- Australia

- /

- Metals and Mining

- /

- ASX:RSG

Are Robust Financials Driving The Recent Rally In Resolute Mining Limited's (ASX:RSG) Stock?

Resolute Mining's (ASX:RSG) stock is up by a considerable 30% over the past month. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. In this article, we decided to focus on Resolute Mining's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Resolute Mining

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Resolute Mining is:

32% = US$183m ÷ US$571m (Based on the trailing twelve months to December 2023).

The 'return' refers to a company's earnings over the last year. So, this means that for every A$1 of its shareholder's investments, the company generates a profit of A$0.32.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Resolute Mining's Earnings Growth And 32% ROE

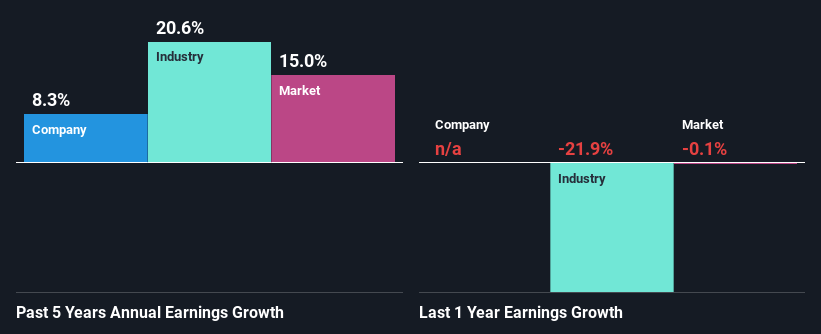

First thing first, we like that Resolute Mining has an impressive ROE. Secondly, even when compared to the industry average of 10% the company's ROE is quite impressive. This probably laid the groundwork for Resolute Mining's moderate 8.3% net income growth seen over the past five years.

As a next step, we compared Resolute Mining's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 21% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Resolute Mining is trading on a high P/E or a low P/E, relative to its industry.

Is Resolute Mining Using Its Retained Earnings Effectively?

Resolute Mining doesn't pay any dividend, meaning that all of its profits are being reinvested in the business, which explains the fair bit of earnings growth the company has seen.

Summary

Overall, we are quite pleased with Resolute Mining's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a respectable growth in its earnings. That being so, according to the latest industry analyst forecasts, the company's earnings are expected to shrink in the future. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RSG

Resolute Mining

Engages in mining, prospecting, and exploration of mineral properties in Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives