- Australia

- /

- Personal Products

- /

- ASX:EZZ

Does EZZ Life Science Holdings (ASX:EZZ) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like EZZ Life Science Holdings (ASX:EZZ). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for EZZ Life Science Holdings

EZZ Life Science Holdings' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that EZZ Life Science Holdings' EPS has grown 35% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

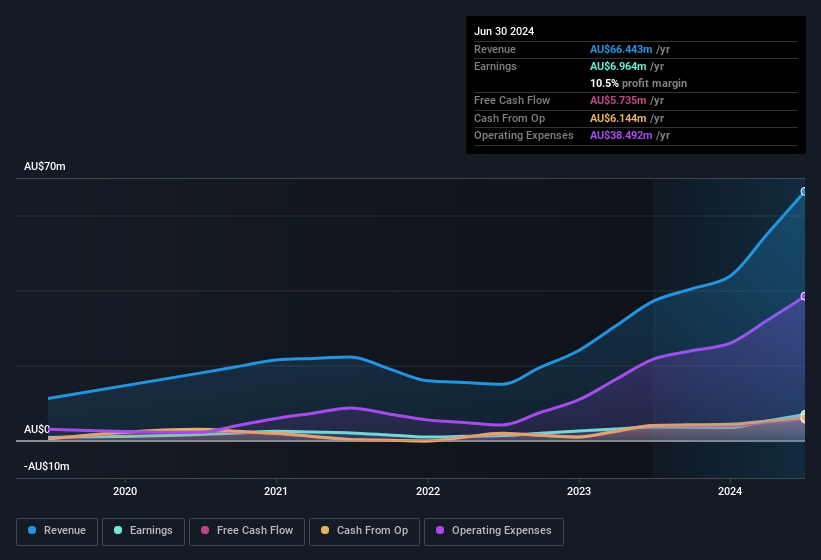

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of EZZ Life Science Holdings shareholders is that EBIT margins have grown from 12% to 15% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since EZZ Life Science Holdings is no giant, with a market capitalisation of AU$108m, you should definitely check its cash and debt before getting too excited about its prospects.

Are EZZ Life Science Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But more importantly, Co-founder Mark Qin spent AU$246k acquiring shares, doing so at an average price of AU$2.71. Purchases like this clue us in to the to the faith management has in the business' future.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for EZZ Life Science Holdings will reveal that insiders own a significant piece of the pie. In fact, they own 36% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about AU$39m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because EZZ Life Science Holdings' CEO, Qizhou Qin, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like EZZ Life Science Holdings with market caps under AU$317m is about AU$455k.

EZZ Life Science Holdings' CEO took home a total compensation package of AU$211k in the year prior to June 2024. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does EZZ Life Science Holdings Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into EZZ Life Science Holdings' strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. These things considered, this is one stock worth watching. What about risks? Every company has them, and we've spotted 2 warning signs for EZZ Life Science Holdings (of which 1 is concerning!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of EZZ Life Science Holdings, you'll probably love this curated collection of companies in AU that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if EZZ Life Science Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EZZ

EZZ Life Science Holdings

Engages in formulation, production, marketing, and sale of the health and wellbeing products in Australia, New Zealand, Mainland China, and South-East Asia.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026