3 ASX Penny Stocks With Market Caps Larger Than A$100M To Watch

Reviewed by Simply Wall St

The Australian market has seen mixed performances recently, with the ASX200 closing slightly down amid sector shifts and reactions to global developments. Despite these fluctuations, certain investment opportunities continue to attract attention, particularly in sectors showing resilience or growth potential. Penny stocks, though often seen as a niche area, can offer intriguing prospects for investors when they are backed by strong financials and fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$68.57M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.98 | A$242.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.53 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$316.68M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.14 | A$328.36M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$240.95M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.01 | A$110.44M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.33 | A$65.63M | ★★★★★☆ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Plenti Group (ASX:PLT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Plenti Group Limited operates in the fintech lending and investment sector in Australia, with a market capitalization of A$133.58 million.

Operations: The company generates revenue of A$83.84 million from its financial services offerings.

Market Cap: A$133.58M

Plenti Group Limited, operating in the fintech lending sector, has shown significant revenue growth, reporting A$124.25 million for the half year ending September 2024. Despite being unprofitable with a high net debt to equity ratio (11169.4%), Plenti has managed to reduce its losses over the past five years and maintains a stable cash runway exceeding three years due to positive free cash flow. The company's board and management team are experienced, contributing to its strategic direction amidst volatility. Short-term assets significantly cover both short and long-term liabilities, indicating strong liquidity management.

- Dive into the specifics of Plenti Group here with our thorough balance sheet health report.

- Gain insights into Plenti Group's future direction by reviewing our growth report.

Race Oncology (ASX:RAC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Race Oncology Limited is a clinical stage biopharmaceutical company dedicated to developing treatments for cancer patients, with a market cap of A$217.14 million.

Operations: The company's revenue is derived entirely from its operations in Australia, amounting to A$4.00 million.

Market Cap: A$217.14M

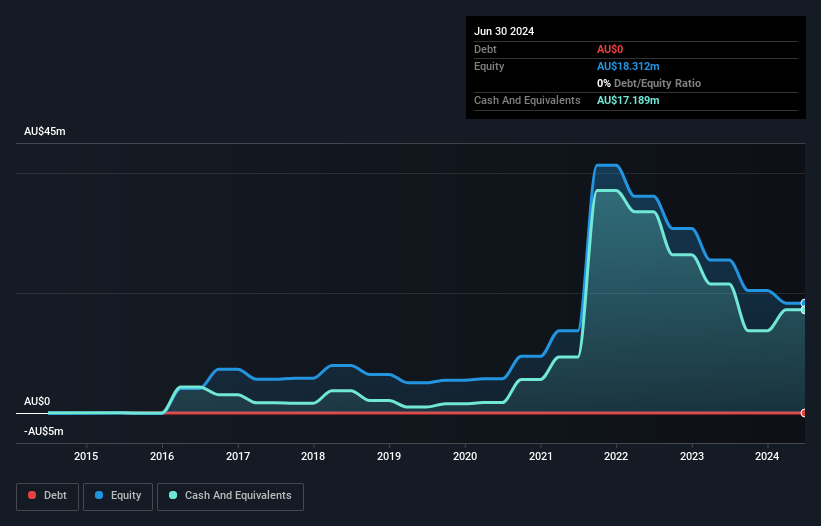

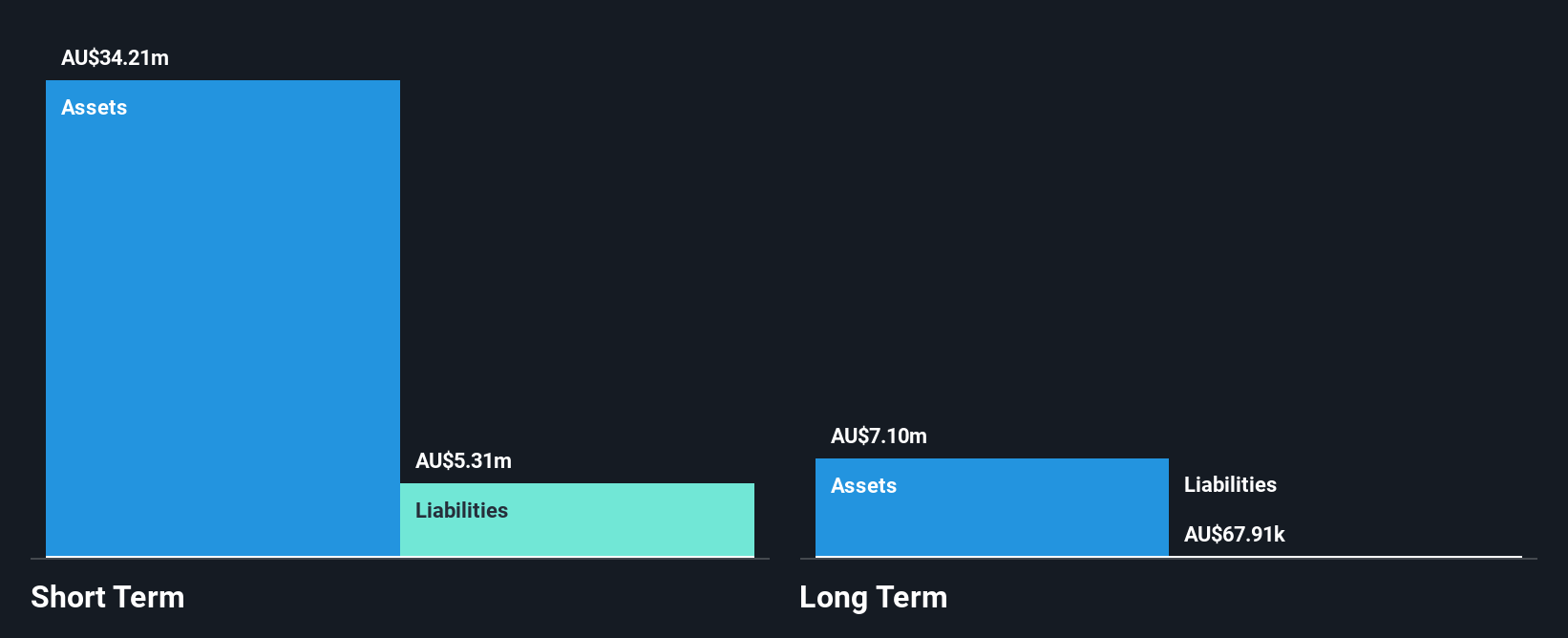

Race Oncology Limited, a clinical stage biopharmaceutical company, remains pre-revenue with A$4 million in revenue and is currently unprofitable. Despite this, the company benefits from being debt-free and having sufficient cash runway for over a year. Recent strategic developments include the appointment of Dr. Megan Baldwin to its board as an Independent Non-Executive Director, bringing over 25 years of experience in oncology drug development and capital raising expertise. While Race Oncology's management team is relatively new, Dr. Baldwin's addition may enhance corporate governance and strategic initiatives in advancing its oncology programs.

- Click here to discover the nuances of Race Oncology with our detailed analytical financial health report.

- Explore Race Oncology's analyst forecasts in our growth report.

Sovereign Metals (ASX:SVM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sovereign Metals Limited, along with its subsidiaries, focuses on the exploration and development of mineral resource projects in Malawi and has a market cap of A$452.91 million.

Operations: Sovereign Metals Limited has not reported any revenue segments.

Market Cap: A$452.91M

Sovereign Metals Limited, currently pre-revenue with a market cap of A$452.91 million, focuses on its Kasiya Rutile-Graphite Project in Malawi. The company remains debt-free and has sufficient cash runway for over a year following recent capital raises. Recent mining trials at Kasiya have successfully demonstrated efficient extraction methods and initiated land rehabilitation efforts, underscoring the project's potential as a significant supplier to the titanium and graphite markets. While Sovereign's management team is relatively new, its experienced board may provide strategic guidance as it progresses towards commercial production amid ongoing environmental assessments.

- Click to explore a detailed breakdown of our findings in Sovereign Metals' financial health report.

- Learn about Sovereign Metals' future growth trajectory here.

Summing It All Up

- Click this link to deep-dive into the 1,026 companies within our ASX Penny Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RAC

Race Oncology

A clinical stage biopharmaceutical company, focuses on addressing the unmet needs of cancer patients for damaging treatments.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives