation of mining projects, totaling A$0.09 million.

Market Cap: A$448.23M

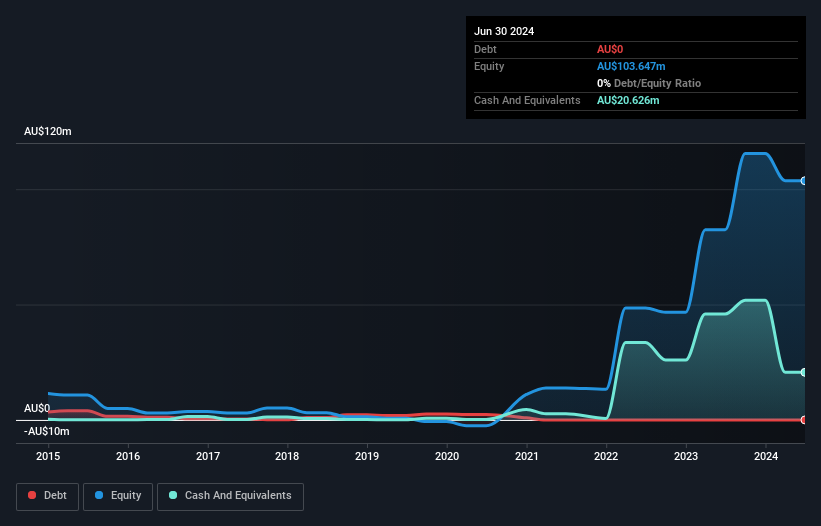

Latin Resources Limited, with a market cap of A$448.23 million, is pre-revenue, generating only A$87K from its mining exploration activities. Despite having a seasoned board and management team, the company remains unprofitable with increasing losses over five years and a negative return on equity of -17.97%. The firm is debt-free but faces financial constraints with less than one year of cash runway based on current free cash flow trends. While short-term assets (A$22.5M) cover both short-term (A$12.8M) and long-term liabilities (A$27.8K), significant insider selling could indicate internal challenges or strategic shifts ahead.

- Dive into the specifics of Latin Resources here with our thorough balance sheet health report.

- Explore Latin Resources' analyst forecasts in our growth report.

TPG Telecom (ASX:TPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TPG Telecom Limited offers telecommunications services to a diverse range of customers in Australia, including consumer, business, enterprise, government, and wholesale sectors, with a market cap of A$8.32 billion.

Operations: The company's revenue is primarily derived from its Consumer segment, which generated A$4.53 billion, and the Enterprise, Government and Wholesale segment, contributing A$1.09 billion.

Market Cap: A$8.32B

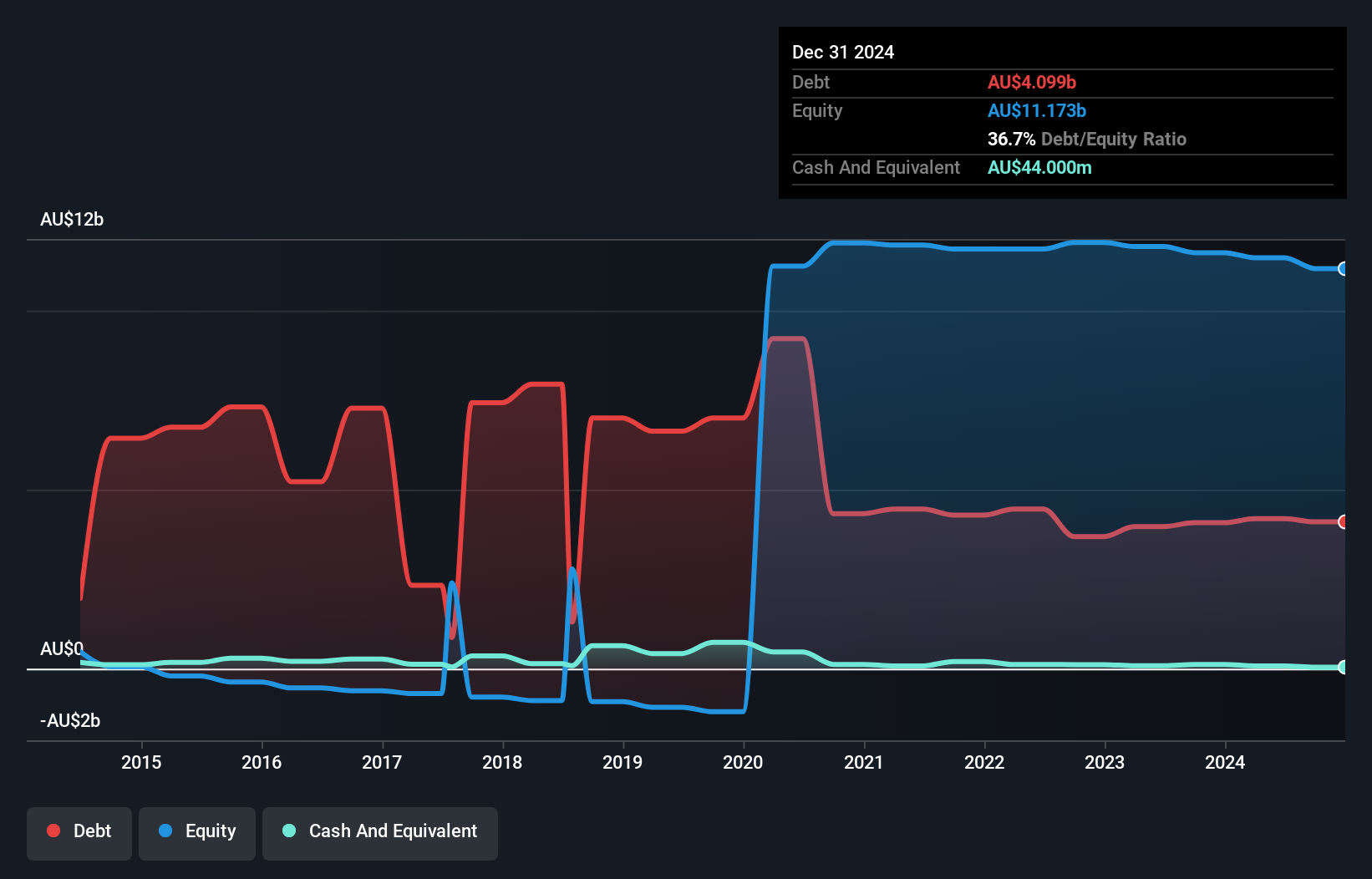

TPG Telecom Limited, with a market cap of A$8.32 billion, shows mixed financial health in the context of penny stocks. Recent board changes include the appointment of Paula Jane Dwyer as an independent non-executive director, enhancing governance oversight. Despite improved shareholder equity and satisfactory net debt to equity ratio (35.8%), TPG's short-term assets (A$1.2 billion) fall short of covering both short-term (A$1.5 billion) and long-term liabilities (A$6.4 billion). The company's earnings have been volatile, impacted by a significant one-off loss of A$14 million, while its profit margins have decreased to 0.5% from last year's 7.2%.

- Click here to discover the nuances of TPG Telecom with our detailed analytical financial health report.

- Examine TPG Telecom's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Get an in-depth perspective on all 1,052 ASX Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LRS

Latin Resources

Explores and develops mining projects in Australia, Peru, Argentina, and Brazil.

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives