- Australia

- /

- Metals and Mining

- /

- ASX:VR8

ASX Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

As the Australian market enjoys a positive streak, led by strong performances in the materials sector and buoyed by stable iron ore and record gold prices, investors are keenly observing emerging opportunities. Penny stocks, though often considered a relic of past market eras, continue to intrigue with their potential for growth in smaller or newer companies. By focusing on those with solid financial foundations, these stocks can offer surprising value and stability amidst broader market movements.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.25 | A$106.14M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.615 | A$117.26M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.05 | A$470.25M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.42 | A$2.76B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.81 | A$478.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.64 | A$887.63M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.80 | A$882.14M | ✅ 5 ⚠️ 3 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.915 | A$154.24M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 463 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian listed investment company that aims to provide long-term capital growth by investing in a concentrated portfolio of high-conviction ideas from leading fund managers, with a market cap of A$753.35 million.

Operations: The company's revenue is derived entirely from investment activities, amounting to A$191.25 million.

Market Cap: A$753.35M

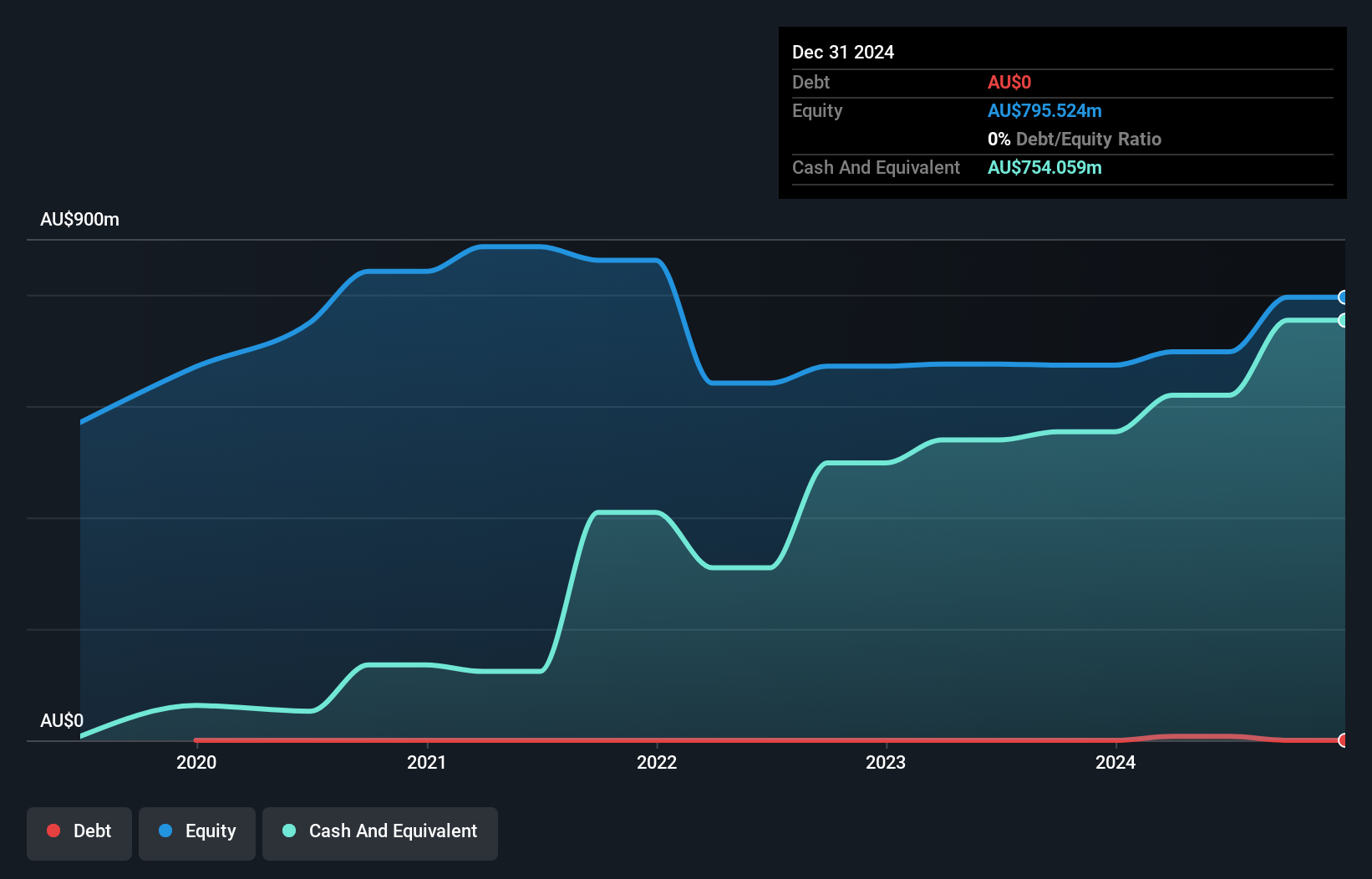

Hearts and Minds Investments, with a market cap of A$753.35 million, is debt-free and benefits from a stable financial position. Its board is experienced, though the management team is relatively new. The company's earnings growth over the past year has been substantial at 466.4%, surpassing industry averages, while maintaining high net profit margins of 67.1%. Despite a low return on equity of 16.1%, its price-to-earnings ratio of 5.9x suggests good value compared to the broader Australian market average of 19x. However, its dividend yield of 4.86% isn't well covered by free cash flows due to high non-cash earnings levels.

- Click here and access our complete financial health analysis report to understand the dynamics of Hearts and Minds Investments.

- Assess Hearts and Minds Investments' previous results with our detailed historical performance reports.

Southern Cross Media Group (ASX:SXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Southern Cross Media Group Limited, along with its subsidiaries, produces audio content for broadcast and digital networks in Australia and has a market cap of A$141.54 million.

Operations: Southern Cross Media Group generates revenue primarily through its Broadcast Radio segment, which accounts for A$370.70 million, and its Digital Audio segment, contributing A$41.57 million.

Market Cap: A$141.54M

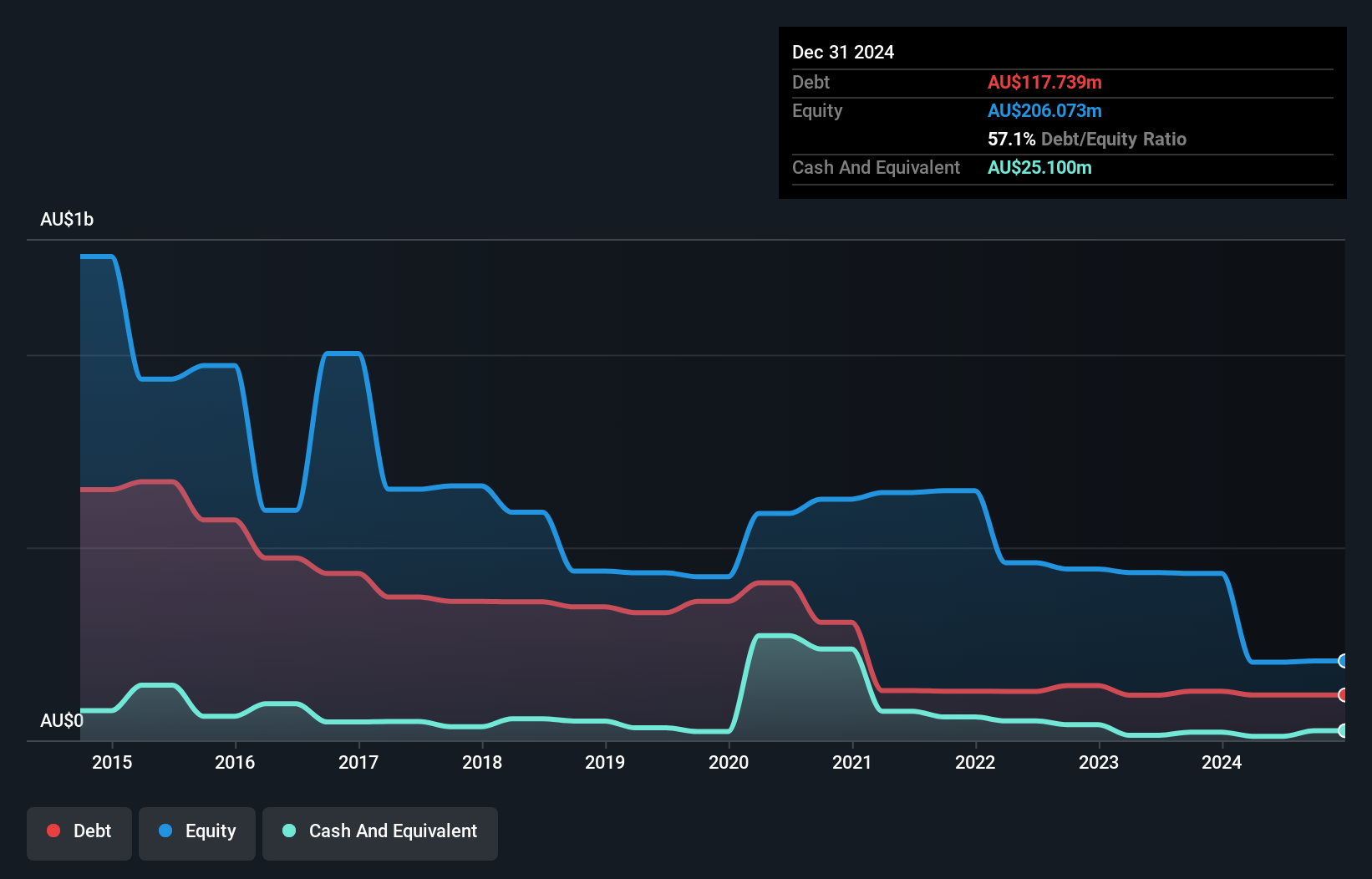

Southern Cross Media Group, with a market cap of A$141.54 million, trades at 34.7% below its estimated fair value, suggesting potential undervaluation. Despite being unprofitable and having a negative return on equity of -108.01%, it maintains over three years of cash runway with positive free cash flow. The company's short-term assets cover its short-term liabilities but fall short against long-term obligations. Recent investor activism from Sandon Capital has targeted board changes, potentially impacting governance stability ahead of the AGM by November 2025. The company plans to resume dividends for FY25 following improved financial performance and asset disposals.

- Get an in-depth perspective on Southern Cross Media Group's performance by reading our balance sheet health report here.

- Assess Southern Cross Media Group's future earnings estimates with our detailed growth reports.

Vanadium Resources (ASX:VR8)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vanadium Resources Limited focuses on the exploration and development of mineral projects in Australia and South Africa, with a market cap of A$23.14 million.

Operations: Vanadium Resources Limited has not reported any specific revenue segments.

Market Cap: A$23.14M

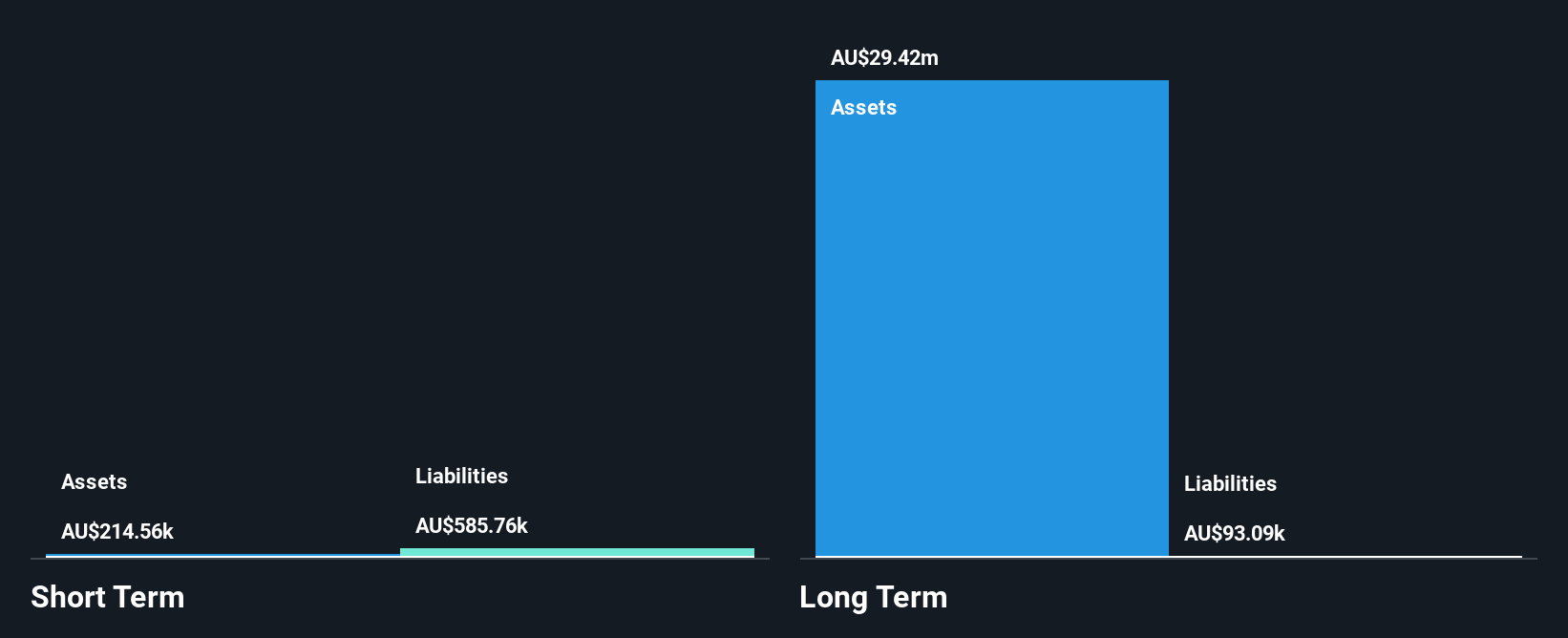

Vanadium Resources Limited, with a market cap of A$23.14 million, remains pre-revenue and unprofitable, reflecting its early-stage exploration focus. Despite this, the company maintains a satisfactory net debt to equity ratio of 0.09% and has not significantly diluted shareholders over the past year. Short-term assets exceed long-term liabilities but fall short against short-term obligations. The management team is considered experienced with an average tenure of 2.9 years, while recent capital raises have extended its cash runway beyond initial estimates based on free cash flow forecasts that indicated zero months' coverage initially.

- Unlock comprehensive insights into our analysis of Vanadium Resources stock in this financial health report.

- Explore historical data to track Vanadium Resources' performance over time in our past results report.

Taking Advantage

- Navigate through the entire inventory of 463 ASX Penny Stocks here.

- Ready For A Different Approach? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VR8

Vanadium Resources

Engages in the exploration and development of mineral projects in Australia and South Africa.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives