- Australia

- /

- Capital Markets

- /

- ASX:PTM

October 2024's ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market has shown mixed performance, with the ASX200 closing up slightly by 0.12% at 8221 points, driven by gains in the IT and Discretionary sectors while Utilities faced losses. In this context, penny stocks—often smaller or newer companies—remain a niche yet intriguing investment area due to their potential for growth at lower price points. Despite being considered an outdated term, these stocks can still offer significant opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.615 | A$72.68M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.79 | A$286.72M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.85 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$353.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.655 | A$825.78M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.465 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.07 | A$117.4M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.44 | A$151.04M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$56.64M | ★★★★★★ |

Click here to see the full list of 1,028 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Oneview Healthcare (ASX:ONE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oneview Healthcare PLC develops and sells software and consultancy services for the healthcare sector across Ireland, the United States, Australia, Asia, and the Middle East with a market cap of A$222.48 million.

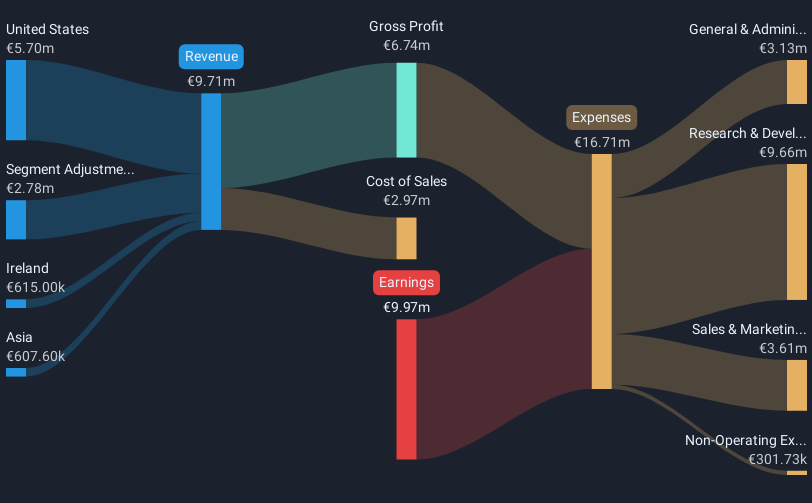

Operations: The company generates revenue of €9.71 million from its Patient Engagement Solution for the healthcare sector.

Market Cap: A$222.48M

Oneview Healthcare has expanded its partnership with Epworth HealthCare, enhancing its Care Experience Platform across over 100 locations, which may bolster revenue generation. Despite being unprofitable with a negative return on equity, Oneview's short-term assets exceed both short and long-term liabilities, indicating financial stability. The company is debt-free and has reduced losses by 13% annually over five years. However, it faces challenges with less than a year of cash runway based on current free cash flow. Management's average tenure of 3.5 years suggests experienced leadership amid recent board changes.

- Click to explore a detailed breakdown of our findings in Oneview Healthcare's financial health report.

- Assess Oneview Healthcare's future earnings estimates with our detailed growth reports.

Platinum Investment Management (ASX:PTM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Platinum Investment Management Limited is a publicly owned hedge fund sponsor with a market cap of A$666.94 million.

Operations: The company's revenue is primarily derived from Funds Management, which generated A$178.63 million, complemented by Investments and Other contributing A$6.35 million.

Market Cap: A$666.94M

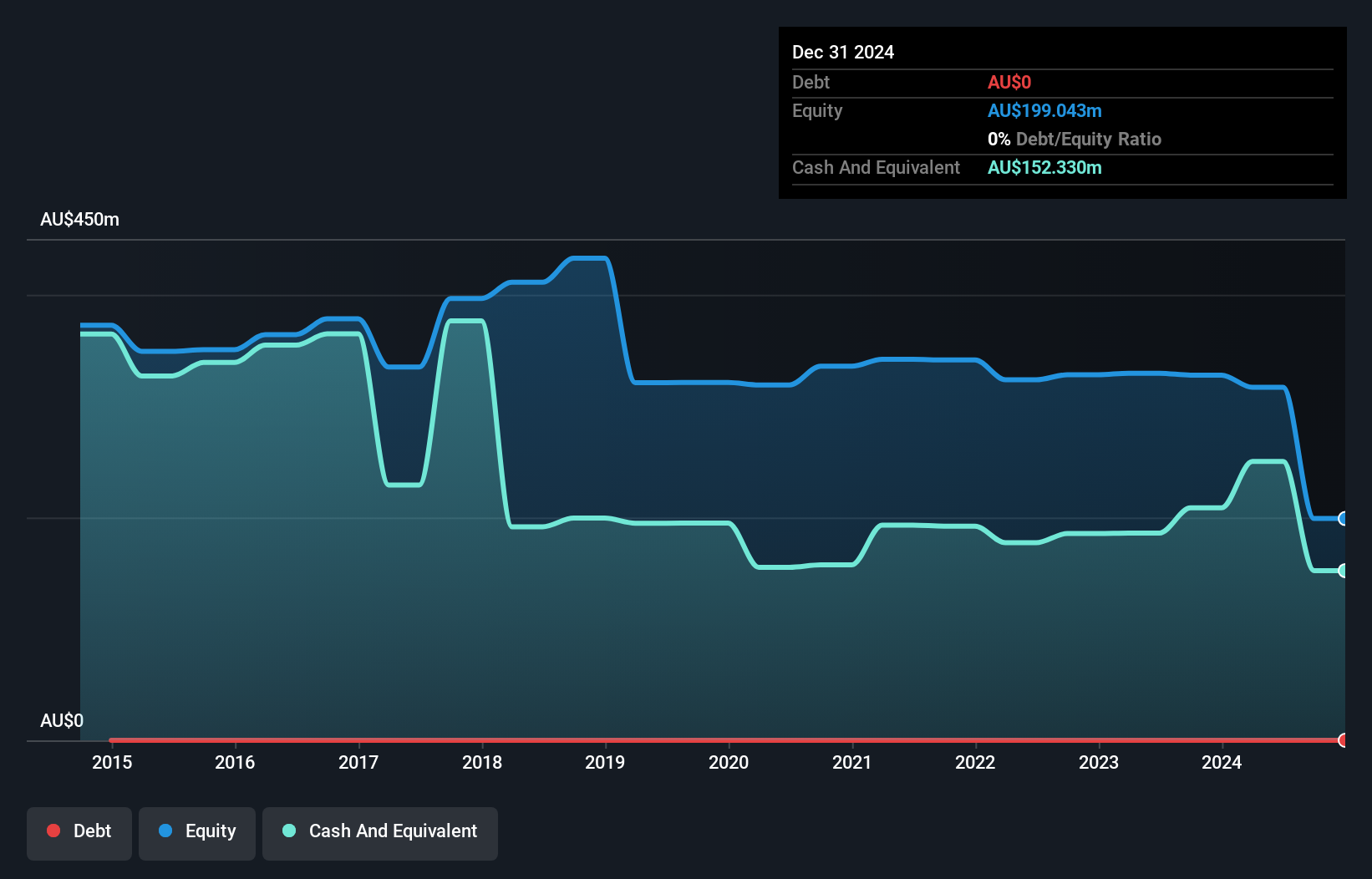

Platinum Investment Management Limited, with a market cap of A$666.94 million, primarily generates revenue from funds management, totaling A$178.63 million. The company has no debt and maintains strong financial health, as short-term assets significantly exceed liabilities. However, recent earnings have declined sharply by 44.3%, and profit margins fell to 24.3% from 37.3% last year, raising concerns about profitability sustainability given the dividend is not well-covered by earnings at 6.72%. Despite stable weekly volatility and experienced leadership averaging over eight years in tenure, future earnings are forecasted to decline slightly by 2.5% annually over three years.

- Jump into the full analysis health report here for a deeper understanding of Platinum Investment Management.

- Examine Platinum Investment Management's earnings growth report to understand how analysts expect it to perform.

Rimfire Pacific Mining (ASX:RIM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rimfire Pacific Mining Limited is an Australian company focused on the exploration and evaluation of mineral deposits, with a market cap of A$130.83 million.

Operations: Rimfire Pacific Mining Limited does not have reported revenue segments.

Market Cap: A$130.83M

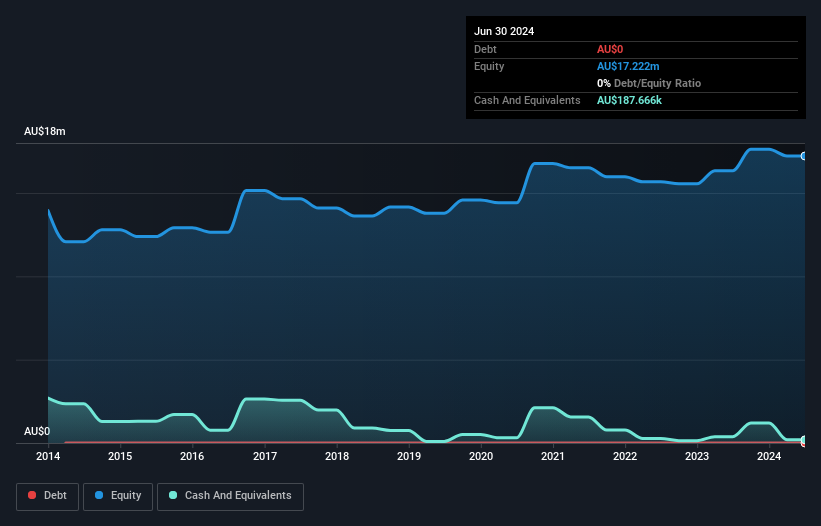

Rimfire Pacific Mining Limited, with a market cap of A$130.83 million, is pre-revenue and currently unprofitable, reporting a net loss of A$1.46 million for the year ending June 2024. The company has experienced shareholder dilution with shares outstanding increasing by 9% over the past year and faces high share price volatility. Despite being debt-free and having an experienced management team, Rimfire's short-term assets (A$385.5K) are insufficient to cover its short-term liabilities (A$423.1K). The company recently raised additional capital to extend its cash runway beyond one month as of June 2024.

- Click here to discover the nuances of Rimfire Pacific Mining with our detailed analytical financial health report.

- Examine Rimfire Pacific Mining's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Gain an insight into the universe of 1,028 ASX Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PTM

Flawless balance sheet and undervalued.