- Australia

- /

- Metals and Mining

- /

- ASX:VUL

Vulcan Energy Resources (ASX:VUL) Is Up 6.6% After Securing EUR110m Lionheart Geothermal Plant Contract Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Vulcan Energy Resources announced it has signed a EUR110 million fixed turnkey contract with a consortium between Turboden and ROM Technik to design, develop, and construct a commercial geothermal power plant in Landau, Germany, as part of the Phase One Lionheart Project.

- The integrated facility aims to co-produce 275 GWh of renewable energy and 24,000 tonnes of lithium hydroxide annually, highlighting Vulcan’s approach to combining clean energy with battery materials production for the electric vehicle sector.

- We’ll look at how this major step toward fully integrated geothermal and lithium production shapes Vulcan’s investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 33 companies in the world exploring or producing it. Find the list for free.

What Is Vulcan Energy Resources' Investment Narrative?

For anyone considering Vulcan Energy Resources, much of the investment thesis comes down to believing in the company’s ability to deliver on its vision of fully integrated, low-carbon lithium and renewable energy production for Europe’s EV market. The just-announced EUR110 million contract to build its first commercial geothermal power plant is potentially a key inflection point: it addresses execution risk on critical infrastructure and edges the business closer to revenue scale-up. This project could accelerate momentum behind short-term catalysts like final project financing, supplier agreements, and regulatory milestones, all while highlighting the ongoing need for high upfront spending and smooth project delivery. However, the scale, technical complexity and timeline for integration mean that delays, cost overruns or slower-than-targeted financing could remain significant risks in the near future, even after this progress.

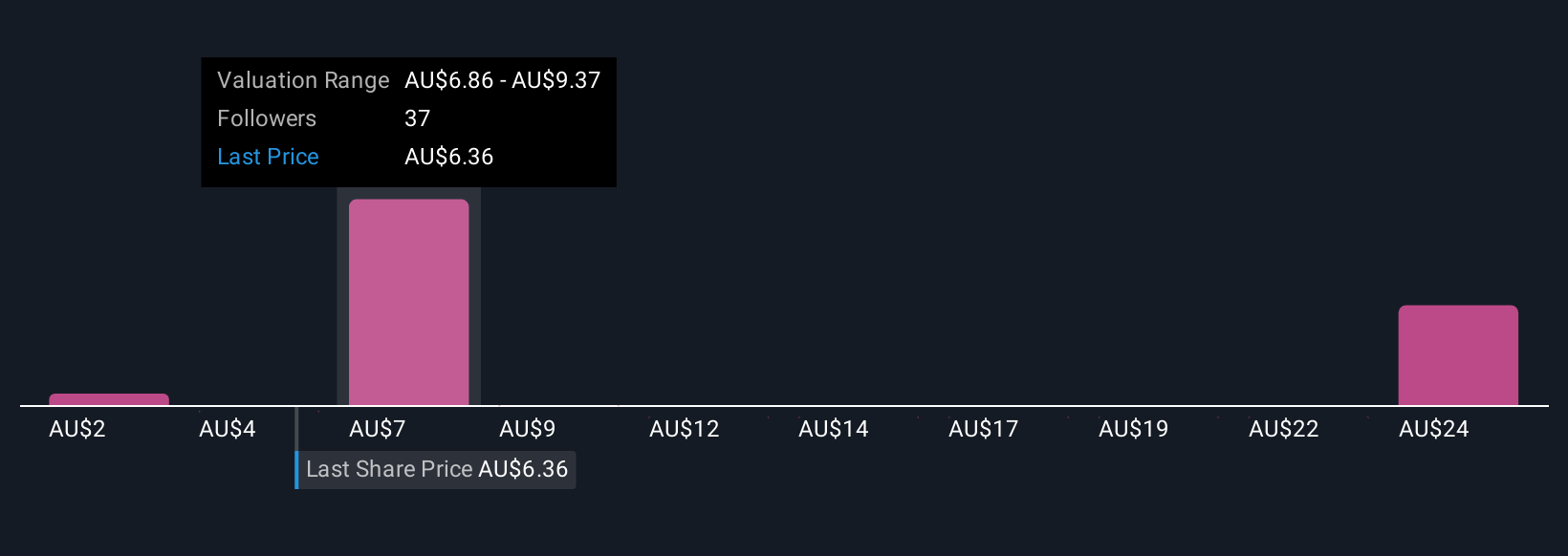

But, big project commitments can introduce new delivery and funding challenges that investors should watch closely. Vulcan Energy Resources' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 13 other fair value estimates on Vulcan Energy Resources - why the stock might be worth over 4x more than the current price!

Build Your Own Vulcan Energy Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vulcan Energy Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vulcan Energy Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vulcan Energy Resources' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VUL

Vulcan Energy Resources

Engages in the geothermal energy, and lithium exploration and production activities in Europe, Germany, and Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives