- Australia

- /

- Metals and Mining

- /

- ASX:SFR

Sandfire Resources (ASX:SFR) shareholder returns have been stellar, earning 124% in 5 years

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Sandfire Resources share price has climbed 87% in five years, easily topping the market return of 26% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 65%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Sandfire Resources

Sandfire Resources isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 5 years Sandfire Resources saw its revenue grow at 18% per year. That's well above most pre-profit companies. While the compound gain of 13% per year is good, it's not unreasonable given the strong revenue growth. If you think there could be more growth to come, now might be the time to take a close look at Sandfire Resources. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

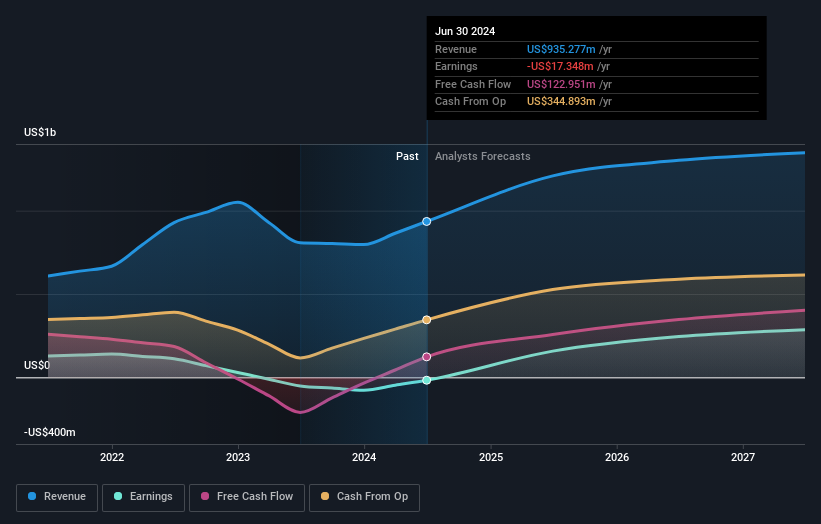

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Sandfire Resources is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About The Total Shareholder Return (TSR)?

We've already covered Sandfire Resources' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Sandfire Resources shareholders, and that cash payout contributed to why its TSR of 124%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that Sandfire Resources shareholders have received a total shareholder return of 65% over one year. That gain is better than the annual TSR over five years, which is 17%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before spending more time on Sandfire Resources it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SFR

Sandfire Resources

A mining company, engages in the exploration, evaluation, and development of mineral tenements and projects.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives