- Australia

- /

- Metals and Mining

- /

- ASX:SVY

It Looks Like Stavely Minerals Limited's (ASX:SVY) CEO May Expect Their Salary To Be Put Under The Microscope

Shareholders will probably not be too impressed with the underwhelming results at Stavely Minerals Limited (ASX:SVY) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 11 November 2022. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. We present the case why we think CEO compensation is out of sync with company performance.

Check out our latest analysis for Stavely Minerals

How Does Total Compensation For Chris Cairns Compare With Other Companies In The Industry?

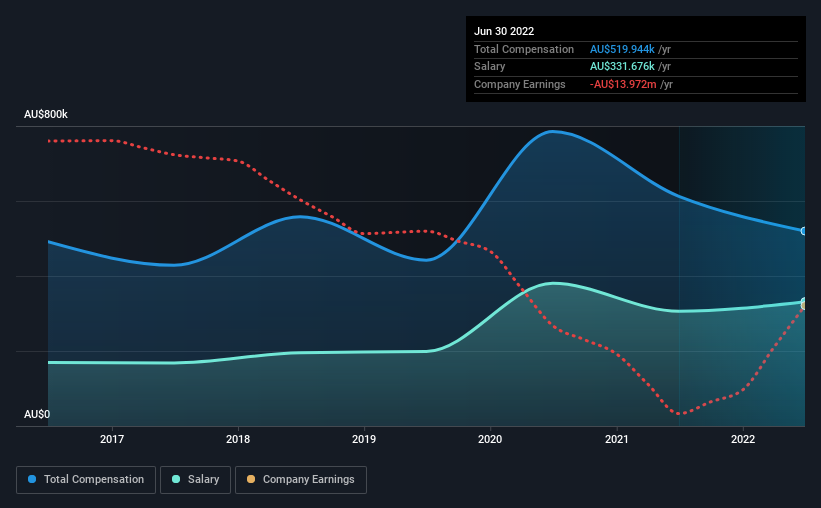

According to our data, Stavely Minerals Limited has a market capitalization of AU$45m, and paid its CEO total annual compensation worth AU$520k over the year to June 2022. Notably, that's a decrease of 15% over the year before. Notably, the salary which is AU$331.7k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below AU$318m, reported a median total CEO compensation of AU$373k. Hence, we can conclude that Chris Cairns is remunerated higher than the industry median. Moreover, Chris Cairns also holds AU$1.2m worth of Stavely Minerals stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$332k | AU$306k | 64% |

| Other | AU$188k | AU$306k | 36% |

| Total Compensation | AU$520k | AU$612k | 100% |

Talking in terms of the industry, salary represented approximately 60% of total compensation out of all the companies we analyzed, while other remuneration made up 40% of the pie. Stavely Minerals is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Stavely Minerals Limited's Growth

Over the last three years, Stavely Minerals Limited has shrunk its earnings per share by 4.8% per year. Its revenue is up 3.2% over the last year.

The decline in EPS is a bit concerning. The fairly low revenue growth fails to impress given that the EPS is down. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Stavely Minerals Limited Been A Good Investment?

Few Stavely Minerals Limited shareholders would feel satisfied with the return of -88% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 5 warning signs for Stavely Minerals you should be aware of, and 3 of them are significant.

Important note: Stavely Minerals is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SVY

Stavely Minerals

A mineral resource company, engages in the exploration and development of mineral projects in Australia.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)