- Australia

- /

- Specialty Stores

- /

- ASX:SUL

3 ASX Dividend Stocks With Yields Between 5% And 8%

Reviewed by Simply Wall St

As the ASX200 experiences a slight downturn, with sectors like Financials and Health Care underperforming, investors are keeping a close eye on dividend stocks as a potential source of steady income amidst market fluctuations. In such an environment, identifying stocks with reliable yields between 5% and 8% can offer investors a measure of stability and income in their portfolios.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 6.75% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.64% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.01% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.29% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.32% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.29% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.40% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.14% | ★★★★★☆ |

| Santos (ASX:STO) | 6.93% | ★★★★☆☆ |

| CTI Logistics (ASX:CLX) | 5.58% | ★★★★☆☆ |

Click here to see the full list of 36 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Bendigo and Adelaide Bank (ASX:BEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bendigo and Adelaide Bank Limited provides banking and financial services to retail customers and small to medium-sized businesses in Australia, with a market cap of A$7.11 billion.

Operations: Bendigo and Adelaide Bank's revenue is primarily derived from its Consumer segment, which accounts for A$1.12 billion, followed by the Business & Agribusiness segment at A$761.10 million, and the Corporate segment contributing A$67.50 million.

Dividend Yield: 5%

Bendigo and Adelaide Bank recently declared a fully franked full-year dividend of A$0.63 per share, up from A$0.61 the previous year, indicating growth in payouts despite a historically volatile dividend record. The bank's payout ratio is 65.4%, suggesting dividends are currently covered by earnings, with forecasts maintaining coverage in three years at 72.9%. However, its dividend yield of 5.02% lags behind top Australian payers, and past earnings have been affected by large one-off items.

- Get an in-depth perspective on Bendigo and Adelaide Bank's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Bendigo and Adelaide Bank's share price might be too pessimistic.

Nine Entertainment Holdings (ASX:NEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nine Entertainment Co. Holdings Limited operates in Australia, focusing on broadcasting and program production through free-to-air television, video on demand, and metropolitan radio networks, with a market cap of A$1.84 billion.

Operations: Nine Entertainment Co. Holdings Limited generates revenue from several segments, including Stan (A$447.73 million), Publishing (A$558.63 million), Broadcasting (A$1.23 billion), and Domain Group (A$395.73 million).

Dividend Yield: 7.3%

Nine Entertainment Holdings' dividend yield of 7.3% ranks in the top 25% of Australian payers, but its sustainability is questionable due to a high payout ratio of 123.8%, indicating dividends are not well covered by earnings. Despite stable cash flow coverage at an 86% cash payout ratio, past dividends have been volatile with recent reductions from A$0.05 to A$0.045 per share. Ongoing M&A discussions may impact future dividend stability and strategic direction.

- Click here to discover the nuances of Nine Entertainment Holdings with our detailed analytical dividend report.

- According our valuation report, there's an indication that Nine Entertainment Holdings' share price might be on the cheaper side.

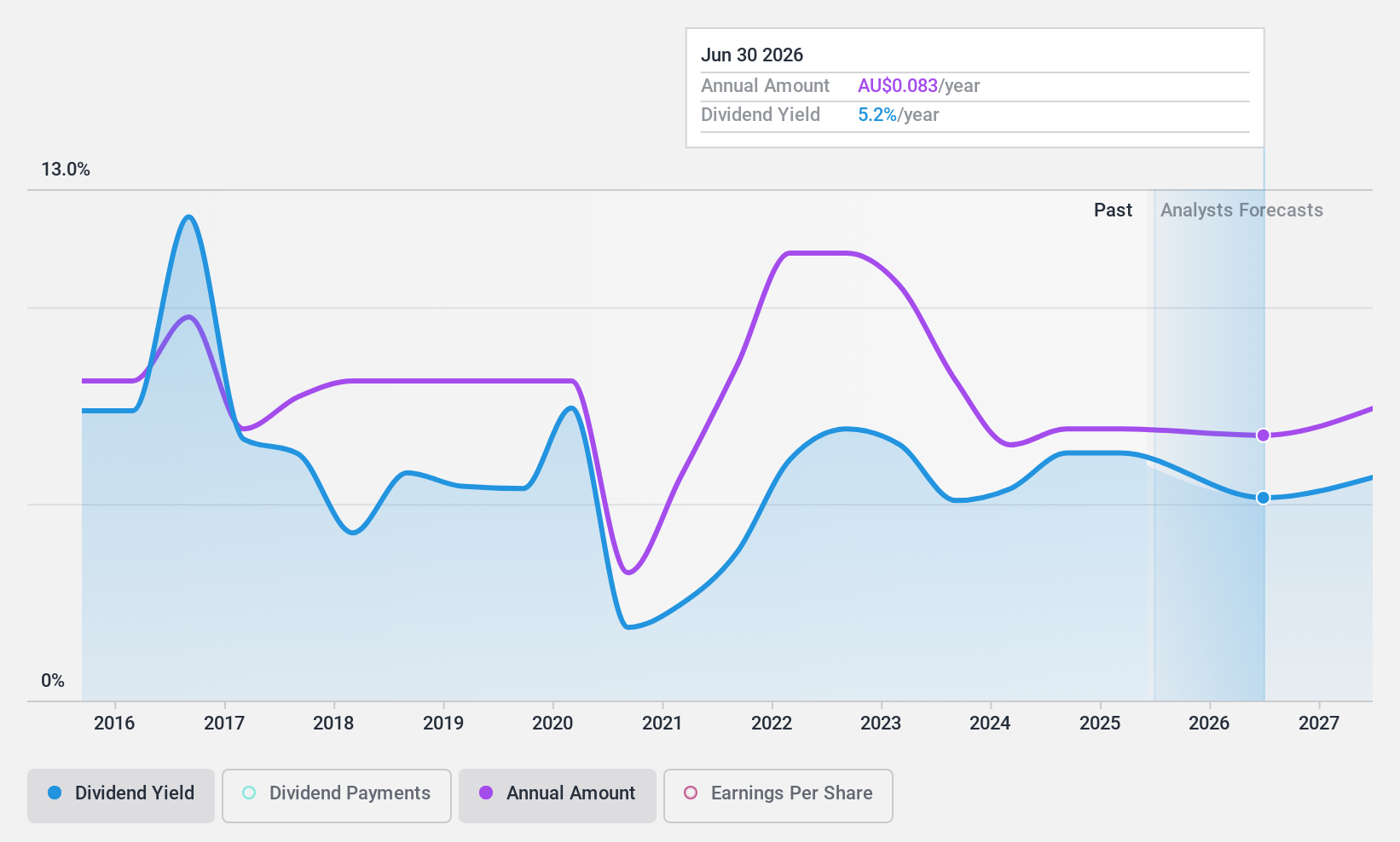

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Super Retail Group Limited operates as a retailer of auto, sports, and outdoor leisure products in Australia and New Zealand with a market cap of A$3.36 billion.

Operations: Super Retail Group Limited generates revenue from its key segments, including Rebel at A$1.29 billion, Macpac at A$214 million, Super Cheap Auto (SCA) at A$1.50 billion, and Boating, Camping and Fishing (BCF) at A$879.10 million.

Dividend Yield: 8%

Super Retail Group's dividend yield of 8.01% is among the top 25% in Australia, supported by a reasonable payout ratio of 64.9%, indicating dividends are covered by earnings. However, its dividend history has been volatile over the past decade. Despite recent earnings decline to A$240.1 million from A$263 million, cash flow coverage remains solid with a cash payout ratio of 53.7%. Recent board changes include appointing Kate Burleigh as a Non-Executive Director.

- Click here and access our complete dividend analysis report to understand the dynamics of Super Retail Group.

- Our expertly prepared valuation report Super Retail Group implies its share price may be lower than expected.

Key Takeaways

- Delve into our full catalog of 36 Top ASX Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SUL

Super Retail Group

Engages in the retail of auto, sports, and outdoor leisure products in Australia and New Zealand.

Flawless balance sheet, undervalued and pays a dividend.