- Australia

- /

- Metals and Mining

- /

- ASX:VAU

3 ASX Stocks That May Be Undervalued In October 2024

Reviewed by Simply Wall St

The Australian market has shown stability over the past week, maintaining a flat trajectory, yet it has experienced a significant 22% rise over the past year with earnings projected to grow by 12% annually. In such an environment, identifying potentially undervalued stocks can be crucial for investors seeking opportunities that align with these growth forecasts while offering potential value relative to their current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Westgold Resources (ASX:WGX) | A$3.29 | A$6.27 | 47.6% |

| VEEM (ASX:VEE) | A$1.68 | A$3.21 | 47.7% |

| Ansell (ASX:ANN) | A$31.34 | A$57.67 | 45.7% |

| Charter Hall Group (ASX:CHC) | A$15.68 | A$31.34 | 50% |

| IDP Education (ASX:IEL) | A$13.71 | A$27.39 | 49.9% |

| Ingenia Communities Group (ASX:INA) | A$4.86 | A$9.38 | 48.2% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Genesis Minerals (ASX:GMD) | A$2.49 | A$4.80 | 48.1% |

| Megaport (ASX:MP1) | A$7.25 | A$13.43 | 46% |

| Energy One (ASX:EOL) | A$5.69 | A$11.07 | 48.6% |

We'll examine a selection from our screener results.

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited focuses on the exploration, production, and development of gold deposits in Western Australia, with a market capitalization of A$2.81 billion.

Operations: The company's revenue segment primarily consists of mineral production, exploration, and development, generating A$438.59 million.

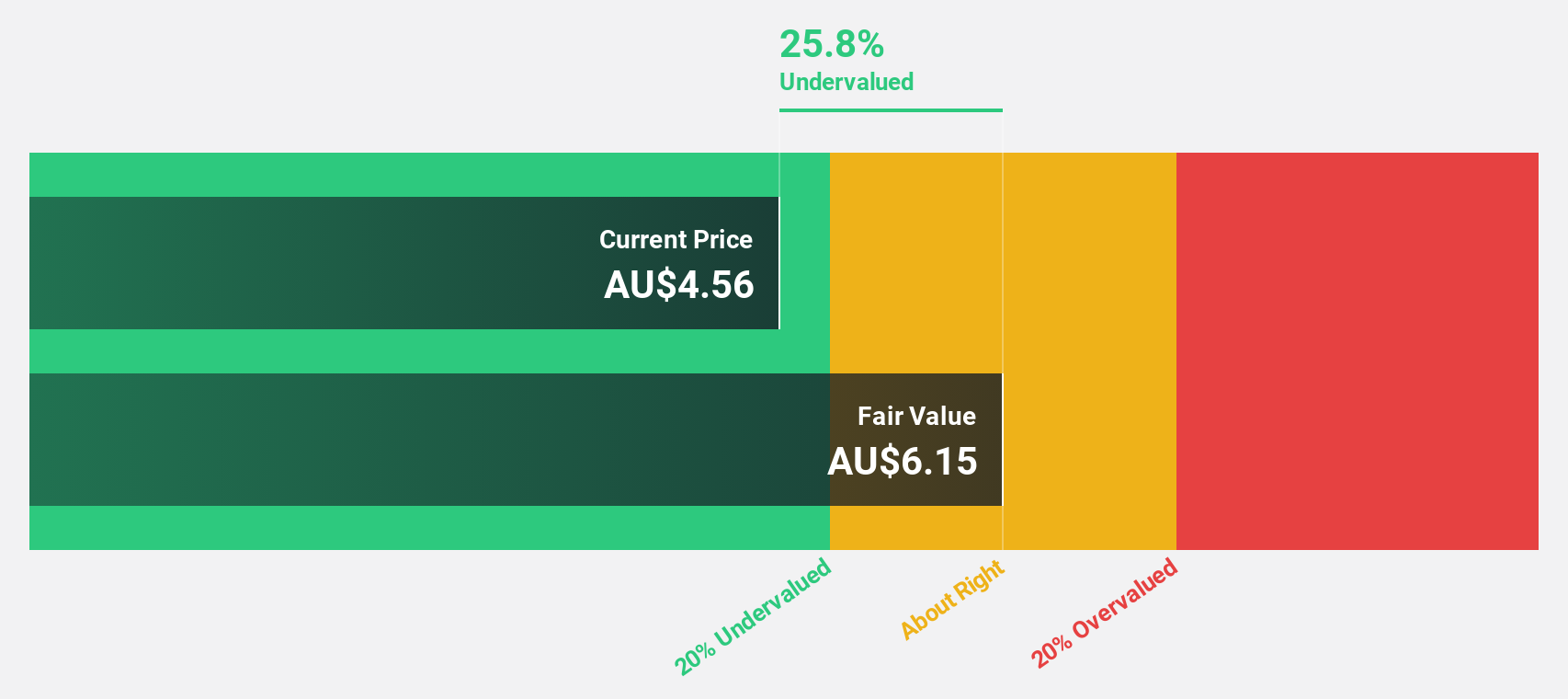

Estimated Discount To Fair Value: 48.1%

Genesis Minerals appears significantly undervalued, trading at A$2.49 compared to its estimated fair value of A$4.8, suggesting potential for appreciation based on discounted cash flow analysis. The company has transitioned to profitability with net income of A$84 million for the year ending June 30, 2024, a substantial improvement from a net loss previously recorded. Earnings are forecasted to grow at an impressive 22.7% annually over the next three years, outpacing broader market expectations.

- The growth report we've compiled suggests that Genesis Minerals' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Genesis Minerals' balance sheet health report.

IDP Education (ASX:IEL)

Overview: IDP Education Limited facilitates student placements into educational institutions across Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland with a market cap of A$3.81 billion.

Operations: The company's revenue is primarily derived from its Educational Services - Education & Training Services segment, which generated A$1.04 billion.

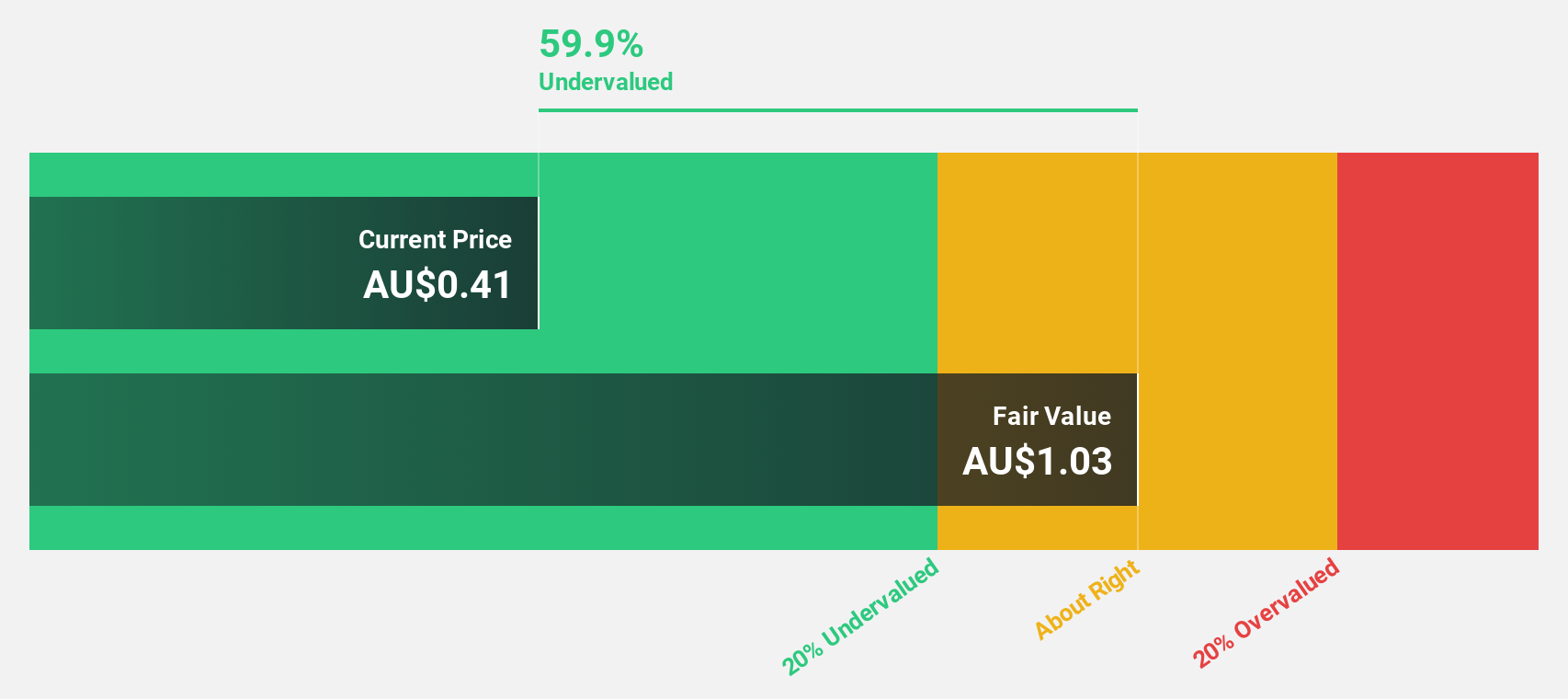

Estimated Discount To Fair Value: 49.9%

IDP Education is trading at A$13.71, significantly below its estimated fair value of A$27.39, indicating it may be undervalued based on cash flows. Despite a decrease in net income to A$132.75 million for the year ending June 30, 2024, earnings are projected to grow at 14.1% annually, surpassing the Australian market's growth rate of 12.3%. However, revenue growth remains modest at 7.4% per year compared to previous periods.

- Insights from our recent growth report point to a promising forecast for IDP Education's business outlook.

- Click here to discover the nuances of IDP Education with our detailed financial health report.

Vault Minerals (ASX:VAU)

Overview: Vault Minerals Limited focuses on the exploration, production, and mining of gold and gold/copper concentrates in Canada and Australia, with a market cap of A$2.62 billion.

Operations: The company's revenue segments include Deflector at A$22.42 million, Mount Monger at A$15.96 million, and King of The Hills generating A$581.62 million.

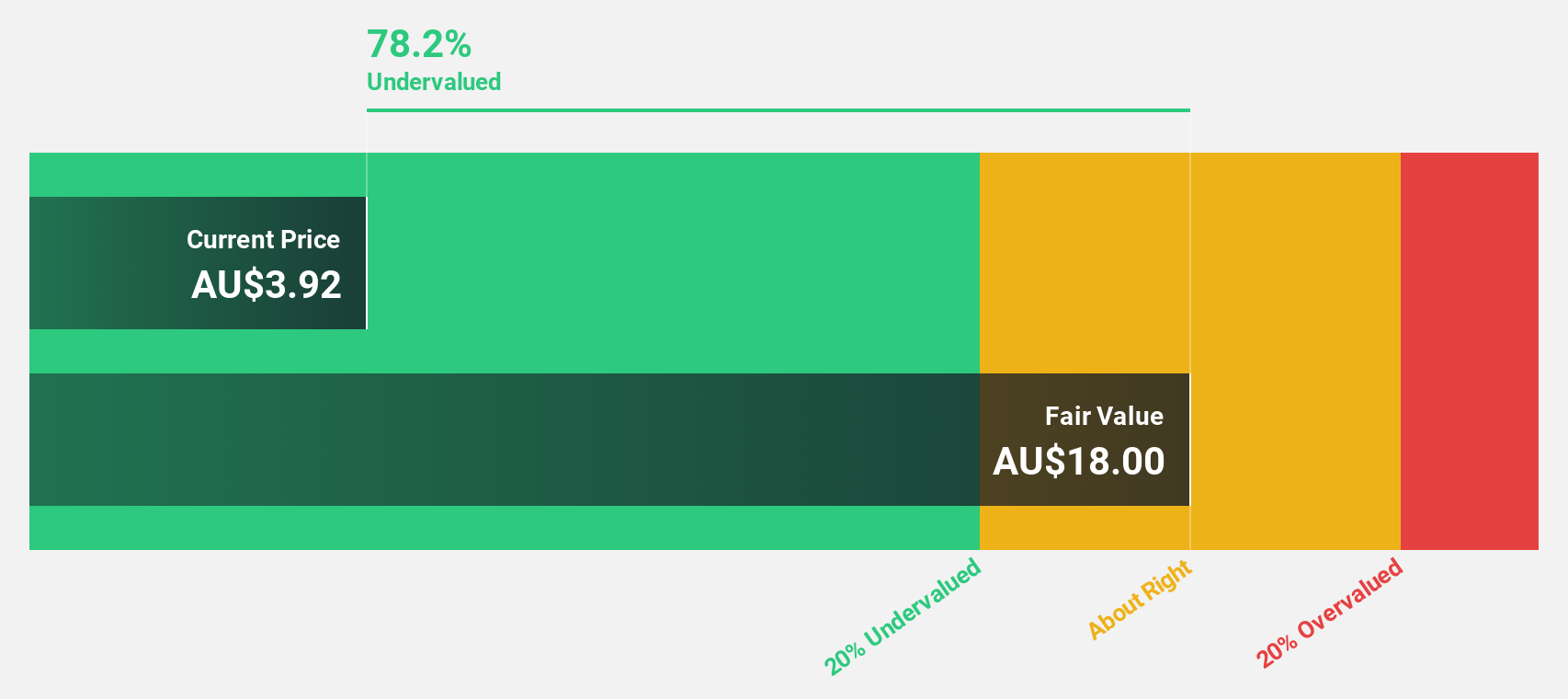

Estimated Discount To Fair Value: 28.4%

Vault Minerals is currently trading at A$0.39, which is 28.4% below its estimated fair value of A$0.54, suggesting potential undervaluation based on cash flows. The company's revenue for the year ended June 30, 2024, was A$620 million, up from A$422.75 million the previous year; however, it reported a net loss of A$5.44 million. Despite past shareholder dilution and low forecasted return on equity (9.5%), earnings are expected to grow annually by 21.1%, with profitability anticipated within three years—outpacing average market growth expectations.

- Our earnings growth report unveils the potential for significant increases in Vault Minerals' future results.

- Delve into the full analysis health report here for a deeper understanding of Vault Minerals.

Turning Ideas Into Actions

- Click this link to deep-dive into the 45 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VAU

Vault Minerals

Engages in the exploration, production, and mining of gold and gold/copper concentrates in Canada and Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives