- Australia

- /

- Metals and Mining

- /

- ASX:RIL

3 Promising ASX Penny Stocks With Market Caps Over A$10M

Reviewed by Simply Wall St

The Australian market remained flat over the last week, but it has seen a 22% rise in the past 12 months, with earnings forecasted to grow by 12% annually. For investors willing to explore beyond established names, penny stocks—often smaller or newer companies—can offer intriguing opportunities. While the term might seem outdated, these stocks can still provide significant growth potential when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Close the Loop (ASX:CLG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Close the Loop Ltd operates in the collection and recycling of electronic equipment, imaging consumables, plastics, paper and cartons across Australia, Europe, South Africa, and the United States with a market cap of A$101.05 million.

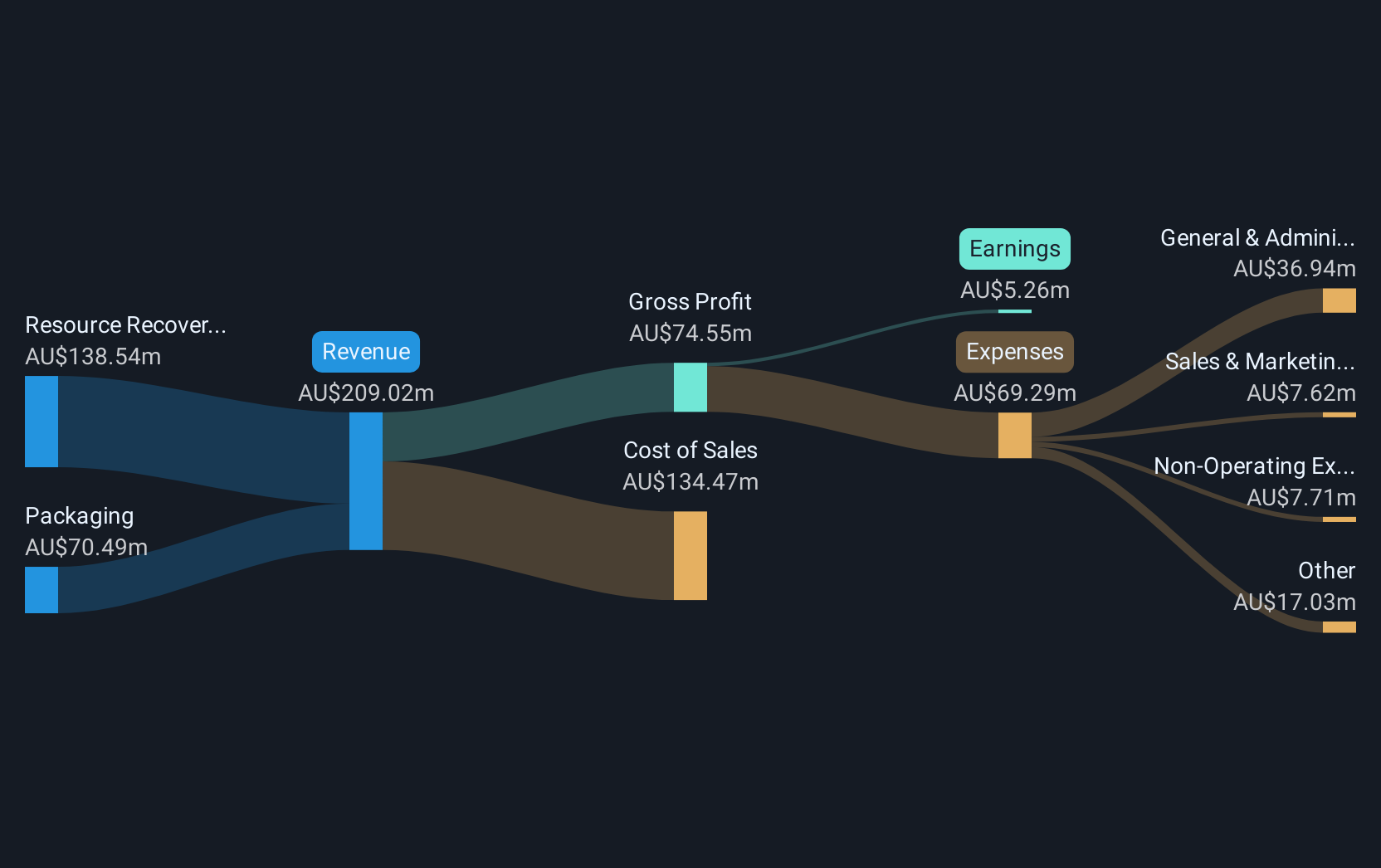

Operations: The company generates revenue from two main segments: Packaging, which accounts for A$66.83 million, and Resource Recovery, contributing A$146.13 million.

Market Cap: A$101.05M

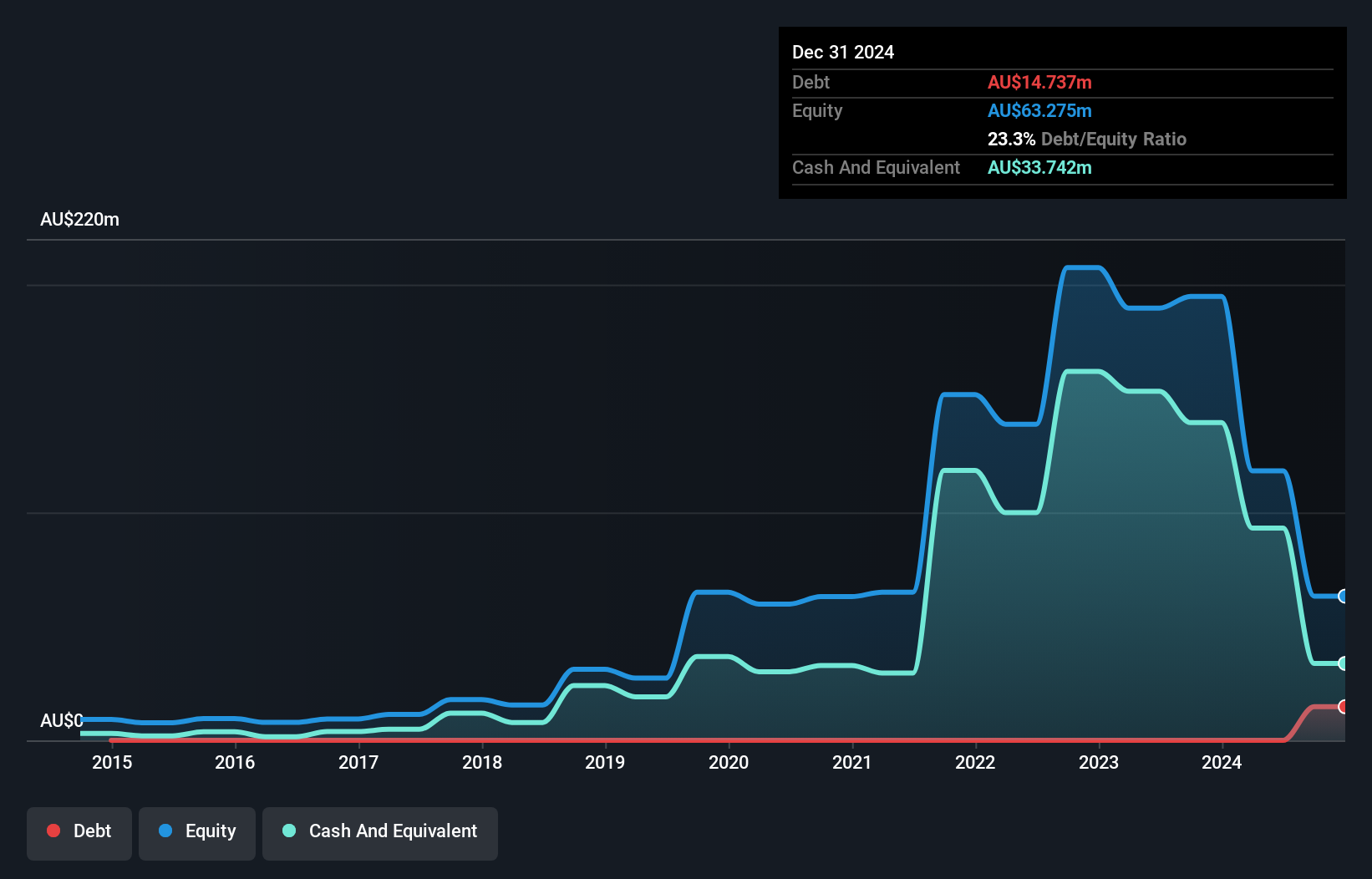

Close the Loop Ltd, with a market cap of A$101.05 million, operates in packaging and resource recovery, generating significant revenue from these segments. Despite trading at a value below its estimated fair value and having high-quality earnings, the company faces challenges such as negative earnings growth (-9.6%) over the past year and declining profit margins (5.1% from 8.9%). The board's lack of experience is notable with an average tenure of 2.9 years. However, debt reduction efforts are evident with improvements in their debt-to-equity ratio over five years to 58.5%.

- Get an in-depth perspective on Close the Loop's performance by reading our balance sheet health report here.

- Understand Close the Loop's earnings outlook by examining our growth report.

Imugene (ASX:IMU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Imugene Limited is a clinical stage immuno-oncology company in Australia that focuses on developing immunotherapies to activate the immune system of cancer patients, with a market cap of A$364.43 million.

Operations: The company generates A$4.97 million in revenue from the research, development, and commercialisation of health technologies.

Market Cap: A$364.43M

Imugene Limited, with a market cap of A$364.43 million, is focused on developing immunotherapies and remains pre-revenue with A$4.97 million in revenue from health technologies. The company is debt-free but faces financial challenges, having less than a year of cash runway and shareholders experiencing dilution over the past year. Recent promising results from its Phase 1b clinical trial for the azer-cel therapy in diffuse large B-cell lymphoma highlight potential advancements; however, Imugene's management team has limited experience with an average tenure of 1.6 years, which may impact strategic execution as they aim for further trials.

- Click here to discover the nuances of Imugene with our detailed analytical financial health report.

- Examine Imugene's earnings growth report to understand how analysts expect it to perform.

Redivium (ASX:RIL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Redivium Limited operates in the battery recycling industry and has a market capitalization of A$16.97 million.

Operations: Redivium Limited has not reported any specific revenue segments.

Market Cap: A$16.97M

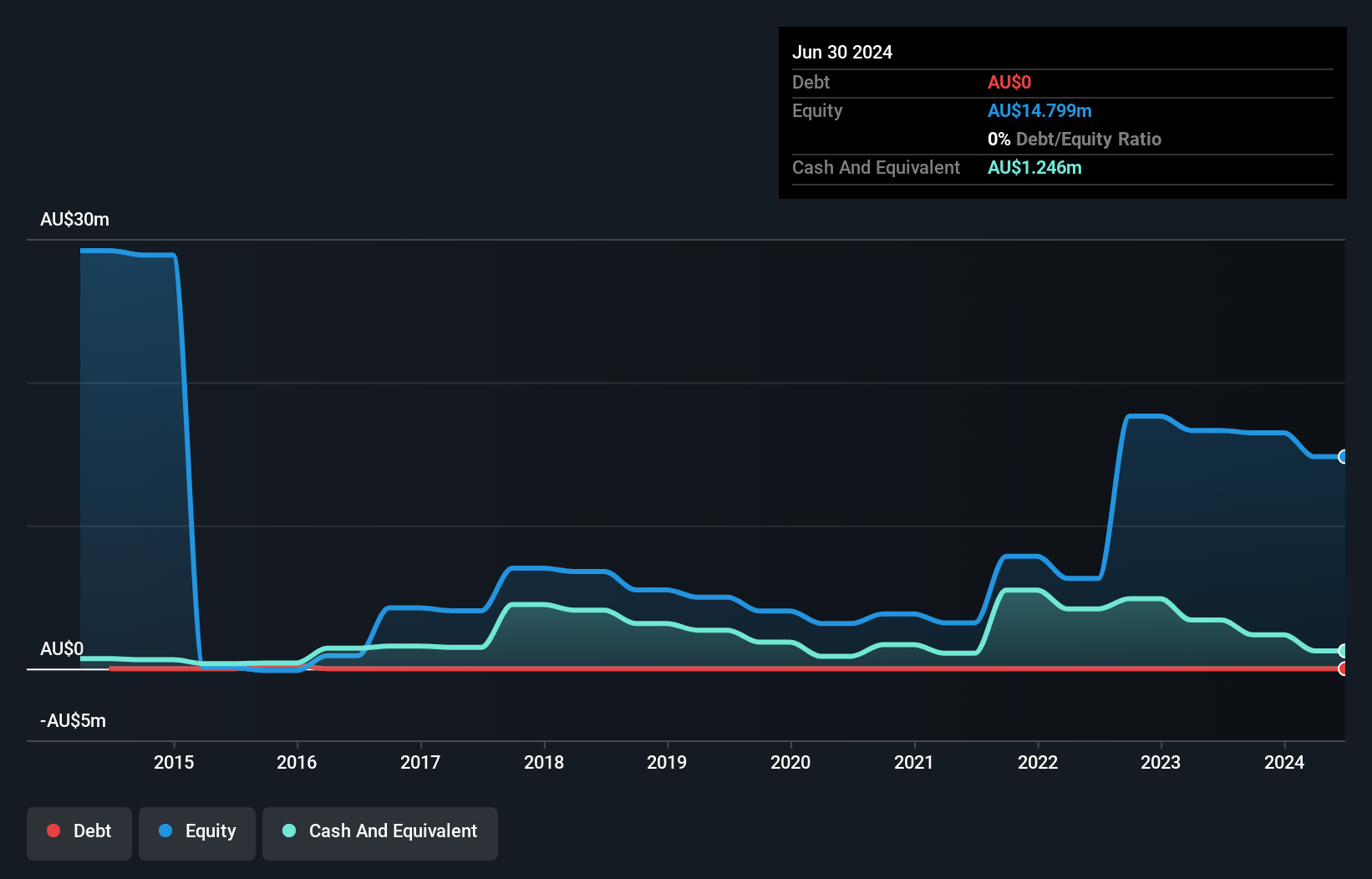

Redivium Limited, with a market cap of A$16.97 million, operates in the battery recycling sector and remains pre-revenue. The company is debt-free but has less than a year of cash runway, posing financial challenges. Its board lacks experience with an average tenure of 1.8 years, potentially affecting strategic decisions. Despite being unprofitable and having losses increase by 16.9% annually over five years, recent results show a reduced net loss from A$4.99 million to A$2.45 million for the year ended June 30, 2024, indicating some progress in managing its financial performance amidst high share price volatility.

- Navigate through the intricacies of Redivium with our comprehensive balance sheet health report here.

- Understand Redivium's track record by examining our performance history report.

Summing It All Up

- Investigate our full lineup of 1,027 ASX Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RIL

Flawless balance sheet slight.

Market Insights

Community Narratives