The Australian stock market has shown resilience, with the ASX 200 closing the Christmas week on a positive note, marking its third consecutive win during this festive period. In such a robust market environment, investors often seek opportunities in various sectors, including those offered by penny stocks. Although "penny stock" may seem like an outdated term, these shares represent smaller or newer companies that can provide significant growth potential when backed by strong financials and fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.83 | A$234.64M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.10 | A$143.09M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$216.86M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.90 | A$106.58M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.85 | A$478.53M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Genesis Minerals (ASX:GMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Genesis Minerals Limited is involved in the exploration, production, and development of gold deposits in Western Australia with a market cap of A$2.88 billion.

Operations: The company generated A$438.59 million from its mineral production, exploration, and development activities.

Market Cap: A$2.88B

Genesis Minerals has recently turned profitable, with earnings forecasted to grow at 22.78% annually, highlighting potential for significant future growth. The company holds more cash than its total debt and covers short and long-term liabilities with its assets, indicating a strong financial position. Despite low return on equity at 8.4%, the company trades significantly below estimated fair value, suggesting potential undervaluation. However, shareholders experienced dilution over the past year, which might concern some investors. The management team is relatively new but considered experienced based on their average tenure of 2.3 years.

- Jump into the full analysis health report here for a deeper understanding of Genesis Minerals.

- Gain insights into Genesis Minerals' future direction by reviewing our growth report.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$679.99 million.

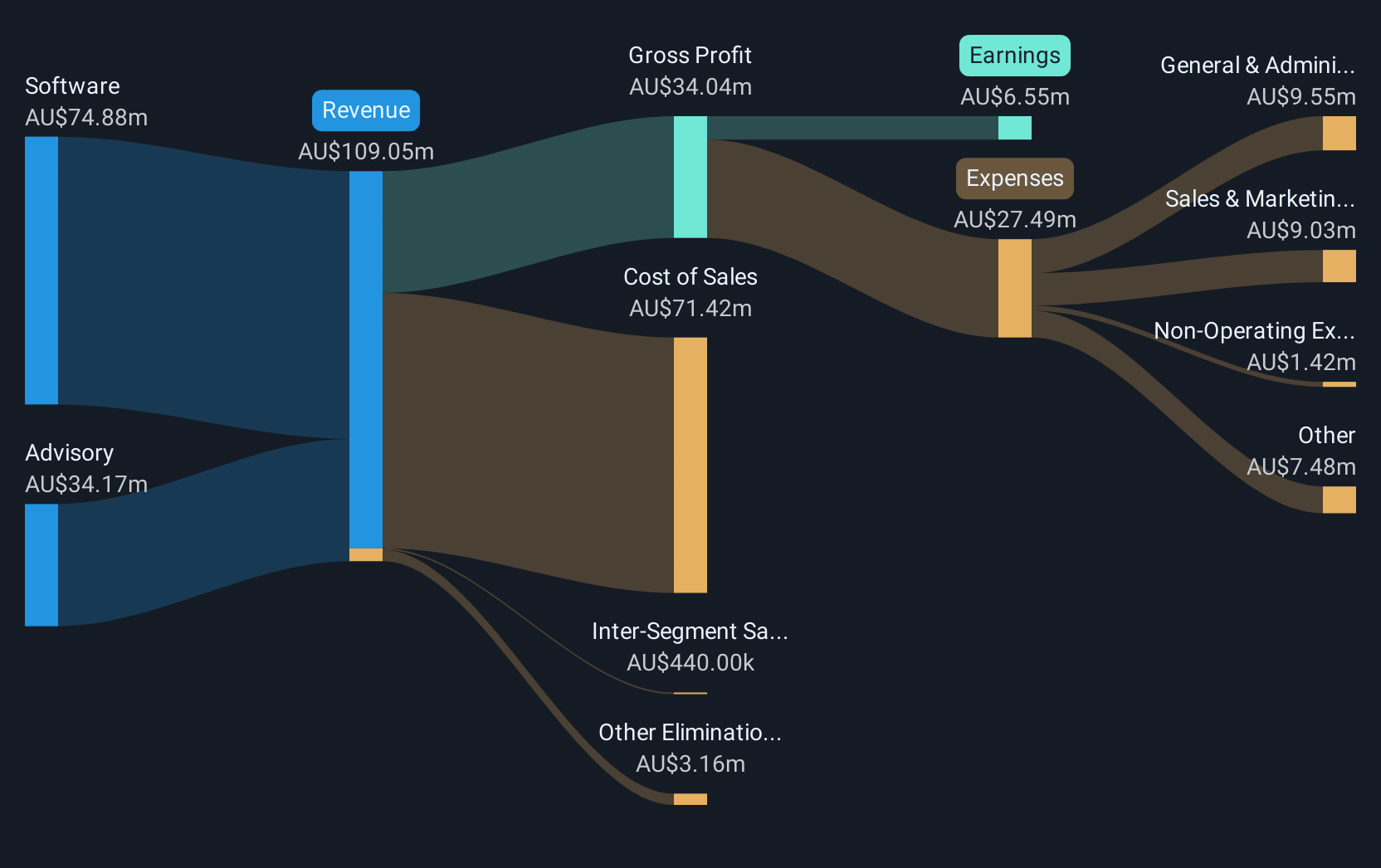

Operations: The company generates revenue from two main segments: Advisory services, contributing A$31.41 million, and Software solutions, which account for A$72.67 million.

Market Cap: A$679.99M

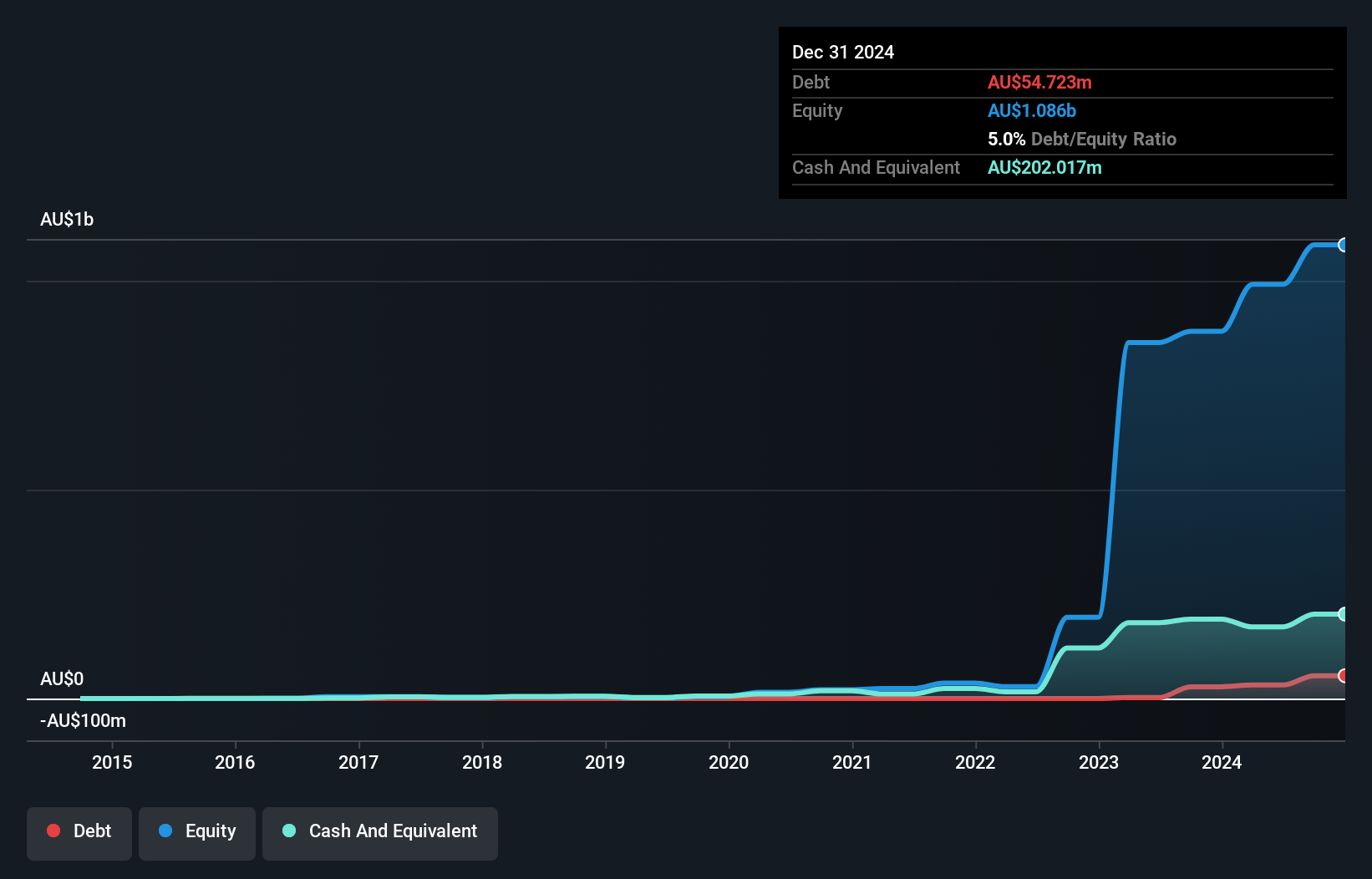

RPMGlobal Holdings Limited, with a market cap of A$679.99 million, has shown impressive financial health and growth potential. The company operates debt-free, alleviating concerns about interest coverage and financial leverage. Its short-term assets of A$70.2 million comfortably cover both short-term (A$52.1M) and long-term liabilities (A$5.5M). Earnings have surged by 134.6% over the past year, significantly outpacing the software industry average of 6.8%, while maintaining high-quality earnings with improved profit margins from 4.1% to 8.6%. The experienced management team further strengthens its operational foundation amidst confirmed revenue guidance for up to A$125 million in 2025.

- Dive into the specifics of RPMGlobal Holdings here with our thorough balance sheet health report.

- Understand RPMGlobal Holdings' earnings outlook by examining our growth report.

Silex Systems (ASX:SLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silex Systems Limited is a technology commercialization company focused on the research, development, commercialization, and licensing of SILEX laser enrichment technology across Australia, the United States, and the United Kingdom with a market cap of A$1.19 billion.

Operations: The company's revenue is derived from two segments: Translucent, contributing A$2.25 million, and Silex Systems, generating A$6.16 million.

Market Cap: A$1.19B

Silex Systems Limited, with a market cap of A$1.19 billion, is focused on commercializing its SILEX laser enrichment technology. Despite being unprofitable and not expected to achieve profitability in the next three years, the company maintains financial stability with short-term assets of A$126.7 million exceeding both short-term and long-term liabilities. It operates debt-free and has a seasoned management team with an average tenure of 14.2 years, supported by a seasoned board averaging 19.4 years in tenure. The recent appointment of Susan Corlett as Chair of the Audit Committee may bolster governance as the company navigates its growth trajectory.

- Take a closer look at Silex Systems' potential here in our financial health report.

- Gain insights into Silex Systems' outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Access the full spectrum of 1,053 ASX Penny Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLX

Silex Systems

A technology commercialization company, engages in the research and development, commercialization, and license of SILEX laser enrichment technology in Australia, the United States, and the United Kingdom.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives