What Type Of Shareholders Make Up REA Group Limited's (ASX:REA) Share Registry?

If you want to know who really controls REA Group Limited (ASX:REA), then you'll have to look at the makeup of its share registry. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. We also tend to see lower insider ownership in companies that were previously publicly owned.

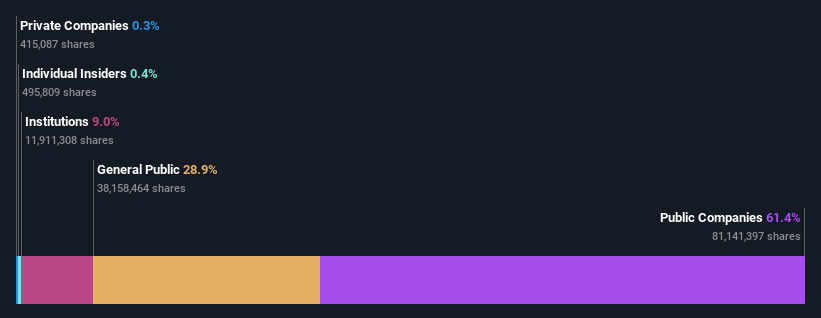

REA Group is a pretty big company. It has a market capitalization of AU$21b. Normally institutions would own a significant portion of a company this size. Taking a look at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry. We can zoom in on the different ownership groups, to learn more about REA Group.

See our latest analysis for REA Group

What Does The Institutional Ownership Tell Us About REA Group?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

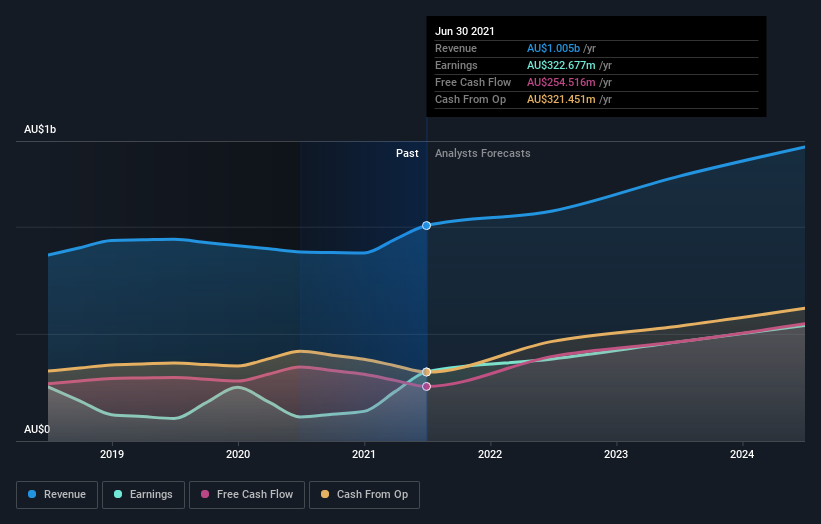

As you can see, institutional investors have a fair amount of stake in REA Group. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of REA Group, (below). Of course, keep in mind that there are other factors to consider, too.

REA Group is not owned by hedge funds. News Corporation is currently the largest shareholder, with 61% of shares outstanding. This implies that they have majority interest control of the future of the company. The Vanguard Group, Inc. is the second largest shareholder owning 1.7% of common stock, and BlackRock, Inc. holds about 1.1% of the company stock.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of REA Group

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own less than 1% of REA Group Limited. It is a very large company, so it would be surprising to see insiders own a large proportion of the company. Though their holding amounts to less than 1%, we can see that board members collectively own AU$77m worth of shares (at current prices). In this sort of situation, it can be more interesting to see if those insiders have been buying or selling.

General Public Ownership

With a 29% ownership, the general public have some degree of sway over REA Group. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

Public companies currently own 61% of REA Group stock. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I always like to check for a history of revenue growth. You can too, by accessing this free chart of historic revenue and earnings in this detailed graph.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading REA Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:REA

REA Group

Engages in online property advertising business in Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives