The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Vysarn (ASX:VYS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Vysarn

Vysarn's Improving Profits

Vysarn has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, Vysarn's EPS soared from AU$0.0098 to AU$0.015, over the last year. That's a commendable gain of 57%.

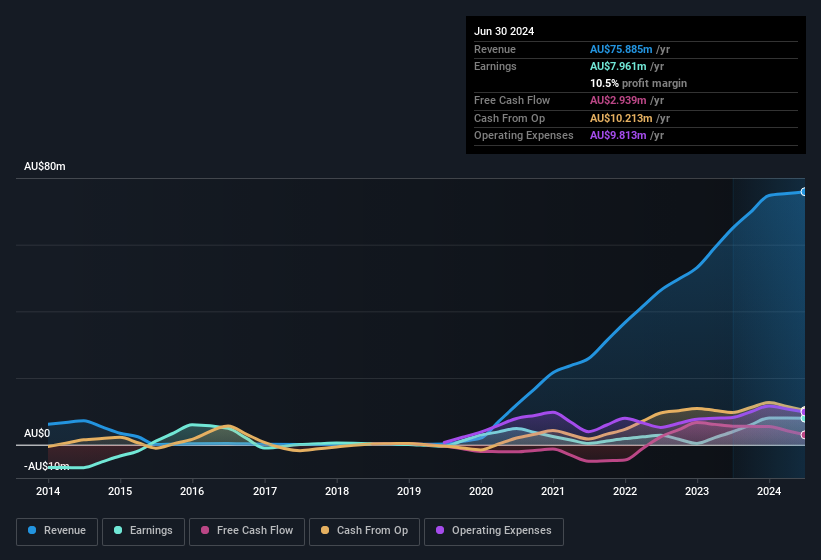

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Vysarn shareholders is that EBIT margins have grown from 11% to 14% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Vysarn isn't a huge company, given its market capitalisation of AU$223m. That makes it extra important to check on its balance sheet strength.

Are Vysarn Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Vysarn followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at AU$72m. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 33% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add Vysarn To Your Watchlist?

You can't deny that Vysarn has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Vysarn's continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. However, before you get too excited we've discovered 1 warning sign for Vysarn that you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Australian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VYS

Vysarn

Provides water services to various sectors, including resources, urban development, government and utilities in Australia.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)