Downgrade: What You Need To Know About The Latest SciDev Limited (ASX:SDV) Forecasts

One thing we could say about the covering analyst on SciDev Limited (ASX:SDV) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) estimates were cut sharply as the analyst factored in the latest outlook for the business, concluding that they were too optimistic previously.

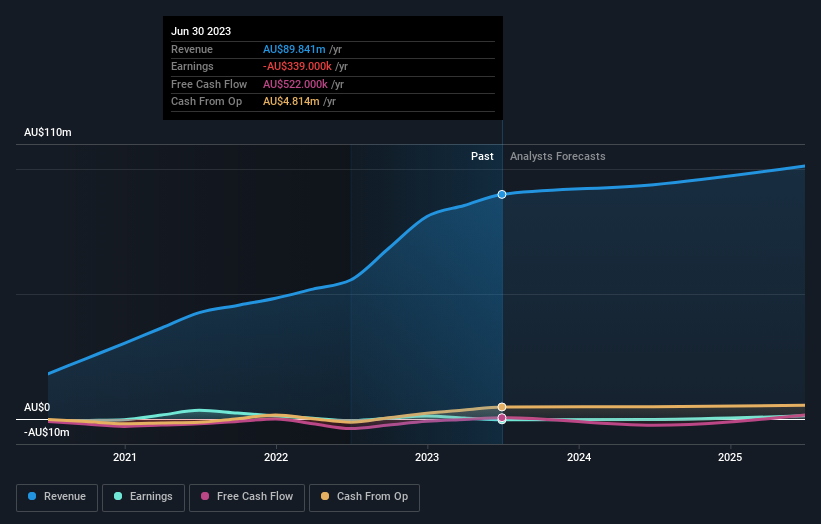

Following the downgrade, the latest consensus from SciDev's single analyst is for revenues of AU$94m in 2024, which would reflect a credible 4.3% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 44% to AU$0.001 per share. Prior to this update, the analyst had been forecasting revenues of AU$107m and earnings per share (EPS) of AU$0.013 in 2024. There looks to have been a major change in sentiment regarding SciDev's prospects, with a measurable cut to revenues and the analyst now forecasting a loss instead of a profit.

View our latest analysis for SciDev

The consensus price target fell 20% to AU$0.40, implicitly signalling that lower earnings per share are a leading indicator for SciDev's valuation.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that SciDev's revenue growth is expected to slow, with the forecast 4.3% annualised growth rate until the end of 2024 being well below the historical 55% p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 9.8% annually. Factoring in the forecast slowdown in growth, it seems obvious that SciDev is also expected to grow slower than other industry participants.

The Bottom Line

The biggest low-light for us was that the forecasts for SciDev dropped from profits to a loss this year. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of SciDev.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2025, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SDV

SciDev

Engages in the provision of environmental solutions focused on water intensive industries in Australia, the United States, Asia, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)