- Australia

- /

- Basic Materials

- /

- ASX:WGN

Undiscovered Gems In Australia For October 2025

Reviewed by Simply Wall St

As the Australian market experiences a soft upswing, buoyed by optimistic trade talks and rising commodity prices, investors are keenly watching small-cap stocks for potential opportunities. In such an environment, undiscovered gems often possess strong fundamentals and resilience to broader market fluctuations, making them appealing candidates for growth-oriented portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Rand Mining | NA | 10.19% | 2.74% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Diversified United Investment (ASX:DUI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market cap of A$1.15 billion.

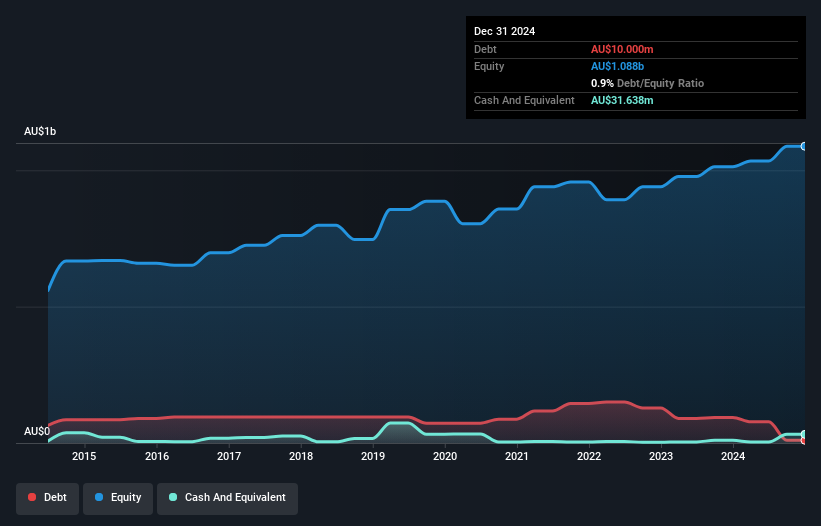

Operations: The company generates revenue primarily from its investment activities, amounting to A$46.71 million.

Diversified United Investment (DUI) has shown resilience with a net income of A$37.99 million for the year ending June 2025, up from A$36.03 million the previous year, reflecting steady growth in earnings per share from A$0.166 to A$0.176. Over five years, earnings have grown at an annual rate of 5%, although recent growth of 5.4% lagged behind the broader Capital Markets industry at 19.3%. The company is debt-free, contrasting with its past debt-to-equity ratio of 9%, which highlights prudent financial management despite significant insider selling recently observed over three months.

Peet (ASX:PPC)

Simply Wall St Value Rating: ★★★★☆☆

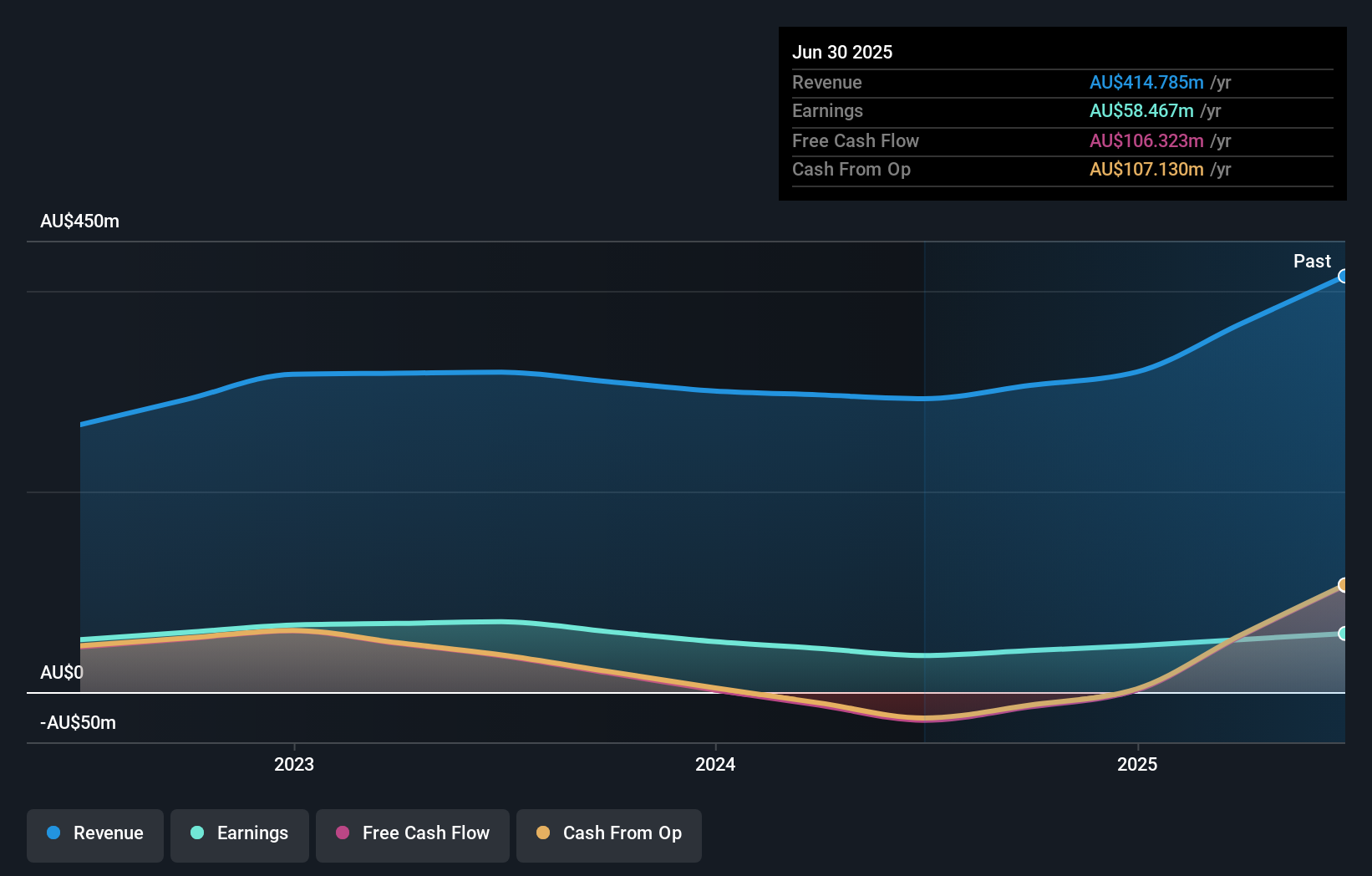

Overview: Peet Limited is an Australian company that focuses on acquiring, developing, and marketing residential land, with a market capitalization of A$894.18 million.

Operations: Peet generates revenue primarily through its Company Owned Projects, contributing A$313.24 million, followed by Funds Management at A$56.39 million and Joint Arrangements at A$51.88 million.

Peet, a notable player in the Australian property scene, has shown resilience with its debt to equity ratio improving from 57.1% to 53.5% over five years. Despite a high net debt to equity ratio of 45.8%, its interest payments are well covered by EBIT at 10.7 times, reflecting robust financial health. The company reported earnings growth of 60% last year, outpacing the real estate industry average of 40.9%. With sales jumping from A$292 million to A$415 million and net income rising from A$36 million to A$58 million, Peet's strategic review led by Goldman Sachs aims to leverage these strong market conditions further.

- Click to explore a detailed breakdown of our findings in Peet's health report.

Understand Peet's track record by examining our Past report.

Wagners Holding (ASX:WGN)

