Clinuvel Pharmaceuticals Limited's (ASX:CUV) Stock's On An Uptrend: Are Strong Financials Guiding The Market?

Most readers would already be aware that Clinuvel Pharmaceuticals' (ASX:CUV) stock increased significantly by 6.1% over the past month. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Particularly, we will be paying attention to Clinuvel Pharmaceuticals' ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Clinuvel Pharmaceuticals

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Clinuvel Pharmaceuticals is:

23% = AU$17m ÷ AU$74m (Based on the trailing twelve months to June 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every A$1 worth of equity, the company was able to earn A$0.23 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Clinuvel Pharmaceuticals' Earnings Growth And 23% ROE

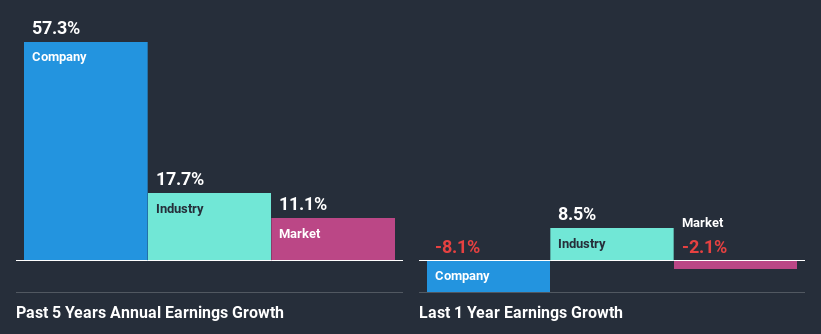

To begin with, Clinuvel Pharmaceuticals has a pretty high ROE which is interesting. Second, a comparison with the average ROE reported by the industry of 11% also doesn't go unnoticed by us. As a result, Clinuvel Pharmaceuticals' exceptional 57% net income growth seen over the past five years, doesn't come as a surprise.

We then compared Clinuvel Pharmaceuticals' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 34% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. What is CUV worth today? The intrinsic value infographic in our free research report helps visualize whether CUV is currently mispriced by the market.

Is Clinuvel Pharmaceuticals Making Efficient Use Of Its Profits?

Clinuvel Pharmaceuticals has a really low three-year median payout ratio of 7.2%, meaning that it has the remaining 93% left over to reinvest into its business. This suggests that the management is reinvesting most of the profits to grow the business as evidenced by the growth seen by the company.

While Clinuvel Pharmaceuticals has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 7.8%. Accordingly, forecasts suggest that Clinuvel Pharmaceuticals' future ROE will be 19% which is again, similar to the current ROE.

Conclusion

On the whole, we feel that Clinuvel Pharmaceuticals' performance has been quite good. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you’re looking to trade Clinuvel Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:CUV

Clinuvel Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for patients with genetic, metabolic, systemic, and life-threatening disorders in Australia, Europe, the United States, Switzerland, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives