- Australia

- /

- Metals and Mining

- /

- ASX:S32

South32 (ASX:S32) Teams With US on Alaska Critical Minerals Will This Strengthen Its Strategic Position?

Reviewed by Sasha Jovanovic

- Earlier this month, Trilogy Metals, South32, and Ambler Metals announced a binding letter of intent with the U.S. Department of War to advance exploration and development at the Upper Kobuk Mineral Projects in Alaska, which includes the U.S. government acquiring a 10% stake in Trilogy Metals for US$17.8 million.

- This partnership is aligned with broader U.S. initiatives to secure supply chains for critical minerals, enhancing South32’s involvement in projects considered important to national security.

- We'll assess how South32's participation in a U.S.-backed critical minerals initiative could influence its long-term investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

South32 Investment Narrative Recap

To invest in South32, you need to believe in the company's ability to navigate commodity cycles, deliver consistent growth across a diverse base metals portfolio, and execute on new projects that support global energy transition themes. The recent partnership with the U.S. government to develop the Upper Kobuk Mineral Projects is a positive headline, but it does not directly address short-term risks tied to South32's exposure to power supply issues at key aluminum assets in Mozambique and South Africa, nor does it significantly shift the central near-term catalyst: disciplined progress at core copper and base metals projects.

Of the recent announcements, the update on Mozal Aluminium’s power negotiations stands out due to its direct impact on operations, earnings, and future asset value. While the U.S.-backed minerals initiative strengthens South32’s growth pipeline, ongoing uncertainty over affordable electricity supply at Mozal highlights how unpredictable energy markets and infrastructure constraints still pose significant operational and financial risks for the company.

However, investors should be aware that unlike the optimism from U.S. project news, risks tied to electricity supply and cost inflation at South32's African operations remain unresolved and could...

Read the full narrative on South32 (it's free!)

South32's narrative projects $6.8 billion revenue and $1.1 billion earnings by 2028. This requires 4.5% yearly revenue growth and a $782 million earnings increase from $318.0 million today.

Uncover how South32's forecasts yield a A$3.11 fair value, in line with its current price.

Exploring Other Perspectives

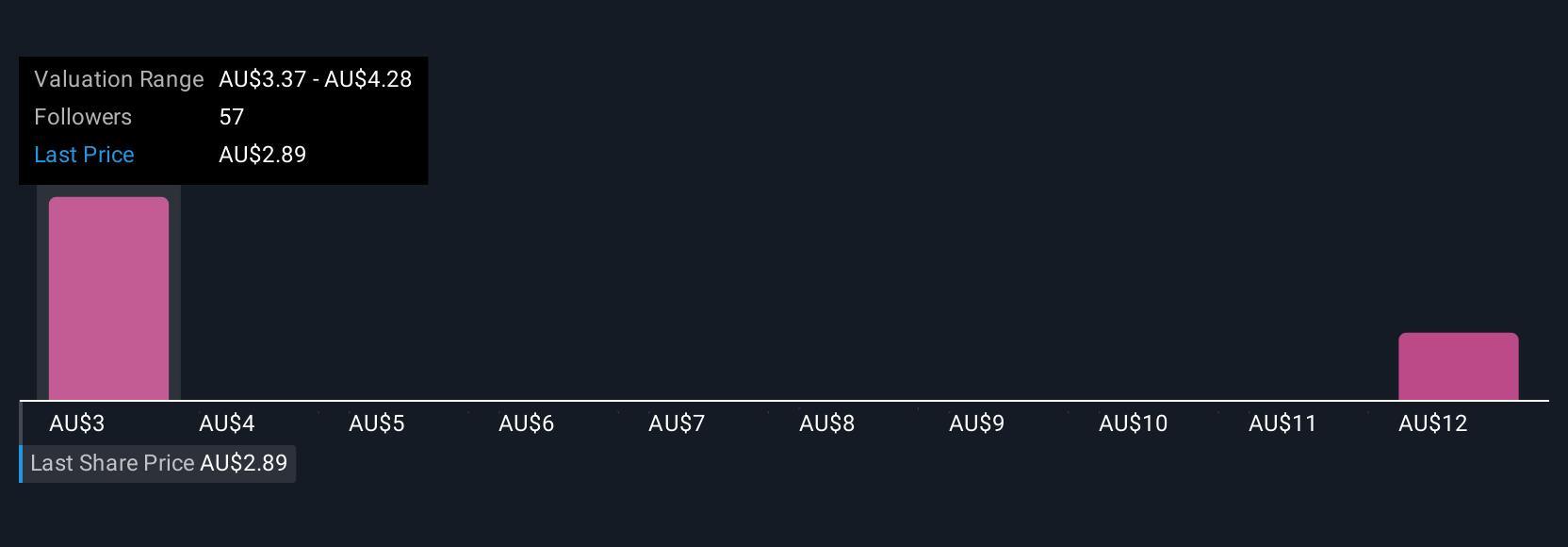

Six fair value estimates from the Simply Wall St Community range from A$2.50 to A$4.68 per share, reflecting widely different expectations on South32’s outlook. You can compare this range with the ongoing uncertainty around power contracts at key assets, which may have broader consequences for the company’s longer-term performance.

Explore 6 other fair value estimates on South32 - why the stock might be worth 20% less than the current price!

Build Your Own South32 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your South32 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free South32 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate South32's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:S32

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives