ASX Dividend Stocks Spotlight Bendigo and Adelaide Bank and Two More

Reviewed by Simply Wall St

As the Australian market navigates a mixed performance with the ASX200 slightly down and sectors like Energy and Information Technology showing resilience, investors are keeping a close eye on economic indicators such as the falling unemployment rate, which suggests a tight labor market amid broader economic challenges. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those seeking steady returns; Bendigo and Adelaide Bank along with two other noteworthy stocks exemplify these qualities in today's fluctuating landscape.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.80% | ★★★★★☆ |

| Perenti (ASX:PRN) | 6.25% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.36% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.02% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.44% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.56% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.14% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.62% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.01% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.83% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Bendigo and Adelaide Bank (ASX:BEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bendigo and Adelaide Bank Limited provides banking and financial services to retail customers and small to medium-sized businesses in Australia, with a market cap of A$7.51 billion.

Operations: Bendigo and Adelaide Bank Limited generates revenue through its Consumer segment at A$1.12 billion, Business & Agribusiness segment at A$761.10 million, and Corporate segment at A$67.50 million.

Dividend Yield: 4.8%

Bendigo and Adelaide Bank's dividend payments have increased over the past decade but have been unreliable, with volatility exceeding a 20% annual drop at times. The current payout ratio is 65.4%, suggesting dividends are covered by earnings, and this is expected to remain sustainable in three years with a 72.7% forecasted payout ratio. However, its dividend yield of 4.75% lags behind top-tier Australian payers, despite trading at A$11 billion below estimated fair value.

- Click here to discover the nuances of Bendigo and Adelaide Bank with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Bendigo and Adelaide Bank's share price might be too pessimistic.

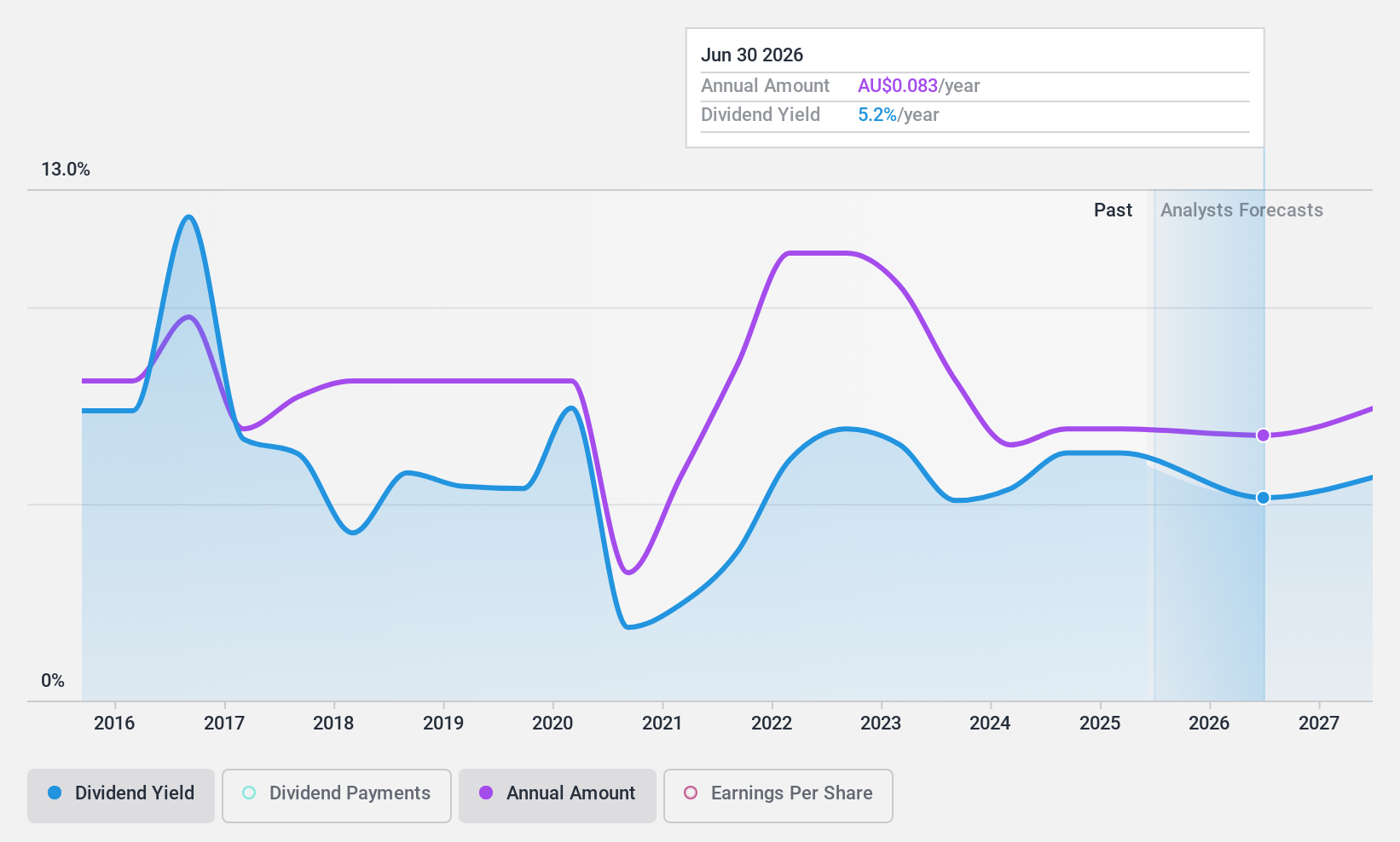

Nine Entertainment Holdings (ASX:NEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nine Entertainment Co. Holdings Limited operates in the broadcasting and program production sectors, offering services across free-to-air television, video on demand, and metropolitan radio networks in Australia with a market cap of A$2 billion.

Operations: Nine Entertainment Co. Holdings Limited generates revenue from several segments, including Broadcasting (A$1.23 billion), Publishing (A$558.63 million), Stan (A$447.73 million), Domain Group (A$395.73 million), and Corporate activities (A$1.23 million).

Dividend Yield: 6.7%

Nine Entertainment Holdings' dividend yield of 6.72% ranks in the top 25% of Australian payers, yet its sustainability is questionable due to a high payout ratio of 123.8%, indicating dividends aren't well covered by earnings. Though dividends have grown over the past decade, their reliability is undermined by volatility and large one-off items affecting financial results. Recent M&A rumors suggest potential strategic shifts, but executive instability could delay decisive actions impacting future dividend stability.

- Take a closer look at Nine Entertainment Holdings' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Nine Entertainment Holdings shares in the market.

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Super Retail Group Limited operates as a retailer of auto, sports, and outdoor leisure products in Australia and New Zealand, with a market cap of A$3.35 billion.

Operations: Super Retail Group Limited's revenue is derived from several segments, including Rebel at A$1.29 billion, Macpac at A$214 million, Super Cheap Auto (SCA) at A$1.50 billion, and Boating, Camping and Fishing (BCF) at A$879.10 million.

Dividend Yield: 8%

Super Retail Group's dividend yield of 8.02% places it in the top 25% of Australian payers, supported by a sustainable payout ratio with earnings (64.9%) and cash flows (53.7%). However, its dividend history is marked by volatility over the past decade, raising concerns about reliability despite growth in payments. Recent board changes include appointing Kate Burleigh as a director, potentially bringing fresh strategic insights from her extensive experience across various sectors including technology and retail.

- Delve into the full analysis dividend report here for a deeper understanding of Super Retail Group.

- According our valuation report, there's an indication that Super Retail Group's share price might be on the cheaper side.

Summing It All Up

- Unlock our comprehensive list of 31 Top ASX Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nine Entertainment Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NEC

Nine Entertainment Holdings

Engages in the broadcasting and program production businesses across free to air television, video on demand, and metropolitan radio networks in Australia.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives