- Australia

- /

- Trade Distributors

- /

- ASX:IPG

Discovering Australia's Undiscovered Gems in October 2024

Reviewed by Simply Wall St

The Australian market has experienced a flat week recently but has seen an impressive 20% increase over the past year, with earnings forecasted to grow by 12% annually. In this dynamic environment, identifying stocks that have strong growth potential and are not yet widely recognized can offer unique opportunities for investors looking to capitalize on the market's upward trajectory.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Hancock & Gore | NA | -70.20% | 38.14% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

IPD Group (ASX:IPG)

Simply Wall St Value Rating: ★★★★★☆

Overview: IPD Group Limited is an Australian company that specializes in the distribution of electrical infrastructure, with a market capitalization of A$469.73 million.

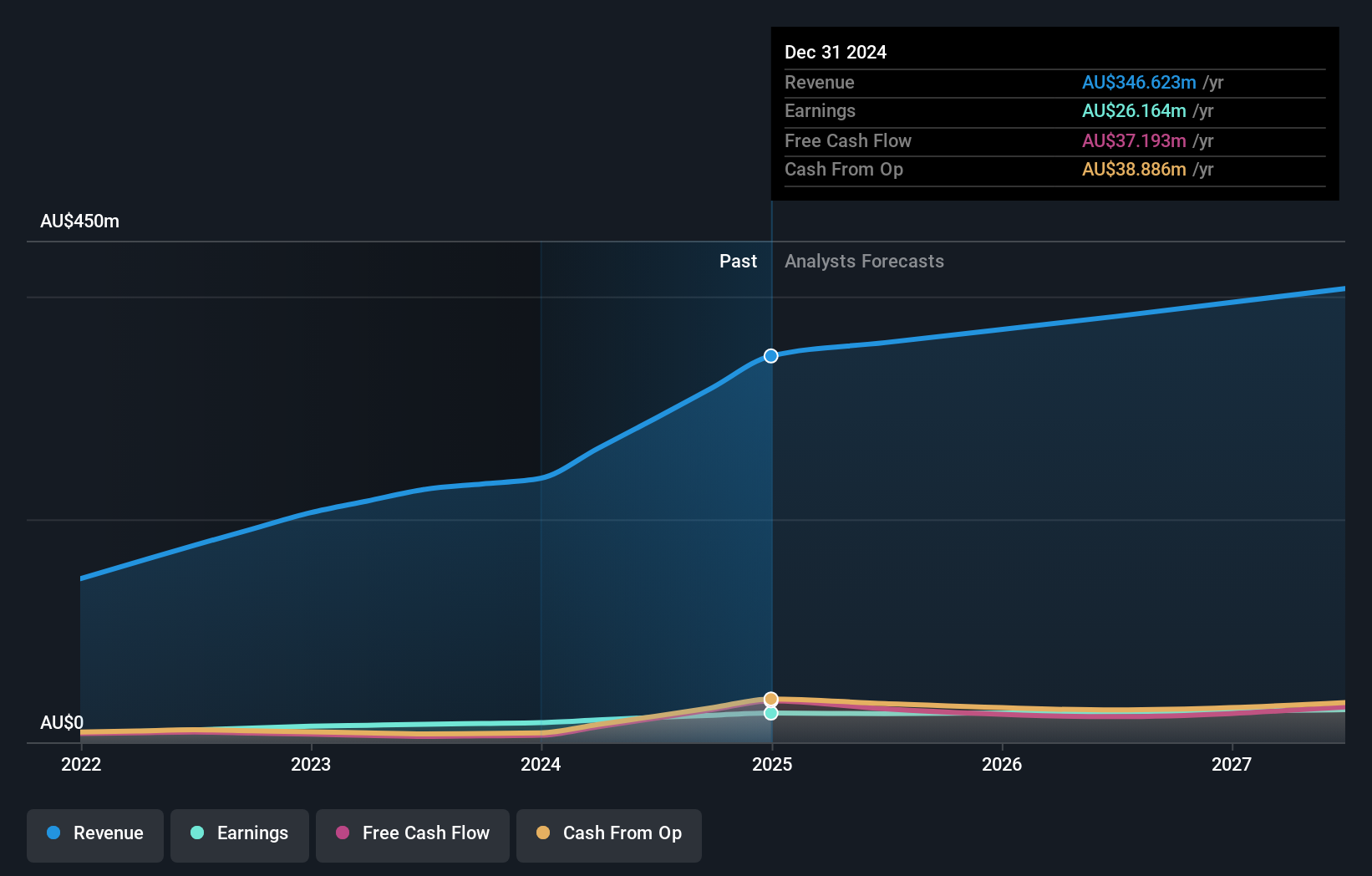

Operations: IPD Group generates revenue primarily from its Products Division, contributing A$270.68 million, and its Services Division, adding A$19.74 million.

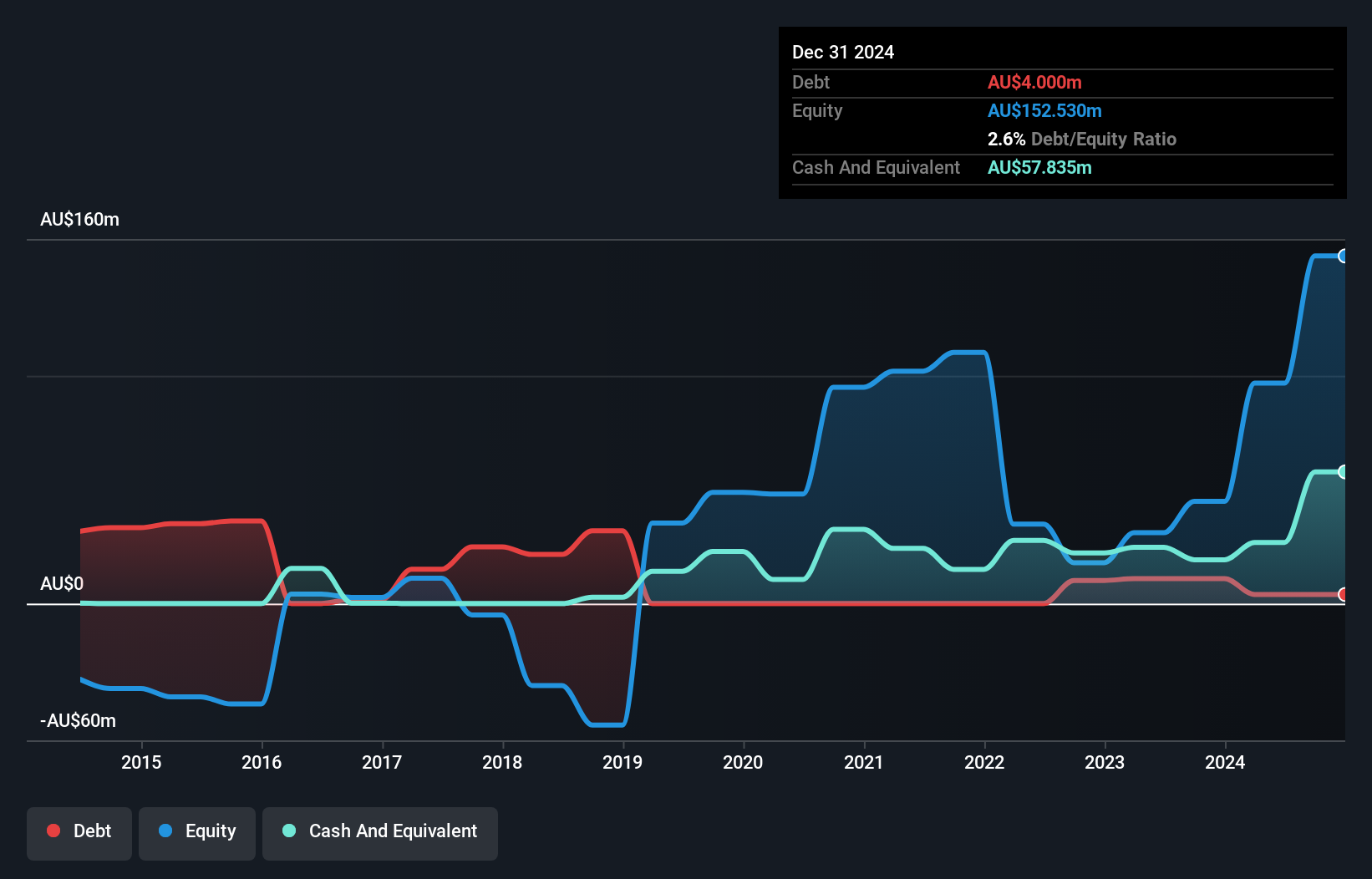

IPD Group, a noteworthy player in the Trade Distributors sector, has been making waves with its robust financial performance. Over the past year, earnings surged by 39.1%, outpacing the industry average of 19.6%. The company's net income climbed to A$22.36 million from A$16.08 million last year, reflecting its high-quality earnings and positive free cash flow status. Despite shareholder dilution over the past year, IPD's net debt to equity ratio stands at a satisfactory 5.8%, and interest payments are well-covered by EBIT with a coverage of 46.8 times, indicating strong financial health amidst recent index inclusion in S&P Global BMI Index on September 23rd, 2024.

- Delve into the full analysis health report here for a deeper understanding of IPD Group.

Review our historical performance report to gain insights into IPD Group's's past performance.

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market capitalization of A$1.72 billion.

Operations: Ora Banda Mining generates revenue primarily from its gold mining operations, amounting to A$214.24 million.

Ora Banda Mining, a promising player in the Australian mining sector, has recently turned profitable with net income reaching A$27.57 million for the year ending June 2024, compared to a loss of A$44.13 million previously. The company’s sales climbed to A$214.24 million from A$135.89 million, highlighting its robust operational performance. Despite an increase in debt-to-equity ratio from 0% to 4.1% over five years, Ora Banda maintains more cash than total debt and enjoys strong EBIT coverage of interest payments at 7.8x. The addition to the S&P Global BMI Index further underscores its growing industry presence and potential appeal to investors seeking value opportunities in mining stocks.

- Click here and access our complete health analysis report to understand the dynamics of Ora Banda Mining.

Evaluate Ora Banda Mining's historical performance by accessing our past performance report.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★★

Overview: Tasmea Limited specializes in providing shutdown, maintenance, emergency breakdown, and capital upgrade services across various sectors in Australia, with a market capitalization of approximately A$585.71 million.

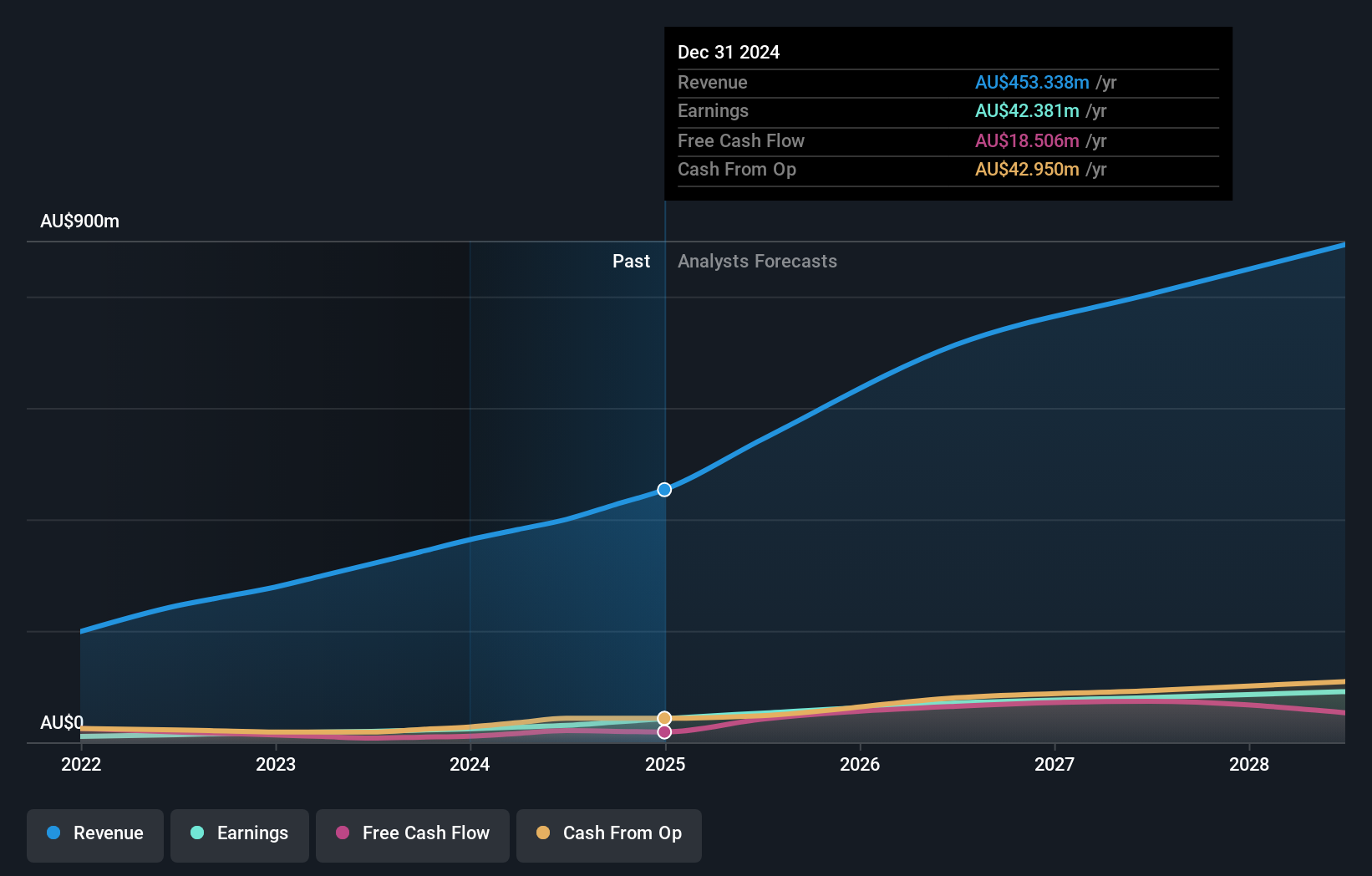

Operations: Tasmea generates revenue primarily from Mechanical Services (A$141.42 million) and Electrical Services (A$129.44 million), with additional contributions from Water & Fluid, Civil, and Corporate Services.

Tasmea Limited, a promising player in the Australian market, has been making waves with its impressive financial performance. The company reported sales of A$400.01 million for the year ending June 2024, up from A$319.98 million the previous year. Net income also rose to A$30.35 million from A$19.32 million, showcasing robust growth in earnings per share at A$0.15 compared to last year's A$0.10. Tasmea's debt management is commendable with a net debt to equity ratio of 25%, and interest payments are comfortably covered by EBIT at 12 times over, reflecting strong operational efficiency and financial health.

- Take a closer look at Tasmea's potential here in our health report.

Explore historical data to track Tasmea's performance over time in our Past section.

Taking Advantage

- Unlock our comprehensive list of 55 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPG

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives