Investors in ARN Media (ASX:A1N) from five years ago are still down 53%, even after 12% gain this past week

ARN Media Limited (ASX:A1N) shareholders should be happy to see the share price up 12% in the last week. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. The share price has failed to impress anyone , down a sizable 63% during that time. So we're not so sure if the recent bounce should be celebrated. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

On a more encouraging note the company has added AU$17m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, ARN Media moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The most recent dividend was actually lower than it was in the past, so that may have sent the share price lower.

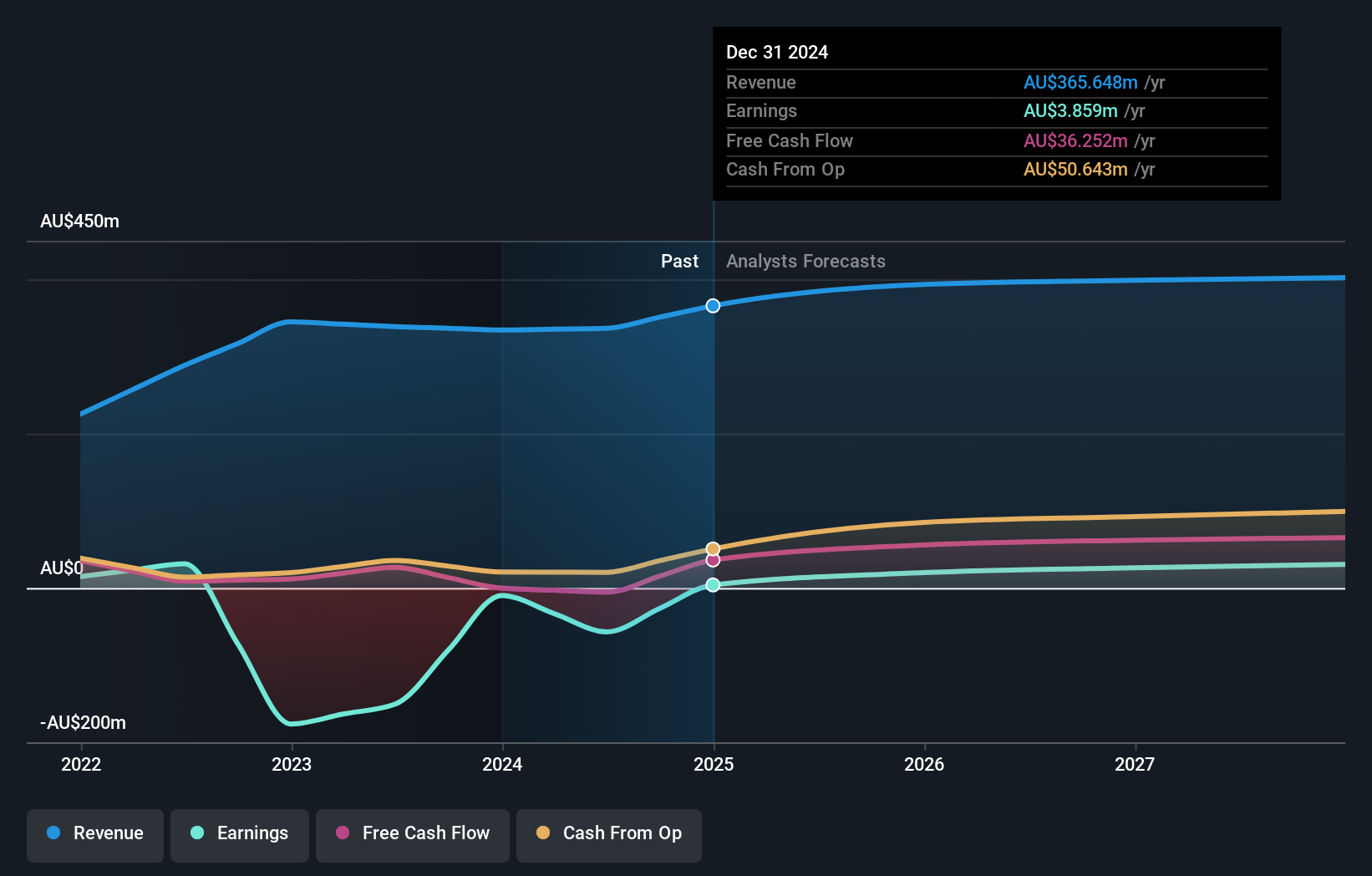

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that ARN Media has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for ARN Media the TSR over the last 5 years was -53%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in ARN Media had a tough year, with a total loss of 11% (including dividends), against a market gain of about 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 9% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand ARN Media better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with ARN Media .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:A1N

ARN Media

Operates as a media and entertainment company in Australia and Hong Kong.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives