- Australia

- /

- Metals and Mining

- /

- ASX:WAF

Did Hyde’s Bigger Stake and New Shares Just Rebalance Insider Alignment and Liquidity at West African Resources (ASX:WAF)?

Reviewed by Sasha Jovanovic

- In late November 2025, West African Resources reported that Managing Director Richard Hyde acquired 484,949 additional shares, lifting his holding to 17,633,118 shares, while also issuing 944,544 new fully paid ordinary shares now quoted on the ASX.

- This combination of increased insider ownership and a larger free float may influence how investors assess alignment between management and shareholders, as well as trading liquidity.

- We’ll now examine how Richard Hyde’s increased shareholding and the additional ASX-quoted shares may reshape West African Resources’ investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

West African Resources Investment Narrative Recap

To own West African Resources, you need to believe in its ability to execute at Sanbrado and Kiaka while managing Burkina Faso specific risks and cost pressures. Richard Hyde’s increased stake and the new ASX quoted shares do not materially change the near term focus on Kiaka ramp up as the key catalyst, or the concentration and power infrastructure risks that still sit in the foreground.

The recent half year 2025 result, with A$477.32 million in sales and A$185.8 million in net income, gives investors a current snapshot of earnings power as Kiaka and Sanbrado ramp toward their guidance ranges. Set against that backdrop, tighter alignment between management and shareholders, plus potentially improved liquidity from the extra 944,544 shares, will be weighed against execution and country specific risks around...

Read the full narrative on West African Resources (it's free!)

West African Resources’ narrative projects A$2.2 billion revenue and A$782.2 million earnings by 2028. This requires 35.7% yearly revenue growth and an earnings increase of about A$455 million from A$327.5 million today.

Uncover how West African Resources' forecasts yield a A$3.80 fair value, a 38% upside to its current price.

Exploring Other Perspectives

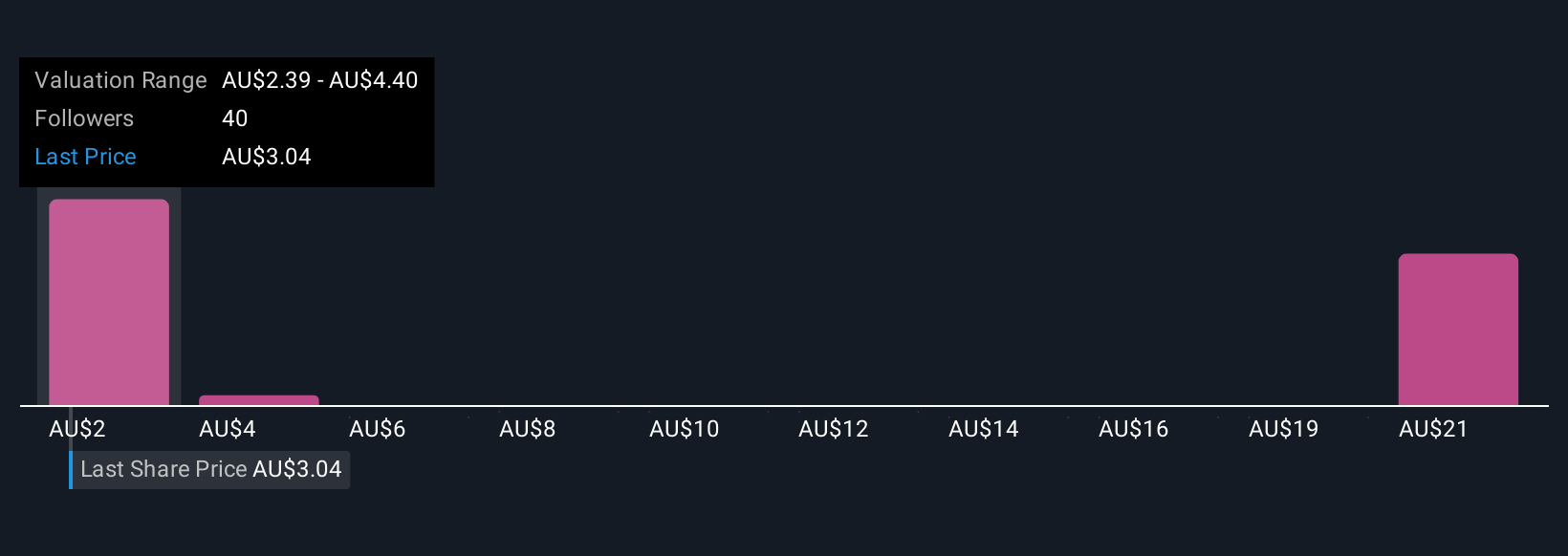

Ten fair value estimates from the Simply Wall St Community span roughly A$3.40 to A$20.60 per share, underlining how far apart individual views can be. When you weigh those opinions against West African Resources’ reliance on Burkina Faso for all current operations, it becomes even more important to compare several perspectives before deciding how that concentration risk might affect future performance.

Explore 10 other fair value estimates on West African Resources - why the stock might be worth just A$3.40!

Build Your Own West African Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West African Resources research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free West African Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West African Resources' overall financial health at a glance.

No Opportunity In West African Resources?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West African Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WAF

West African Resources

Engages in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026