- Australia

- /

- Hospitality

- /

- ASX:CTD

Undervalued Small Caps In Australia With Insider Action For September 2024

Reviewed by Simply Wall St

The market has climbed by 2.1% over the past week, with every sector up. As for the past 12 months, the market is up 13%, and earnings are expected to grow by 12% per annum over the next few years. In this thriving environment, identifying undervalued small-cap stocks with insider action can present compelling opportunities for investors seeking growth potential.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.0x | 1.5x | 43.06% | ★★★★★☆ |

| Bigtincan Holdings | NA | 1.2x | 47.43% | ★★★★★☆ |

| Tabcorp Holdings | NA | 0.4x | 25.64% | ★★★★★☆ |

| SHAPE Australia | 14.0x | 0.3x | 35.75% | ★★★★☆☆ |

| Corporate Travel Management | 20.6x | 2.5x | 3.01% | ★★★★☆☆ |

| Eagers Automotive | 10.2x | 0.3x | 40.00% | ★★★★☆☆ |

| Credit Corp Group | 20.9x | 2.8x | 40.39% | ★★★★☆☆ |

| Coventry Group | 221.5x | 0.4x | -10.94% | ★★★☆☆☆ |

| Dicker Data | 20.6x | 0.7x | -68.39% | ★★★☆☆☆ |

| BSP Financial Group | 7.8x | 2.8x | 1.77% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Corporate Travel Management (ASX:CTD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Corporate Travel Management provides travel services across Asia, Europe, North America, and Australia/New Zealand with a market cap of A$2.75 billion.

Operations: The company generates revenue primarily from travel services in Asia (A$63.66M), Europe (A$168.32M), North America (A$309.63M), and Australia/New Zealand (A$168.82M). The net profit margin has shown variability, reaching its highest at 20.68% in June 2018 and dipping to -51.18% in December 2020, with a recent figure of 11.88% as of June 2024.

PE: 20.6x

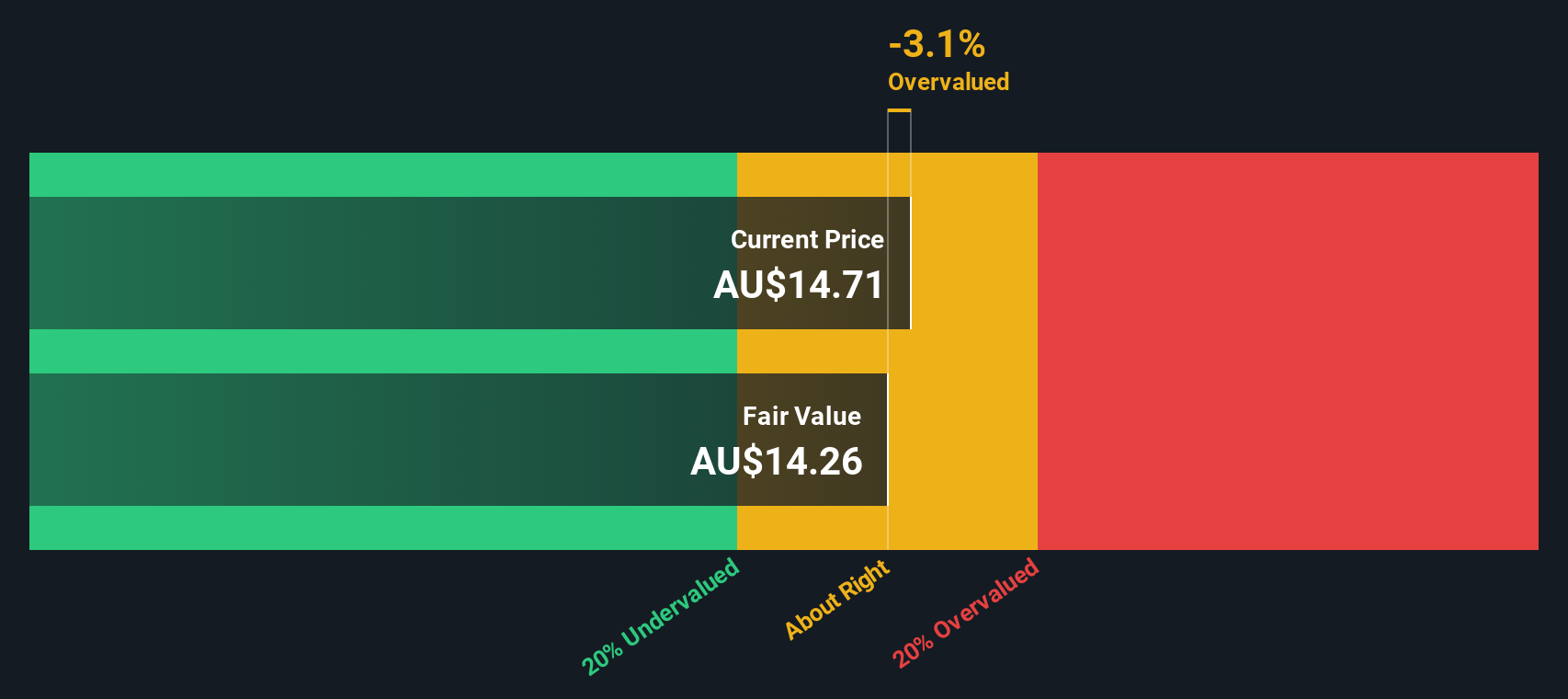

Corporate Travel Management, a small cap in Australia, shows promising growth with earnings forecasted to grow 12.22% annually. The company reported A$710 million in sales and A$84 million net income for the year ending June 30, 2024. Insider confidence is evident as Jamie Pherous purchased 87,500 shares worth approximately A$1.4 million recently. Additionally, the company repurchased over 1.6 million shares for A$26.1 million and extended its buyback plan to June 2025 with increased authorization of A$126 million.

- Delve into the full analysis valuation report here for a deeper understanding of Corporate Travel Management.

Learn about Corporate Travel Management's historical performance.

Deterra Royalties (ASX:DRR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Deterra Royalties is a company that primarily generates revenue through royalty arrangements, with a market cap of approximately A$2.34 billion.

Operations: The company generates revenue primarily from royalty arrangements, with recent figures showing A$240.51 million. The cost of goods sold (COGS) is relatively low, most recently at A$9.08 million, leading to a gross profit margin of 96.22%. Operating expenses and non-operating expenses are minimal compared to revenue, contributing to a net income margin of 64.40%.

PE: 12.8x

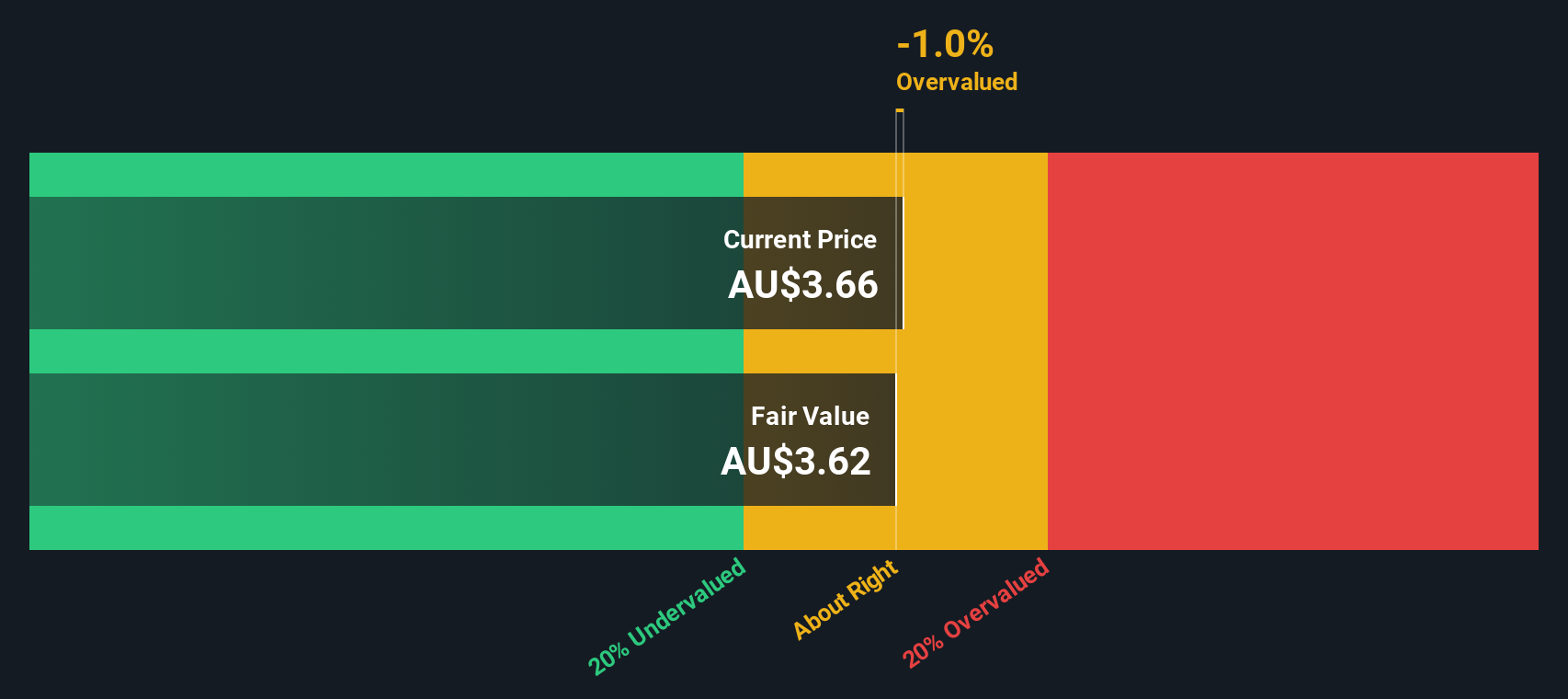

Deterra Royalties, a small cap in Australia, recently reported net income of A$154.89 million for the year ending June 2024, slightly up from A$152.46 million the previous year. The company declared a cash dividend of A$0.144 per share payable on September 24, 2024. Despite earnings forecasted to decline by an average of 6.6% annually over the next three years, insider confidence is evident with significant share purchases in recent months, indicating potential undervaluation and future growth prospects despite higher risk external funding sources.

- Click here to discover the nuances of Deterra Royalties with our detailed analytical valuation report.

Understand Deterra Royalties' track record by examining our Past report.

Sims (ASX:SGM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sims operates in the metal recycling and electronics reuse sectors with a market cap of approximately A$2.87 billion.

Operations: The company's revenue primarily comes from North America Metals (A$4.49 billion) and Australia/New Zealand Metals (A$1.60 billion), with additional contributions from Global Trading and Sims Lifecycle Services. Gross profit margin has shown variability, peaking at 14.22% on December 31, 2016, while net income margins have ranged from -5.39% to 6.46%. Operating expenses generally include depreciation and amortization costs along with non-operating expenses that can significantly impact net income outcomes over different periods.

PE: 1329.3x

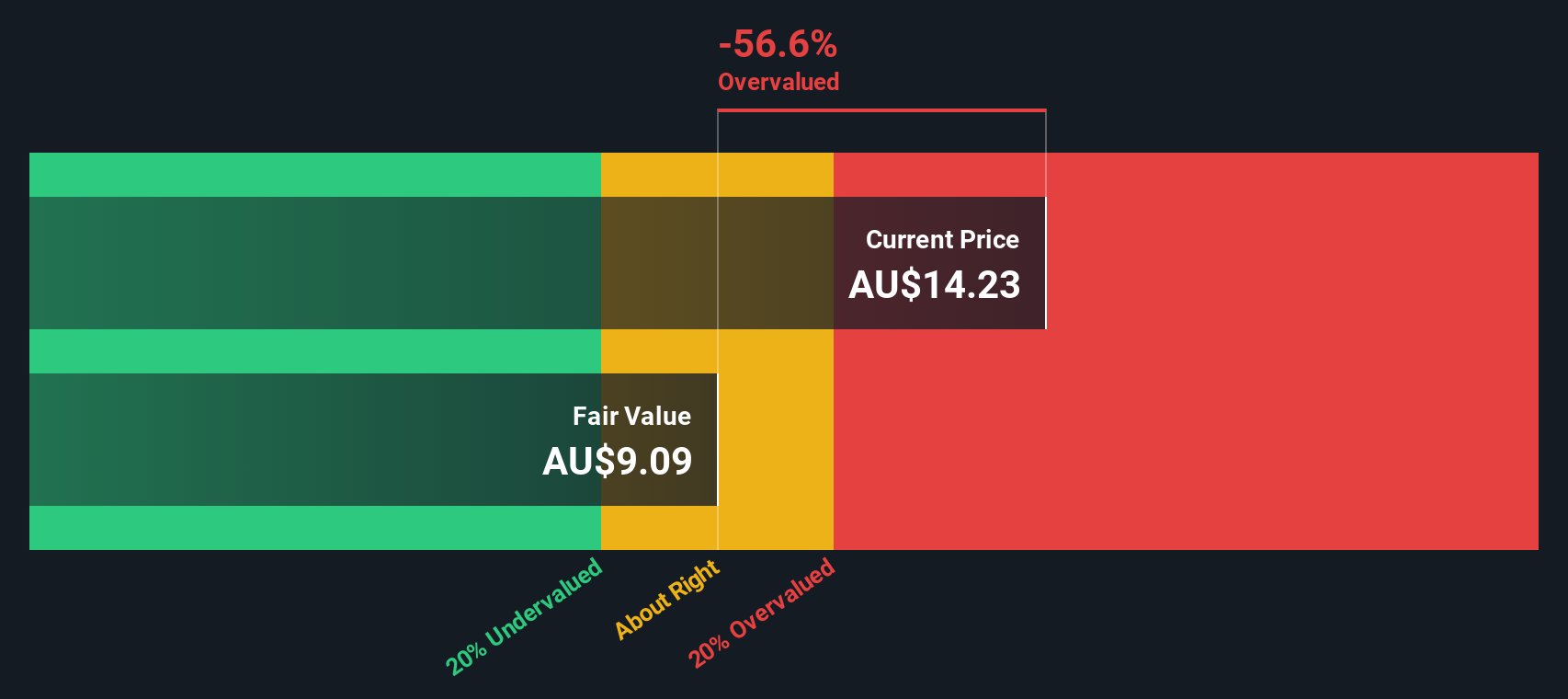

Sims Limited, a small cap stock in Australia, has shown insider confidence with recent purchases by executives in July 2024. Despite reporting a net loss of A$57.8 million for the year ended June 30, 2024, compared to a net income of A$181.1 million last year, the company’s revenue grew to A$7.22 billion from A$6.66 billion. The dividend was decreased to A$0.10 per share for the same period but remains payable on October 16, 2024.

- Click to explore a detailed breakdown of our findings in Sims' valuation report.

Review our historical performance report to gain insights into Sims''s past performance.

Next Steps

- Access the full spectrum of 23 Undervalued ASX Small Caps With Insider Buying by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTD

Corporate Travel Management

A travel management solutions company, manages the procurement and delivery of travel services in Australia and New Zealand, North America, Asia, and Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives