3 ASX Stocks Estimated To Be Trading At Discounts Of Up To 49.5%

Reviewed by Simply Wall St

The Australian market has seen mixed movements recently, with the ASX200 closing flat at 8,484 points as gains in some sectors were offset by a significant sell-off in index giant CSL. Amid these fluctuations and global economic considerations such as potential tariff exemptions on Aussie steel and aluminium, investors are increasingly seeking opportunities in undervalued stocks that could offer growth potential despite current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SKS Technologies Group (ASX:SKS) | A$2.01 | A$3.77 | 46.7% |

| Mader Group (ASX:MAD) | A$6.21 | A$11.88 | 47.7% |

| Nick Scali (ASX:NCK) | A$17.12 | A$32.14 | 46.7% |

| Atlas Arteria (ASX:ALX) | A$4.98 | A$9.59 | 48.1% |

| Symal Group (ASX:SYL) | A$1.98 | A$3.78 | 47.7% |

| MLG Oz (ASX:MLG) | A$0.62 | A$1.16 | 46.6% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.07 | 48.1% |

| South32 (ASX:S32) | A$3.43 | A$6.59 | 48% |

| Pantoro (ASX:PNR) | A$0.135 | A$0.27 | 49.5% |

| Sandfire Resources (ASX:SFR) | A$10.72 | A$20.38 | 47.4% |

Let's uncover some gems from our specialized screener.

Pantoro (ASX:PNR)

Overview: Pantoro Limited is involved in gold mining, processing, and exploration activities in Western Australia with a market cap of A$839.02 million.

Operations: The company's revenue segment includes the Norseman Gold Project, which generated A$229.43 million.

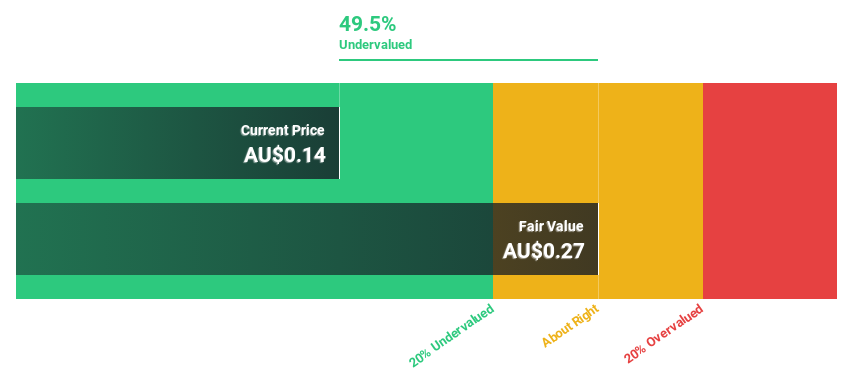

Estimated Discount To Fair Value: 49.5%

Pantoro is trading at A$0.14, significantly below its estimated fair value of A$0.27, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow annually by 51.53%, with revenue growth expected to outpace the Australian market at 17.9% per year. Despite past shareholder dilution, Pantoro's profitability is projected within three years, supported by strategic leadership changes with the appointment of Stuart Mathews as an Independent Non-Executive Director.

- Our expertly prepared growth report on Pantoro implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Pantoro with our detailed financial health report.

SiteMinder (ASX:SDR)

Overview: SiteMinder Limited develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.78 billion.

Operations: The company generates revenue from its Software & Programming segment, amounting to A$190.84 million.

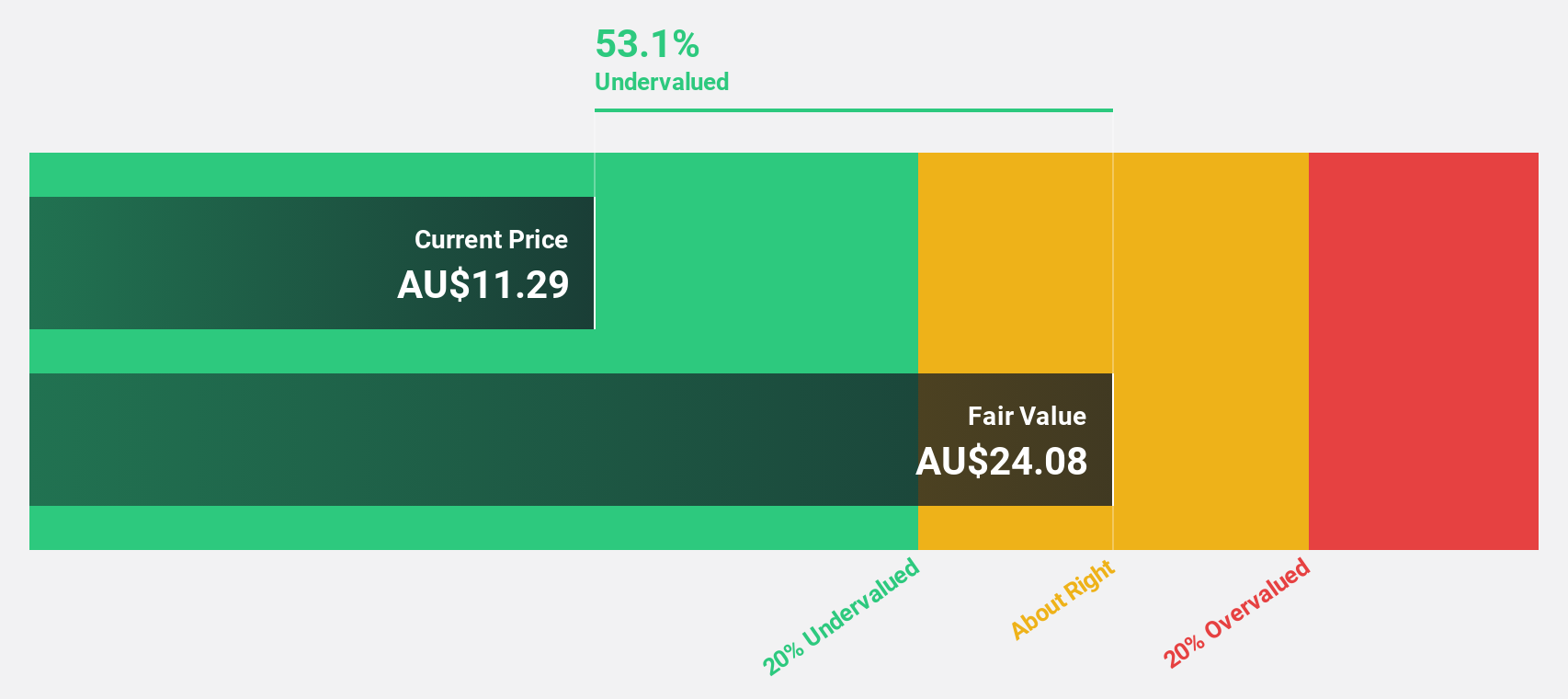

Estimated Discount To Fair Value: 30.7%

SiteMinder is trading at A$6.50, below its estimated fair value of A$9.38, reflecting potential undervaluation based on cash flows. The company is expected to achieve profitability within three years, with earnings forecasted to grow 61.07% annually and revenue growth projected at 19.5% per year—outpacing the Australian market average of 5.9%. Additionally, SiteMinder's return on equity is anticipated to be high in three years, enhancing its investment appeal.

- The growth report we've compiled suggests that SiteMinder's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in SiteMinder's balance sheet health report.

Sandfire Resources (ASX:SFR)

Overview: Sandfire Resources Limited is a mining company focused on the exploration, evaluation, and development of mineral tenements and projects, with a market cap of A$4.86 billion.

Operations: The company's revenue segments comprise $346.47 million from the Motheo Copper Project, $565.68 million from MATSA Copper Operations, and $29.40 million from Degrussa Copper Operations.

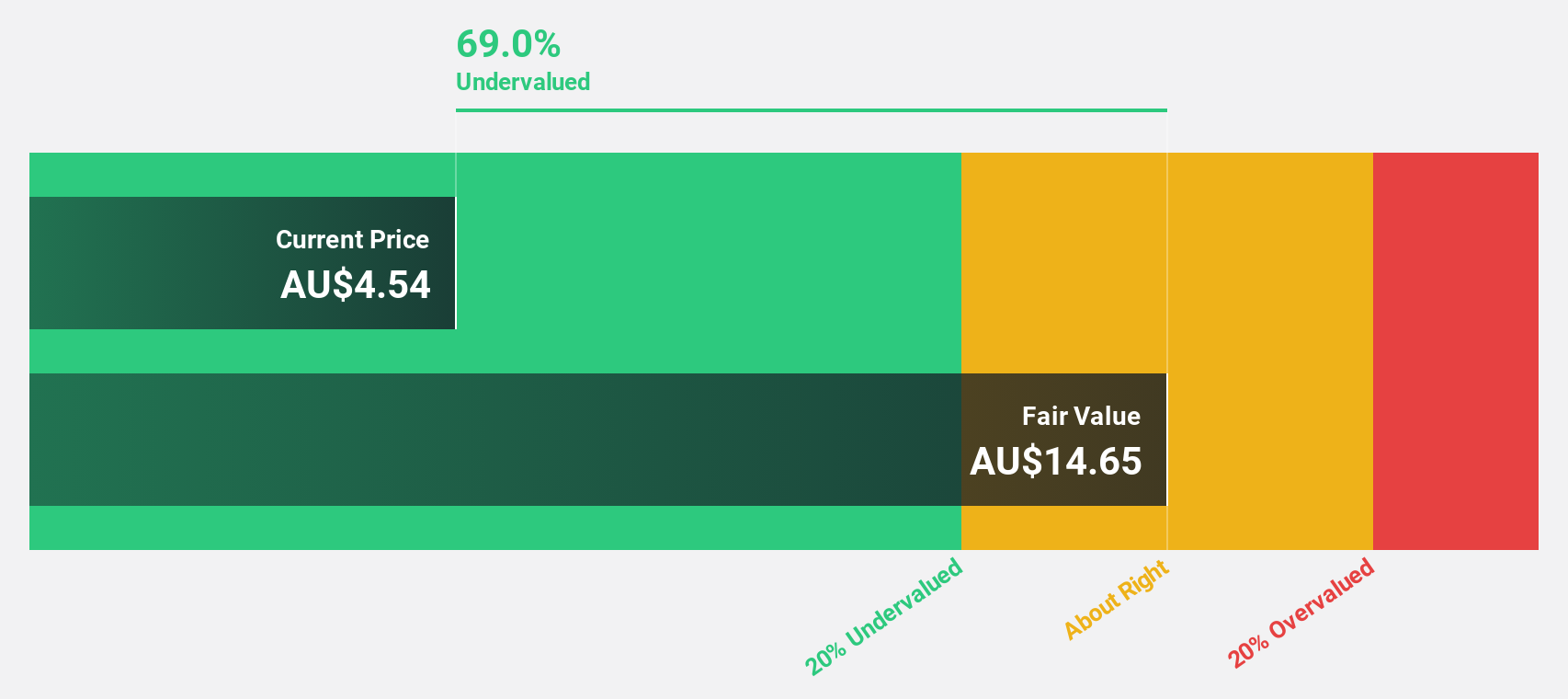

Estimated Discount To Fair Value: 47.4%

Sandfire Resources is trading at A$10.72, significantly below its estimated fair value of A$20.38, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 40.4% annually, with the company expected to turn profitable within three years—surpassing average market growth. Revenue is forecasted to increase by 9.8% per year, outpacing the Australian market's 5.9%. However, return on equity remains low at a forecasted 11.8%.

- Our earnings growth report unveils the potential for significant increases in Sandfire Resources' future results.

- Unlock comprehensive insights into our analysis of Sandfire Resources stock in this financial health report.

Summing It All Up

- Investigate our full lineup of 48 Undervalued ASX Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDR

SiteMinder

Provides software and online licensing solutions in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion