- Australia

- /

- Metals and Mining

- /

- ASX:PNR

3 Undervalued Small Caps In Global With Insider Buying

Reviewed by Simply Wall St

In recent weeks, global markets have been navigating a complex landscape of trade policy shifts and inflationary pressures, with U.S. stocks experiencing gains despite some late-week volatility. Smaller-cap indexes have shown resilience amid these broader market dynamics, presenting potential opportunities for investors seeking value in the small-cap sector. In this context, identifying promising small-cap stocks involves looking for those that demonstrate strong fundamentals and are well-positioned to benefit from current economic conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 12.0x | 0.5x | 34.10% | ★★★★★☆ |

| FRP Advisory Group | 12.3x | 2.2x | 14.77% | ★★★★☆☆ |

| Lion Rock Group | 5.0x | 0.4x | 49.92% | ★★★★☆☆ |

| Tristel | 27.4x | 3.9x | 12.78% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.5x | 45.96% | ★★★★☆☆ |

| Eastnine | 18.5x | 8.9x | 40.58% | ★★★★☆☆ |

| Savills | 24.6x | 0.5x | 42.19% | ★★★☆☆☆ |

| Italmobiliare | 11.9x | 1.6x | -219.09% | ★★★☆☆☆ |

| SmartCraft | 42.3x | 7.6x | 32.53% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.3x | 46.42% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

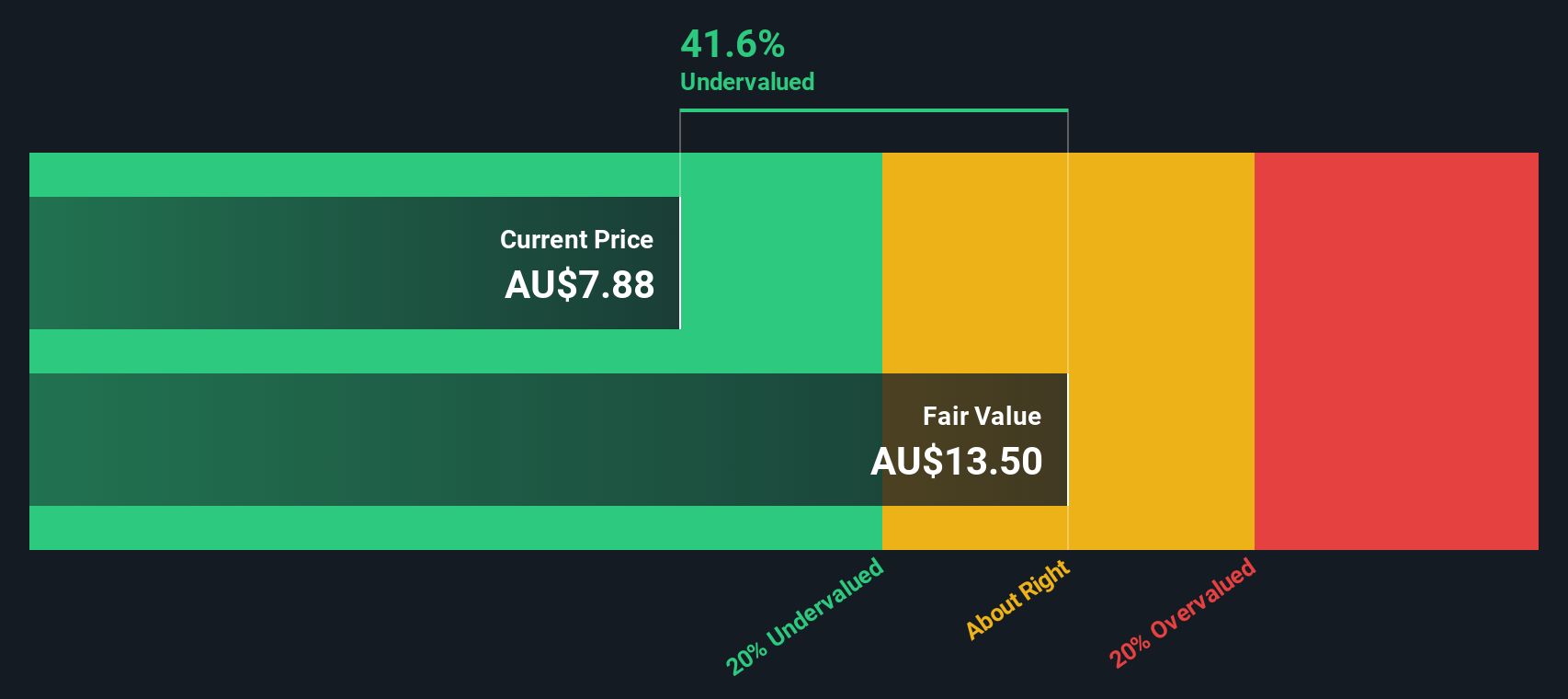

Amotiv (ASX:AOV)

Simply Wall St Value Rating: ★★★★★★

Overview: Amotiv specializes in manufacturing and supplying automotive components, focusing on powertrain and undercar systems, lighting power and electrical solutions, as well as 4WD accessories and trailering products, with a market cap of A$1.45 billion.

Operations: Amotiv generates revenue primarily from three segments: Powertrain & Undercar, Lighting Power & Electrical, and 4WD Accessories & Trailering. The company's gross profit margin has shown variability over time, with the most recent figure being 44.12%. Operating expenses are a significant part of the cost structure, with sales and marketing consistently being a major component.

PE: 13.3x

Amotiv, a smaller company with growth potential, is forecasted to increase earnings by 13% annually. This promising outlook is bolstered by insider confidence, as recent share purchases in April 2025 suggest optimism about future performance. However, the company's reliance on external borrowing for funding introduces higher risk. Investors should note that Amotiv's Q3 2025 results are anticipated soon, providing further insights into its trajectory and potential value within its industry context.

- Click here to discover the nuances of Amotiv with our detailed analytical valuation report.

Examine Amotiv's past performance report to understand how it has performed in the past.

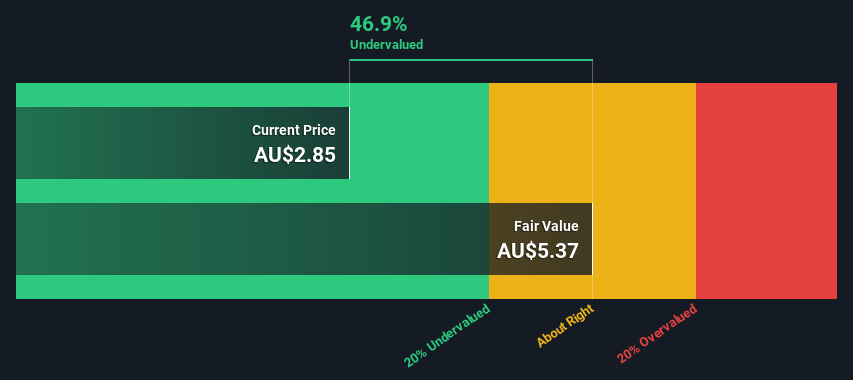

Pantoro Gold (ASX:PNR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pantoro Gold focuses on gold exploration and production, primarily through its Norseman Gold Project, with a market capitalization of A$0.12 billion.

Operations: Pantoro Gold generates revenue primarily from its operations at the Norseman Gold Project, with recent figures indicating A$289.11 million in revenue. The company has faced challenges in managing costs, as indicated by a gross profit margin of 0.71% and a net income of -A$26.89 million for the period ending December 2024. Operating expenses and non-operating expenses have been significant, affecting overall profitability despite increasing revenues over time.

PE: -53.7x

Pantoro Gold, a small-cap miner, is drawing attention with its forecasted 57% annual earnings growth. Despite relying on external borrowing for funding, the company shows promise through its ongoing drilling program at the OK Underground Mine. Recent results highlight strong continuity in key lodes, supporting potential ore reserve upgrades. Insider confidence is evident with share purchases throughout early 2025. The company reported a notable turnaround with A$6.62 million net income for H2 2024 compared to a prior loss.

- Click here and access our complete valuation analysis report to understand the dynamics of Pantoro Gold.

Gain insights into Pantoro Gold's historical performance by reviewing our past performance report.

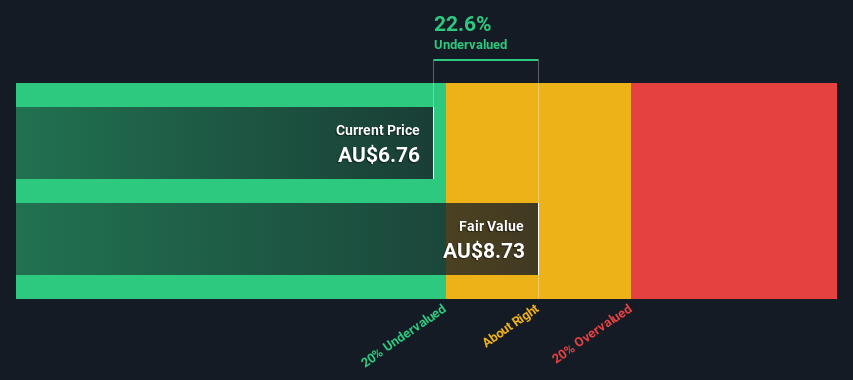

PWR Holdings (ASX:PWH)

Simply Wall St Value Rating: ★☆☆☆☆☆

Overview: PWR Holdings specializes in the design and manufacture of advanced cooling solutions for various industries, with a market capitalization of approximately A$1.15 billion.

Operations: PWR Holdings generates revenue primarily from its PWR Performance Products segment, contributing A$109.04 million, and the PWR C&R segment with A$46.48 million. The company has experienced fluctuations in its net income margin, which was 13.84% as of December 2024 after a decline from previous periods. Operating expenses have been increasing over time, impacting the overall profitability despite a gross profit margin of 79.69%.

PE: 36.8x

PWR Holdings, a small company in the automotive sector, shows potential for growth with earnings projected to rise by 24.66% annually. Despite relying entirely on external borrowing, which presents higher risk without customer deposits, insider confidence is evident as an Independent Non-Executive Director recently acquired 20,341 shares worth A$128,897. This purchase suggests belief in the company's future prospects and value proposition within its industry segment.

- Take a closer look at PWR Holdings' potential here in our valuation report.

Explore historical data to track PWR Holdings' performance over time in our Past section.

Make It Happen

- Click here to access our complete index of 180 Undervalued Global Small Caps With Insider Buying.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNR

Pantoro Gold

Engages in the gold mining, processing, and exploration activities in Western Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives