- Australia

- /

- Metals and Mining

- /

- ASX:VUL

Vulcan Energy Resources (ASX:VUL) Valuation After Major Rights Issue and Follow-On Equity Raising

Reviewed by Simply Wall St

Vulcan Energy Resources (ASX:VUL) is in the middle of a substantial capital reshuffle, with a major rights issue, follow on equity offering, and fresh regulatory filings all reshaping who owns what.

See our latest analysis for Vulcan Energy Resources.

All this capital raising comes after a tough stretch for the stock, with a 30 day share price return of negative 43.21 percent and a one year total shareholder return of negative 24.9 percent. However, the five year total shareholder return of 77.84 percent shows that longer term investors are still ahead, even as near term momentum has clearly faded.

If Vulcan’s volatility has you rethinking concentration risk, it could be worth scanning for other opportunities using fast growing stocks with high insider ownership to see what else is gaining traction with committed insiders.

With the share price under pressure yet trading at a steep discount to analyst targets, the key question now is whether Vulcan is a mispriced growth story or whether the market has already factored in its ambitious expansion plans.

Price-to-Sales of 41.3x: Is it justified?

On a price-to-sales ratio of 41.3 times against a last close of A$3.72, Vulcan Energy Resources screens expensive relative to closer peers, even though broader sector comparisons paint a more nuanced picture.

The price-to-sales multiple compares the company’s market value with its current revenues, a common yardstick for high growth, early stage or loss making resource names where earnings are not yet a reliable guide.

For Vulcan, this high sales multiple suggests investors are already baking in aggressive top line expansion and eventual margin uplift, despite the company being unprofitable today and forecast to remain so over the next three years. The contrast between its elevated 41.3 times sales and a much lower peer average of 2.1 times highlights how much future growth is being priced in, even as losses have been widening.

Set against that, the stock looks cheaper when compared with the wider Australian Metals and Mining industry, which trades on an average of 121.5 times sales. It is also notably below an estimated fair price-to-sales ratio of 63.8 times that our models imply the market could ultimately converge toward if Vulcan executes on its growth plans.

Explore the SWS fair ratio for Vulcan Energy Resources

Result: Price-to-Sales of 41.3x (OVERVALUED)

However, lingering losses and execution risk around its European geothermal lithium projects could quickly undermine the growth story if delays or cost overruns occur.

Find out about the key risks to this Vulcan Energy Resources narrative.

Another View: Our DCF Lens

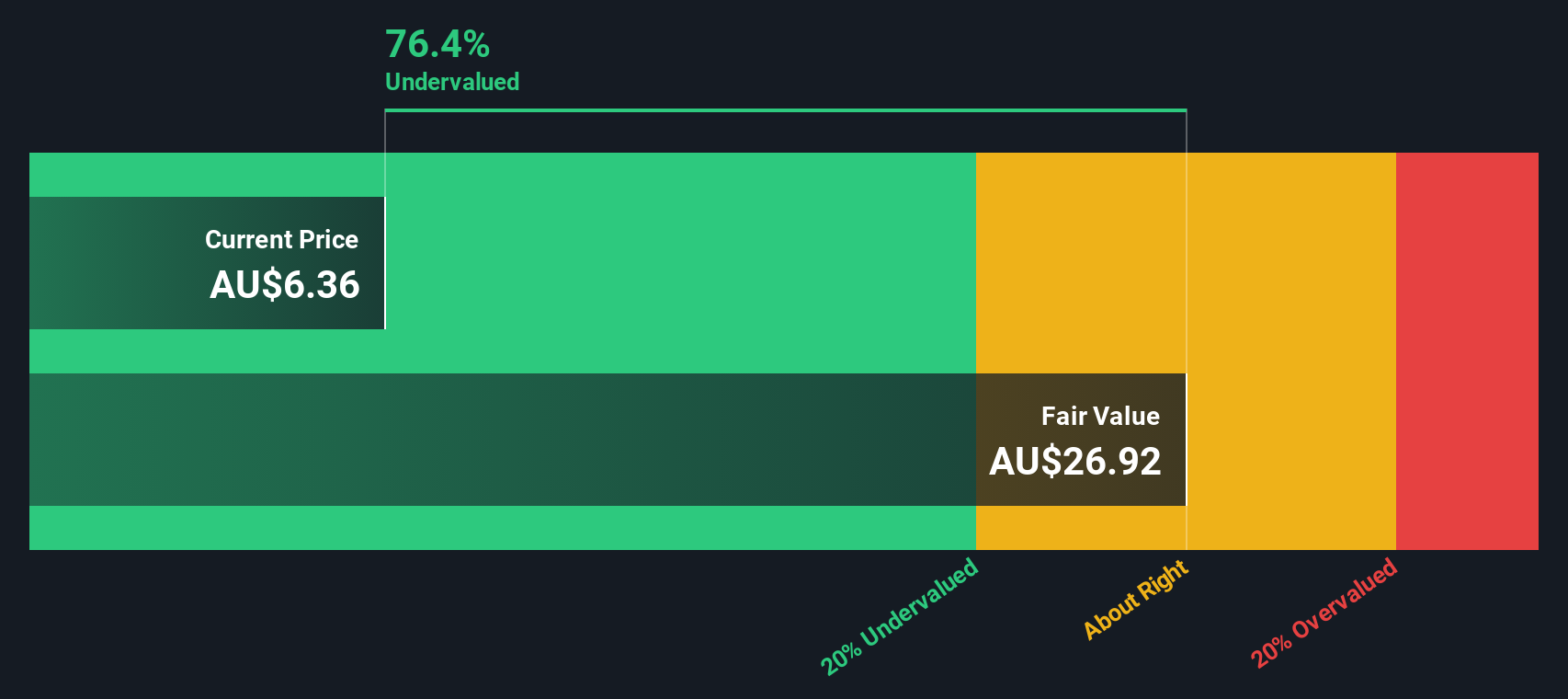

While the price to sales ratio makes Vulcan look stretched, our DCF model paints a very different picture, suggesting fair value closer to A$13.01 versus the current A$3.72, implying the shares might actually be significantly undervalued. Is the market overreacting to near term pain?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vulcan Energy Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vulcan Energy Resources Narrative

If you see things differently, or simply want to dive into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Vulcan Energy Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next smart move by scanning hand picked stock ideas on Simply Wall Street that many investors may not be focusing on yet.

- Identify potential multi baggers early by assessing these 3612 penny stocks with strong financials that already show financial strength instead of relying on speculative hype.

- Explore the long-term trend in automation and data by reviewing these 26 AI penny stocks involved in productivity-focused technologies.

- Look for quality at a discount by focusing on these 907 undervalued stocks based on cash flows where cash flow suggests the market may be pricing them conservatively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VUL

Vulcan Energy Resources

Engages in the geothermal energy, and lithium exploration and production activities in Europe, Germany, and Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)