Simply Wall St Value Rating: ★★★★★☆

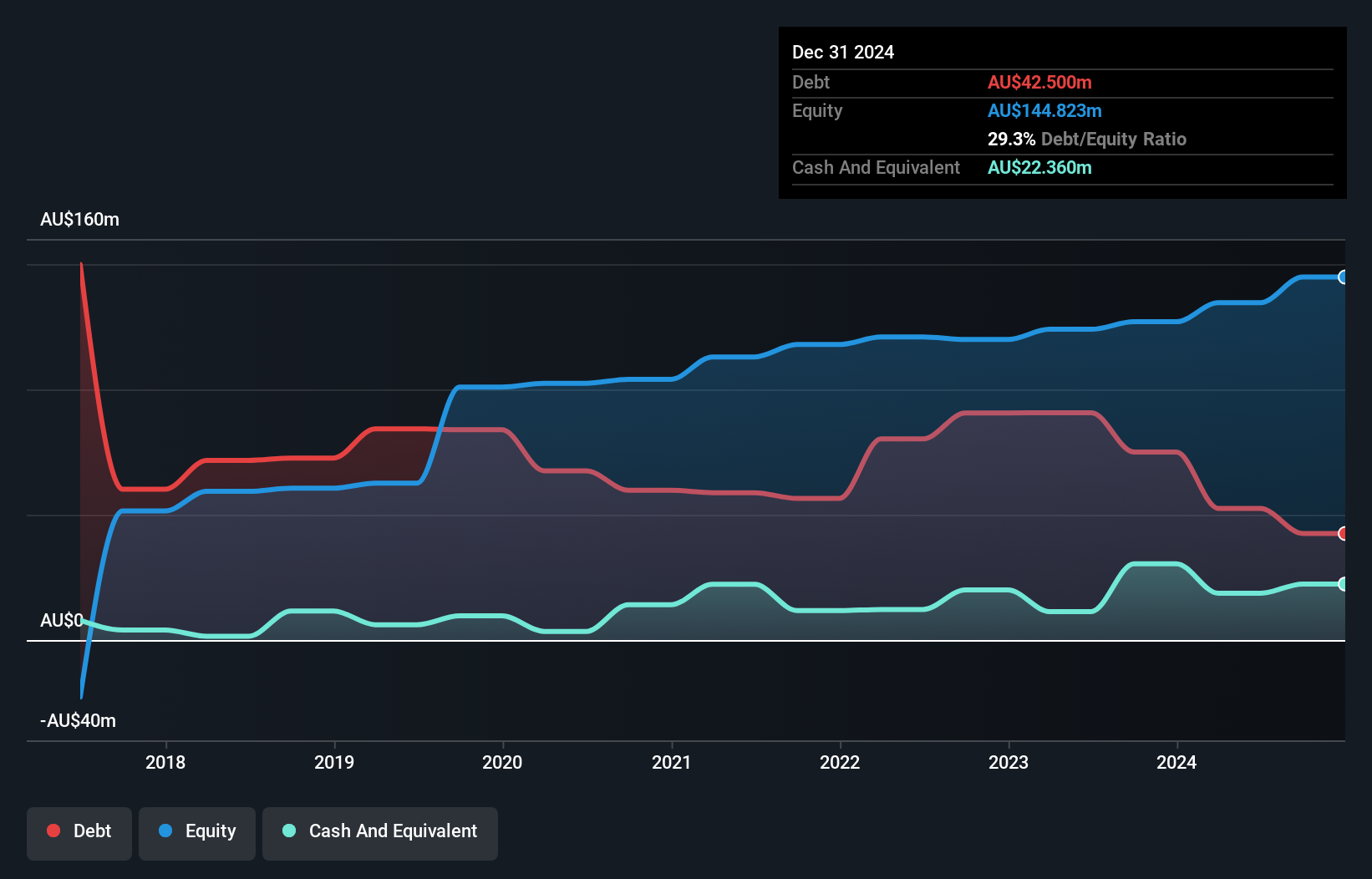

Overview: Wagners Holding Company Limited is involved in the production and sale of construction and building materials across several countries, including Australia, the United States, New Zealand, the United Kingdom, Papua New Guinea, and Malaysia, with a market capitalization of approximately A$565.22 million.

Operations: Wagners Holding generates revenue primarily from Construction Materials (A$257.69 million), Project Services (A$105.71 million), and Composite Fibre Technology (A$68.45 million). The company also earns a small amount from Earth Friendly Concrete, contributing A$0.16 million to its revenue streams.

Wagners Holding, a nimble player in Australia's construction materials sector, has seen its earnings surge by 120.9% over the past year, outpacing industry growth. The company recently expanded its concrete and quarry operations to capitalize on infrastructure demand in Southeast Queensland. Despite sales dipping to A$431 million from A$481 million last year, net income climbed to A$22.72 million from A$10.28 million, highlighting improved operational efficiency with high-quality earnings and satisfactory debt management at a 12.6% net debt-to-equity ratio. Wagners' inclusion in the S&P/ASX Emerging Companies Index underscores its growing market presence amidst strategic expansions and sustainability-focused ventures like Composite Fiber Technologies (CFT).

Seize The Opportunity

- Gain an insight into the universe of 60 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wagners Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WGN

Wagners Holding

Engages in the production and sale of construction materials and related building materials in Australia, the United States, New Zealand, the United Kingdom, Papua New Guinea, and Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)