- Australia

- /

- Commercial Services

- /

- ASX:CLG

Close the Loop Leads 3 ASX Penny Stocks With Growth Potential

Reviewed by Simply Wall St

The Australian market is showing signs of caution, with the ASX 200 projected to open lower following global geopolitical tensions and mixed performances in international markets. Amidst this backdrop, investors are increasingly looking for opportunities that balance risk and potential reward. Penny stocks, while traditionally seen as speculative investments, can offer unique opportunities when backed by solid financial foundations. In this article, we explore three such stocks on the ASX that combine financial strength with growth potential, offering investors a chance to uncover hidden value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$332.15M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.53 | A$328.68M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.80 | A$232.15M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.205 | A$1.11B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.875 | A$127.72M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.94 | A$487.41M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Close the Loop (ASX:CLG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Close the Loop Ltd operates in the collection and recycling of electronic equipment, imaging consumables, plastics, paper and cartons across Australia, Europe, South Africa, and the United States with a market cap of A$130.30 million.

Operations: The company generates revenue from its Packaging segment, which accounts for A$66.83 million, and its Resource Recovery segment, contributing A$146.13 million.

Market Cap: A$130.3M

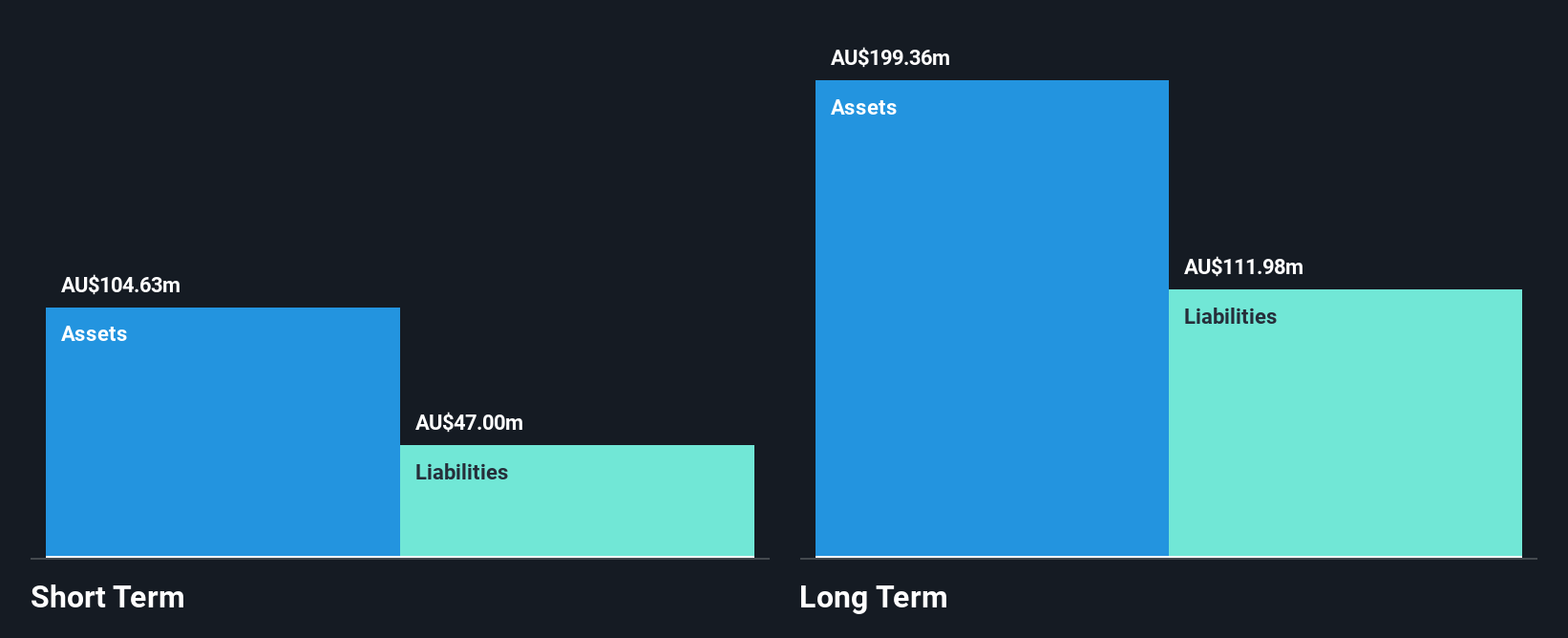

Close the Loop Ltd has recently been in the spotlight due to a proposed acquisition by Adamantem Capital Management Pty Ltd, offering A$0.27 per share. The company reported A$212.96 million in sales for fiscal year 2024, with net income slightly down at A$10.95 million from the previous year. Despite shareholder dilution and volatile share prices, Close the Loop maintains satisfactory debt levels and covers its short-term liabilities with assets of A$99.8 million against liabilities of A$45.5 million. However, profit margins have declined to 5.1%, and interest coverage remains weak at 2.3x EBIT.

- Take a closer look at Close the Loop's potential here in our financial health report.

- Explore Close the Loop's analyst forecasts in our growth report.

Ramelius Resources (ASX:RMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ramelius Resources Limited is involved in the exploration, evaluation, mine development and operation, production, and sale of gold with a market capitalization of A$2.38 billion.

Operations: The company's revenue is derived from its operations at Edna May, contributing A$399.34 million, and Mt Magnet, generating A$483.23 million.

Market Cap: A$2.38B

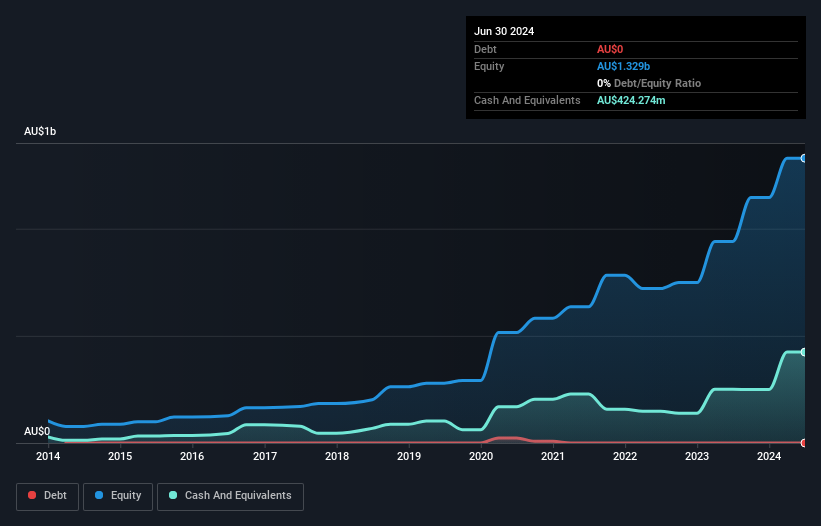

Ramelius Resources has demonstrated significant earnings growth, with a 251.8% increase over the past year, outpacing its five-year average of 4.1%. The company's operations at Edna May and Mt Magnet contribute substantial revenues of A$399.34 million and A$483.23 million respectively, leading to a net income rise from A$61.56 million to A$216.58 million year-over-year. Trading at an attractive price-to-earnings ratio of 11x compared to the broader Australian market's 19.5x, Ramelius Resources remains debt-free with strong short-term asset coverage over liabilities, indicating solid financial health despite forecasted earnings decline ahead.

- Click here to discover the nuances of Ramelius Resources with our detailed analytical financial health report.

- Assess Ramelius Resources' future earnings estimates with our detailed growth reports.

Weebit Nano (ASX:WBT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Weebit Nano Limited develops non-volatile memory using Resistive RAM (ReRAM) technology with operations in Israel and France, and has a market cap of A$636.17 million.

Operations: The company's revenue is derived entirely from its Memory and Semiconductor Technology Development segment, amounting to A$1.02 million.

Market Cap: A$636.17M

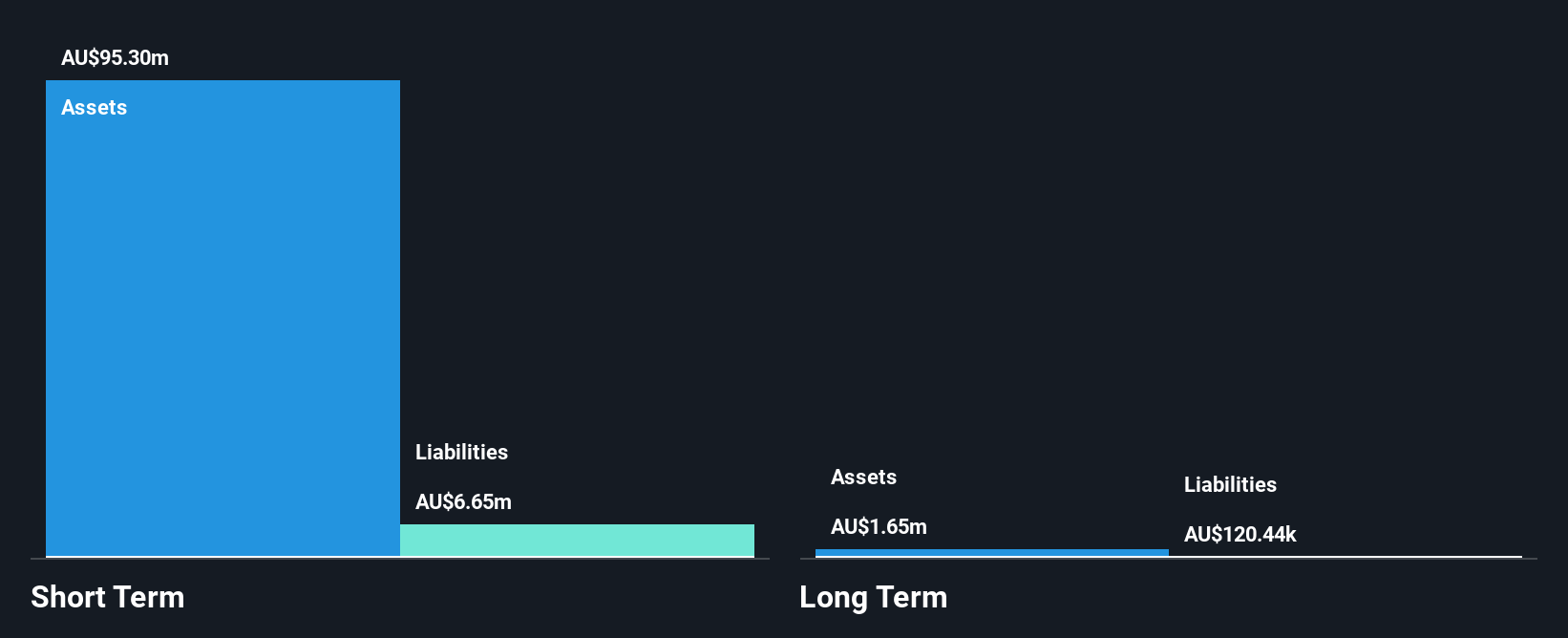

Weebit Nano Limited, with a market cap of A$636.17 million, remains pre-revenue as it focuses on developing ReRAM technology. The company recently completed a follow-on equity offering raising A$50 million, which strengthens its financial position and extends its cash runway beyond three years without debt concerns. Despite stable weekly volatility and sufficient short-term asset coverage over liabilities, Weebit Nano is unprofitable with increasing losses over the past five years at 41.5% annually. Revenue is forecast to grow significantly at 76.05% per year, yet profitability isn't expected within the next three years according to analyst estimates.

- Unlock comprehensive insights into our analysis of Weebit Nano stock in this financial health report.

- Review our growth performance report to gain insights into Weebit Nano's future.

Where To Now?

- Navigate through the entire inventory of 1,044 ASX Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Close the Loop, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CLG

Close the Loop

Engages in the collection and recycling of electronic equipment, imaging consumables, plastics, paper and cartons, and other related activities in Australia, Europe, South Africa, and the United States.

Undervalued with moderate growth potential.

Market Insights

Community Narratives