ASX Growth Stocks With High Insider Ownership And Up To 96% Earnings Growth

Reviewed by Simply Wall St

The Australian market has shown robust performance, rising 3.1% over the last week and achieving a 10% increase over the past year with earnings expected to grow by 13% annually. In this context, stocks with high insider ownership can be particularly appealing as they often indicate that company leaders have a vested interest in the success of their businesses, aligning well with current market trends and growth projections.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.7% |

| Catalyst Metals (ASX:CYL) | 17.1% | 77.1% |

| Biome Australia (ASX:BIO) | 34.5% | 114.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 59.4% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 96.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 109.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

Let's explore several standout options from the results in the screener.

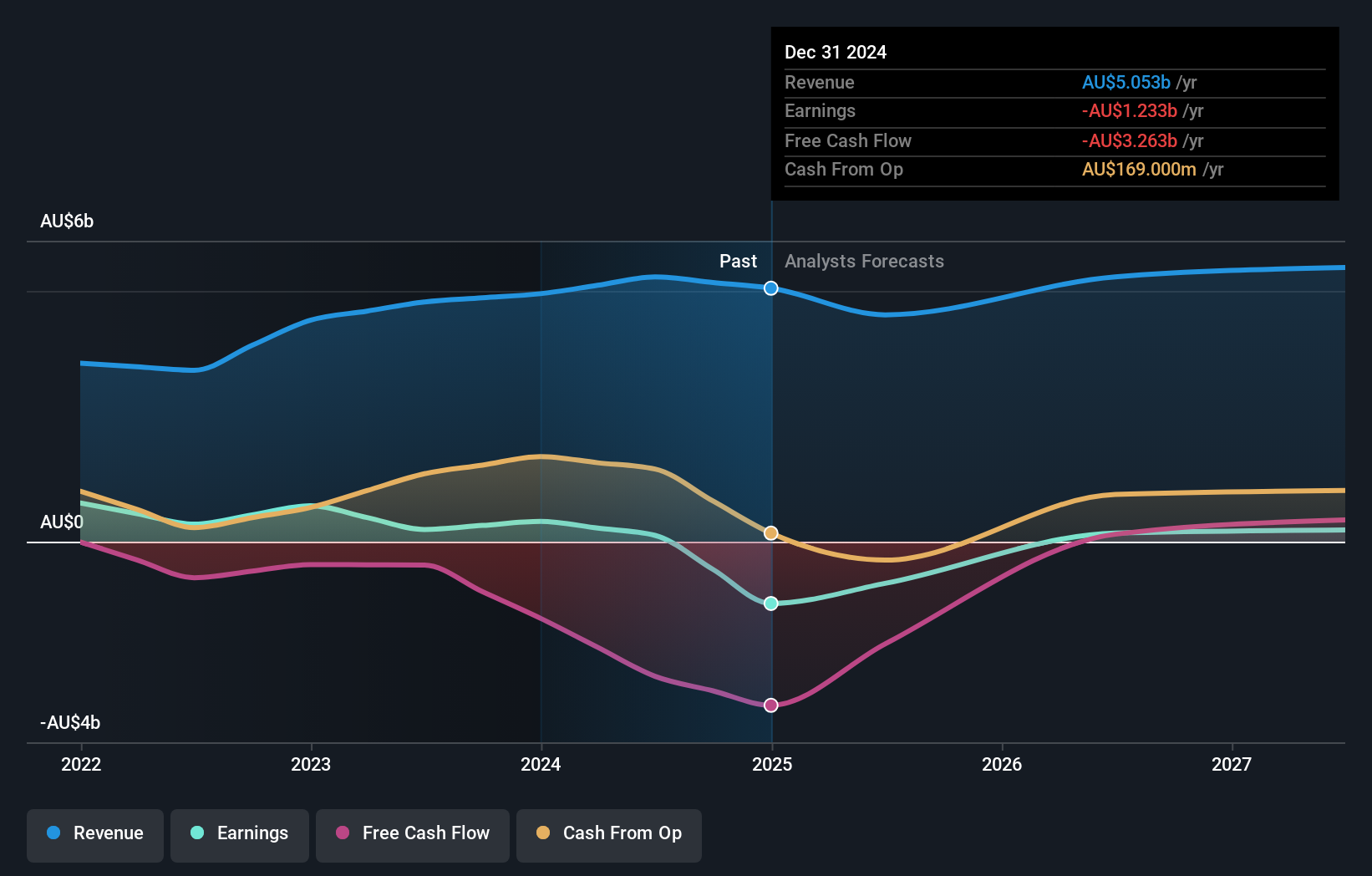

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mineral Resources Limited is a mining services company operating in Australia, Asia, and internationally, with a market capitalization of approximately A$11.27 billion.

Operations: The company generates revenue through three primary segments: lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

Insider Ownership: 11.6%

Earnings Growth Forecast: 30.9% p.a.

Mineral Resources, an Australian growth company with high insider ownership, is poised for substantial earnings growth, forecasted at 30.89% annually over the next three years. Despite this, its current profit margins are lower compared to last year and it faces challenges in covering interest payments with earnings. However, the company's revenue is expected to outpace the Australian market average significantly. Trading at a considerable discount to its estimated fair value suggests potential undervaluation.

- Delve into the full analysis future growth report here for a deeper understanding of Mineral Resources.

- Our expertly prepared valuation report Mineral Resources implies its share price may be too high.

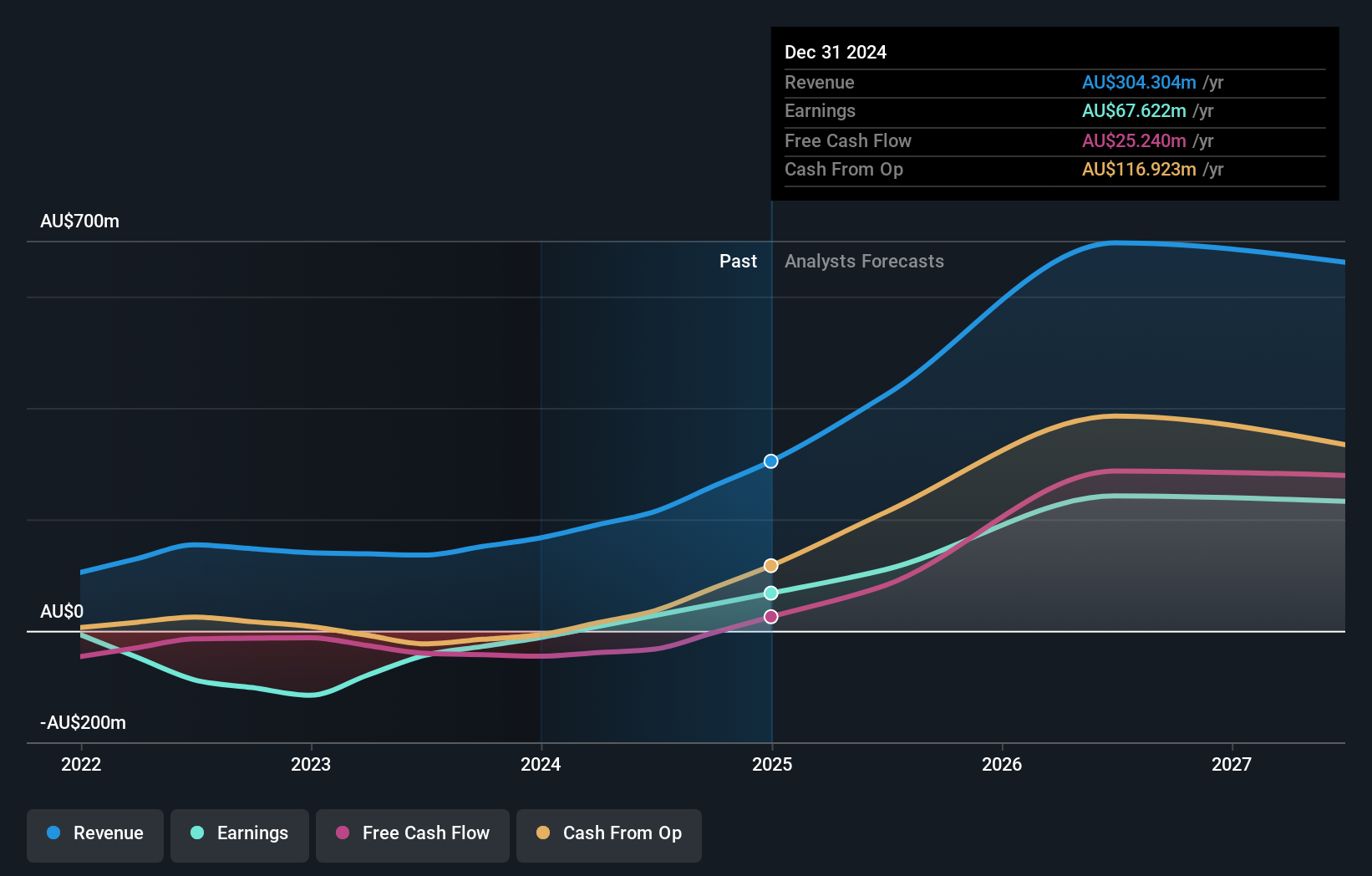

Ora Banda Mining (ASX:OBM)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market capitalization of approximately A$835.94 million.

Operations: The company generates revenue primarily from its gold mining activities, totaling approximately A$166.66 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 96.2% p.a.

Ora Banda Mining, an Australian company, is trading at a significant discount to its fair value and is expected to become profitable within the next three years. Its revenue growth forecast of 45.2% annually outstrips the market average significantly. Despite past shareholder dilution, no recent insider selling has been reported, and the appointment of Kathryn Cutler as a Non-executive Director could bolster its strategic direction. The company's return on equity is also projected to be very high in three years.

- Take a closer look at Ora Banda Mining's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Ora Banda Mining's current price could be quite moderate.

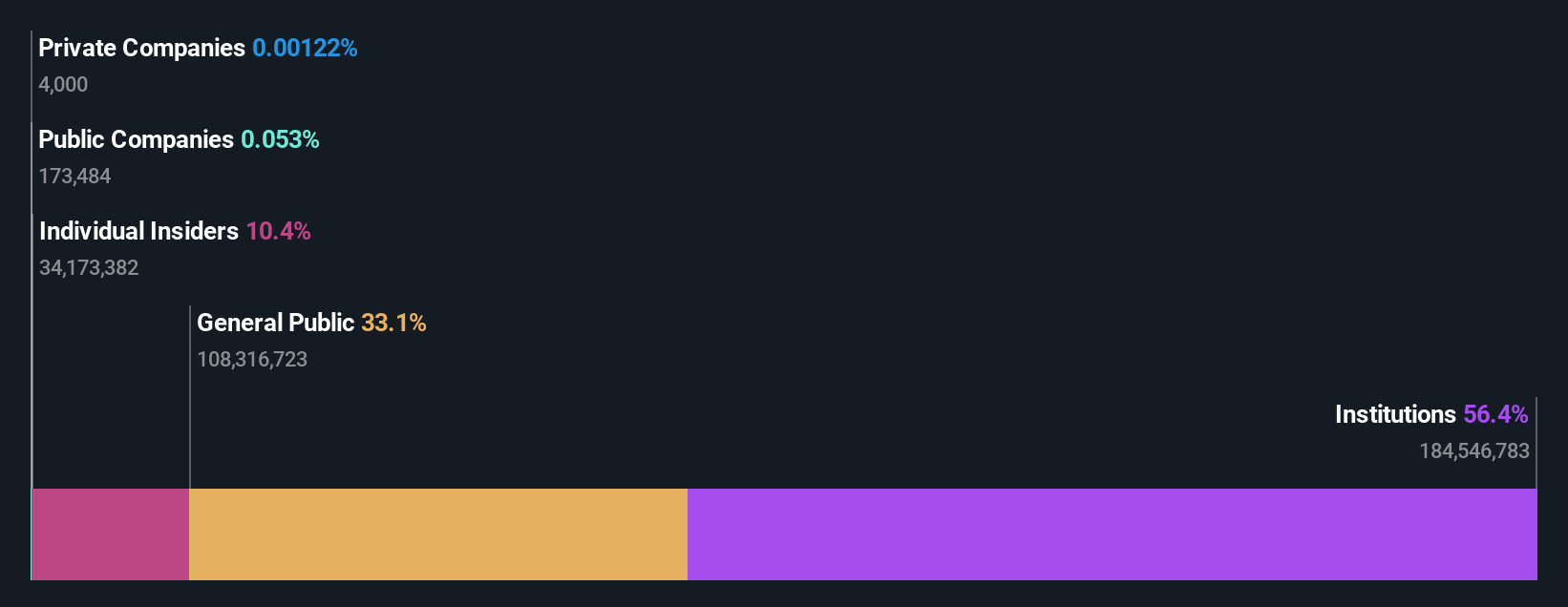

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an enterprise software solutions provider operating both in Australia and internationally, with a market capitalization of approximately A$6.18 billion.

Operations: The company generates revenue through three primary segments: software sales contributing A$317.24 million, corporate services at A$83.83 million, and consulting services amounting to A$68.13 million.

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.4% p.a.

Technology One, a prominent Australian software firm, shows promising growth with earnings expected to rise by 14.4% annually, outpacing the local market's 13.3%. Despite a high price-to-earnings ratio of 56.4x—below the industry average—its revenue growth at 11.1% annually also exceeds the national rate of 5.3%. The recent appointment of Paul Robson as Non-Executive Director could further enhance strategic and operational capabilities, aligning with its robust half-year financial performance where net income rose to A$48 million from A$41.28 million year-on-year.

- Get an in-depth perspective on Technology One's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Technology One's shares may be trading at a premium.

Turning Ideas Into Actions

- Click this link to deep-dive into the 91 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)