- Australia

- /

- Metals and Mining

- /

- ASX:ZIM

Is Zimplats Holdings' (ASX:ZIM) Reinvestment Strategy Delivering Diminishing Returns on Capital?

Reviewed by Sasha Jovanovic

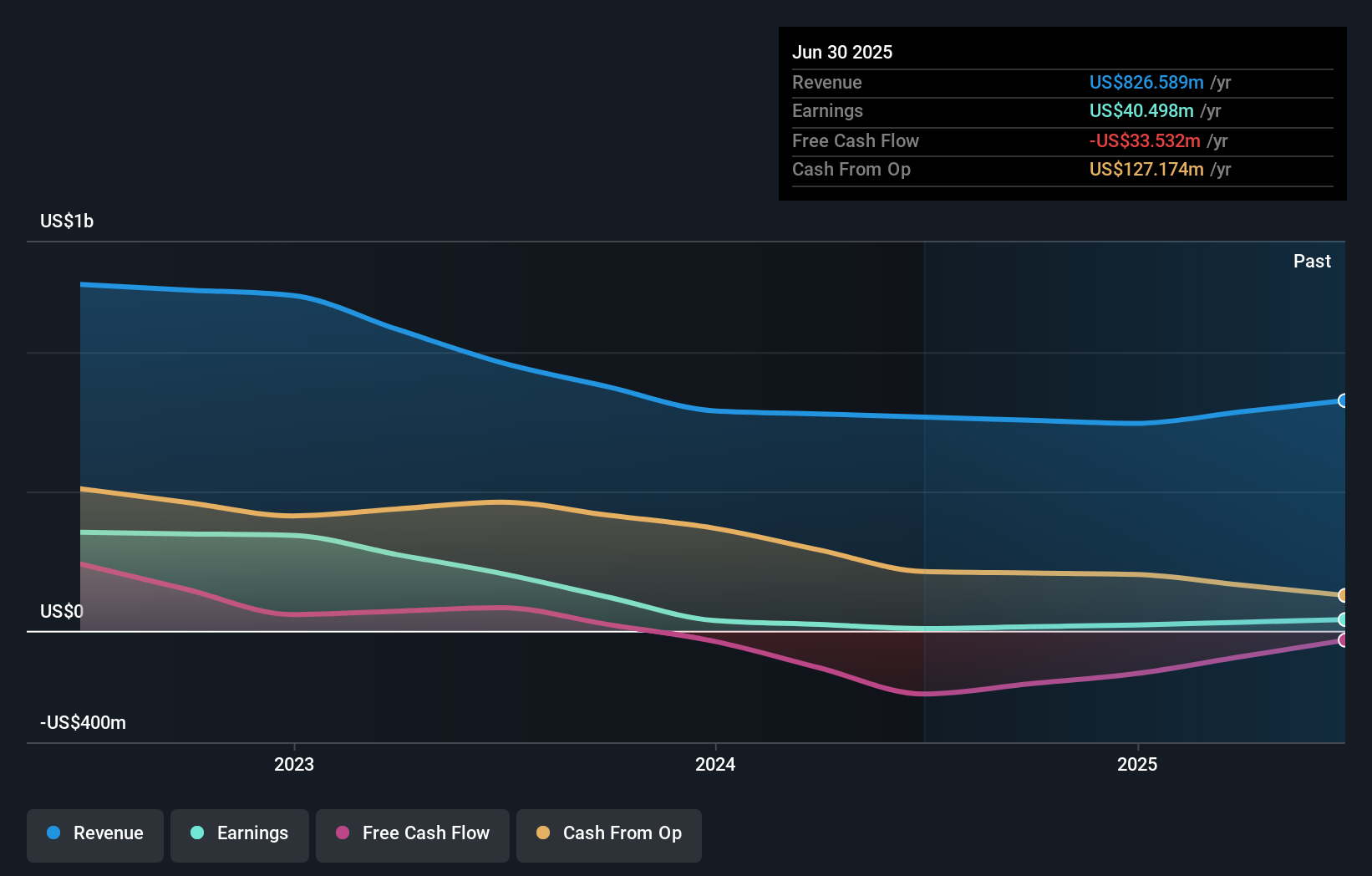

- In recent news as of October 2025, Zimplats Holdings has increased its capital investments, but its return on capital employed (ROCE) has continued a five-year slide from 24% to just 3.7%, trailing the Metals and Mining industry average of 9.2%.

- This trend highlights a disconnect between ongoing reinvestment and immediate improvements in sales or earnings, raising questions about the near-term benefits of these capital deployments.

- We'll next explore how the company's falling returns on capital may be shaping Zimplats Holdings' broader investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Zimplats Holdings' Investment Narrative?

To be a shareholder in Zimplats Holdings right now, you have to be comfortable with the story shifting more towards long-term reinvestment, even as the company’s latest five-year trend in return on capital employed (ROCE) has declined to 3.7%. This recent drop in ROCE, falling well behind the Metals and Mining average, throws some cold water on the idea of a quick rebound driven by new projects or expanded capacity. While Zimplats’ recent earnings report did reveal improved profits and sales over the last year, the underlying risk is that these stronger results might be fleeting if fresh capital investments do not soon translate into higher profitability. For the short term, what looked like a possible catalyst, a rise in sales, is now overshadowed by the market’s skepticism about how effectively dollars are being deployed. Ongoing price strength suggests optimism lingers, but after this latest news, near-term payoffs from reinvestment look less of a sure thing and the return profile might remain pressured until clearer signs emerge. Contrast that with lingering concern about whether capital investments will boost earnings any time soon.

Upon reviewing our latest valuation report, Zimplats Holdings' share price might be too optimistic.Exploring Other Perspectives

Explore 5 other fair value estimates on Zimplats Holdings - why the stock might be worth less than half the current price!

Build Your Own Zimplats Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zimplats Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Zimplats Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zimplats Holdings' overall financial health at a glance.

No Opportunity In Zimplats Holdings?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zimplats Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIM

Zimplats Holdings

Engages in the production and sales of platinum group and associated metals in Zimbabwe.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026