Unpacking CAR Group (ASX:CAR): Revenue Growth Amidst Market Challenges

Reviewed by Simply Wall St

CAR Group (ASX:CAR) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a notable 31.2% increase in dividend payouts and innovative product launches, juxtaposed against a 16.7% drop in Q2 net sales and inflationary pressures. In the discussion that follows, we will delve into CAR Group's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click to explore a detailed breakdown of our findings on CAR Group.

Strengths: Core Advantages Driving Sustained Success For CAR Group

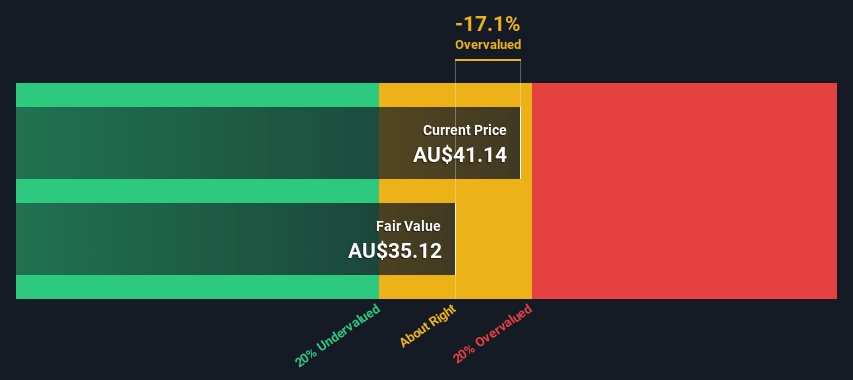

CAR Group has demonstrated robust financial performance, with a 15% growth in revenue and a 16% increase in EBITDA on a constant currency basis, as noted by CEO Cameron McIntyre. The company maintains strong market leadership in its four key markets, showcasing its competitive edge. Diversification across geographies and verticals has significantly strengthened CAR Group's business model over the past five years. Additionally, the company has seen a consistent increase in dealer customer numbers, reflecting the strong value proposition it offers. CAR Group's innovative approach to product development, particularly in simplifying the vehicle buying and selling process, underscores its commitment to maintaining a competitive edge. Despite these strengths, it is important to note that CAR Group is currently trading above its estimated fair value of A$34.91 and has a high Price-To-Earnings Ratio of 57x, which is significantly above industry and peer averages.

Weaknesses: Critical Issues Affecting CAR Group's Performance and Areas For Growth

CAR Group faces several challenges, including market variability with consistent demand in Korea being offset by softer demand in the United States. The company is also impacted by high interest rates, which have driven up finance costs, as highlighted by CFO William Elliot. Operational risks are further compounded by these financial pressures. Additionally, CAR Group's current net profit margins of 22.8% are significantly lower than last year's 82.6%, indicating a need for improvement. The company's Return on Equity (ROE) is forecast to be low at 15.4% in three years, which is below the preferred benchmark. Furthermore, CAR Group's high Price-To-Earnings Ratio of 57x compared to the industry average of 21x and peer average of 51.5x suggests that the stock may be overvalued.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

CAR Group has several growth opportunities, including market expansion with current penetration under 10%, providing significant long-term growth potential. The company is also launching new verticals, such as marine in the United States, which could diversify revenue streams. Investments in emerging technologies like AI and electrification, along with strategic acquisitions in high-growth markets like Webmotors, position CAR Group to capitalize on future trends. Additionally, the company's strong partnership with Santander enhances its strategic capabilities. With earnings forecasted to grow at 13.62% per year, CAR Group is well-placed to leverage these opportunities for sustained growth.

Threats: Key Risks and Challenges That Could Impact CAR Group's Success

CAR Group operates in a highly competitive global new car market, particularly with the entry of new Chinese manufacturers. Economic factors, including high interest rates, pose ongoing challenges to both operational and financial performance. Regulatory scrutiny remains a concern, especially as the company continues to execute its media strategy in Australia. Market risks such as yield increases, dynamic pricing, and media revenue volatility, as noted by David McMinn, could impact financial stability. Additionally, significant insider selling over the past three months may indicate potential concerns about future performance among those closest to the company.

Conclusion

CAR Group's strong financial performance, market leadership, and innovative product development highlight its competitive strengths. However, challenges such as market variability, high interest rates, and declining profit margins indicate areas needing improvement. The company's growth opportunities in market expansion and emerging technologies position it well for future growth, but high competition and economic factors pose risks. Importantly, CAR Group is currently trading above its estimated fair value of A$34.91 with a high Price-To-Earnings Ratio of 57x, suggesting that despite its strengths, the stock may be overvalued relative to industry and peer averages. This overvaluation could impact future investment returns and requires careful consideration by potential investors.

Summing It All Up

- Got skin in the game with CAR Group? Elevate how you manage them by using Simply Wall St's portfolio , where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:CAR

CAR Group

Engages in the operation of online automotive, motorcycle, and marine classifieds business in Australia, New Zealand, Brazil, South Korea, Malaysia, Indonesia, Thailand, Chile, China, the United States, and Mexico.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives